With 2023 RRSP contributions out of the way, individuals are likely turning their attention to the next major date circled in their calendars - the April 30, 2024 deadline for personal tax filings. While many Canadians returned to work on premise in 2023, below we highlight recent CRA updates on its guidelines for claiming home office expenses for eligible employees who continue or occasionally still work from home.

New rules for filing “WFH” expenses

In response to the Covid-19 pandemic, the government introduced a temporary measure which allowed Canadians working from home to claim up to $400 in employment expenses in 2020 and up to $500 in 2021 and 2022. This simplified method didn’t require an employee to track expenses or obtain certain forms from their employer. For 2023 and beyond, individuals must use the detailed method to claim home office expenses (if eligible).

Who can claim a deduction for home office expenses?

To be eligible to claim a deduction for home office expenses for the period you worked from home, you must meet all the following conditions:

1. You were required to work from home by your employer. This requirement does not have to be part of an employment contract and may be a written or verbal agreement. Alternatively, for 2023, if you voluntarily worked from home and entered in a formal telework arrangement with your employer, you are considered to have been required to work from home.

2. You were required to pay for expenses related to the work space in your home.

3. The expenses are directly tied to your work during the period; and

4. The work space is defined as where you worked for more than 50% of the time for a period of at least four consecutive weeks. If you have more than one eligible period during the year, you can claim expenses for each period.

Detailed method for claiming home office expenses:

If you worked from home in 2023 and are considered eligible, you must use the Detailed method to claim home office expenses; your employer must also complete and sign the updated CRA Form T2200 – Declaration of Conditions of Employment. This form certifies that you are required to cover your own expenses while carrying out work duties and that those expenses are not reimbursed by your employer.

To claim expenses, you must complete Form T777 - Statement of Employment Expenses and must keep receipts, documents and related records.

Although you’re not required to file the T2200 with your income tax return, you should keep a copy of it for at least six years, in addition to any receipts or supporting documents, in case the CRA asks to see them.

What expenses can you claim?

Whether you rent or own, the amount you can claim for the work space in your home must be apportioned on a reasonable basis. For example, assume you have a dedicated room in your house, such as an office or a spare room that is used only for work. If that room accounts for 30% of your home’s total square footage, you can deduct 30% of the expenses related to your work space. If you are the only one working in a particular space in your home, you can claim the whole employment use of that space. However, if you and another household member share the work space, you will each have to calculate a portion of the employment use of the work space being shared.

If you worked only part of the year from home, you can only claim the expenses you paid during that period of the year.

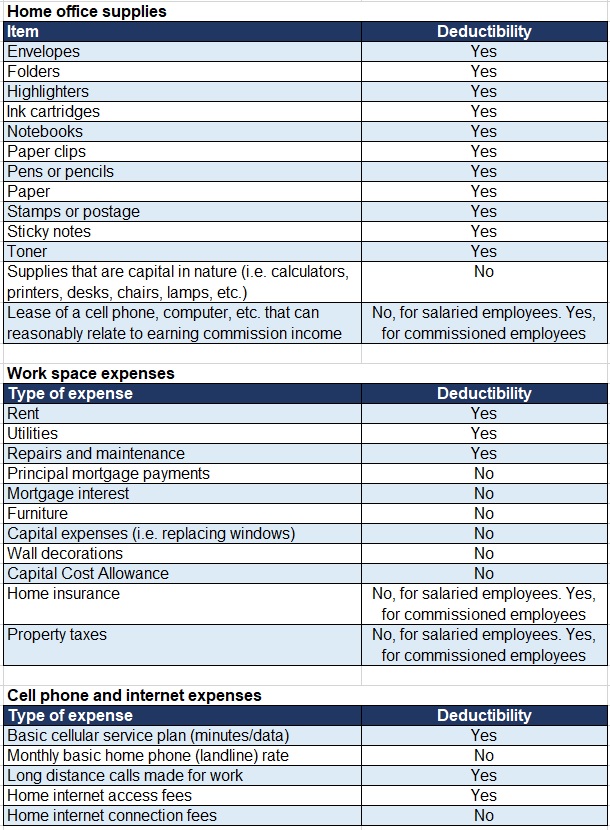

The following tables highlight some common expenses that are deductible. For a more comprehensive list and detailed information on how to make the claim on your personal tax return, please refer to the CRA website (What the changes are – Home office expenses for employees - Canada.ca) or discuss with a qualified tax advisor.

Work space expenses: