With the recent interest rate pauses from Canada and the US, some investors are increasingly expecting an end to rate hikes and the potential for rate cuts in 2024. Fixed income (bond) investing is becoming very topical as falling yields has traditionally caused bonds prices to rise. As we contemplate whether now is an opportune moment for bond investments, it is prudent to understand the tax treatment of bonds and the concept of the ‘GIC Equivalent Yield’.

What are bonds?

Bonds are debt instruments that offer regular interest payments at a fixed rate, often on a semi-annual or annual basis. The initial yield, also known as the "coupon rate," is typically established at the time of bond issuance and is typically set around prevailing market interest rates. Furthermore, the principal amount of the bond, referred to as the "face value" or "par value", is the amount that the issuer is committed to repay upon the bond's maturity. Most bonds are actively traded on the secondary market, where prices are influenced by the credit quality of the issuer and the difference between the bond's coupon rate and current market interest rates of similar time horizons.

How are Bonds Priced?

There are three distinct scenarios when purchasing bonds:

Buying a Bond at Par

In this scenario, you acquire a bond at its face value, paying the amount specified at the time of issuance, often in multiples of $100.

Buying a Bond at a Premium

Bond prices move inversely to interest rates, so if market interest rates decline after issuance, the bond's price should rise. The premium price that investors pay is attributed to the idea that the bond looks relatively more attractive than a newly issued bond since it carries a higher coupon.

Buying a Bond at a Discount

Conversely, when interest rates rise post-issuance, you might find yourself holding a bond with an interest rate that is lower than the prevailing market rate. Consequently, potential buyers may only be interested in purchasing your bond at a discount (below its face value).

What are the Tax Implications of Bond Investing?

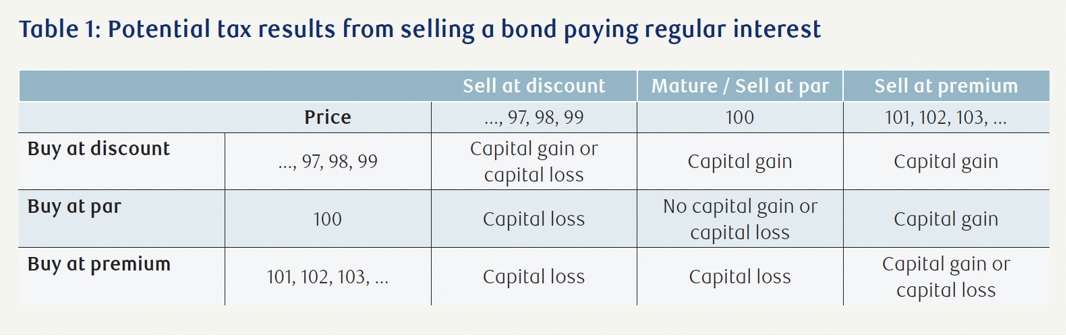

The table below summarizes the potential capital gain or loss implications of selling a bond.

When investors talk about the “Yield %” or “Yield to Maturity” of a bond, it relates to what the return will be if held to maturity. Those bonds where the “yield” encompasses both capital gains and interest coupons can provide a better after-tax return than those yields with only interest coupons. This is because capital gains are taxed at a lower rate than interest income. Hence, a bond purchased at a discount with a lower coupon than a newly issued GIC, could still have a better return (ie. yield to maturity) then a GIC. Contact us to calculate the ‘Taxable Equivalent Yield’ or the ‘GIC Equivalent Yield’ of any potential bond investments. In this current environment it is highly likely that buying a bond at a discount and holding it to maturity will leave more money in your pockets after taxes compared to a GIC. This makes discount bonds a very timely investment.

When investors talk about the “Yield %” or “Yield to Maturity” of a bond, it relates to what the return will be if held to maturity. Those bonds where the “yield” encompasses both capital gains and interest coupons can provide a better after-tax return than those yields with only interest coupons. This is because capital gains are taxed at a lower rate than interest income. Hence, a bond purchased at a discount with a lower coupon than a newly issued GIC, could still have a better return (ie. yield to maturity) then a GIC. Contact us to calculate the ‘Taxable Equivalent Yield’ or the ‘GIC Equivalent Yield’ of any potential bond investments. In this current environment it is highly likely that buying a bond at a discount and holding it to maturity will leave more money in your pockets after taxes compared to a GIC. This makes discount bonds a very timely investment.

As investors, it is essential to understand all the elements that go into bond pricing and returns. To navigate these fixed income investments and the associated taxes effectively, consult your accountant and financial advisor to help optimize your bond strategy.