Many investors have heard the phrase, “Don’t Fight The Fed”. This implies that investors should stay invested as markets can continue to rise if central banks are committed to a loose monetary policy and are cutting interest rates. The inverse also implies that investors should exit the markets as they fall in response to tighter monetary policy and rising interest rates. In last week’s blog titled, 'When Will the Fed Raise Interest Rates', we wrote about the Fed’s formal announcement of tapering their QE program and the market pricing in interest rate increases within the next 12 months. Hence, the natural question from investors is whether it is time to reduce their equity exposure.

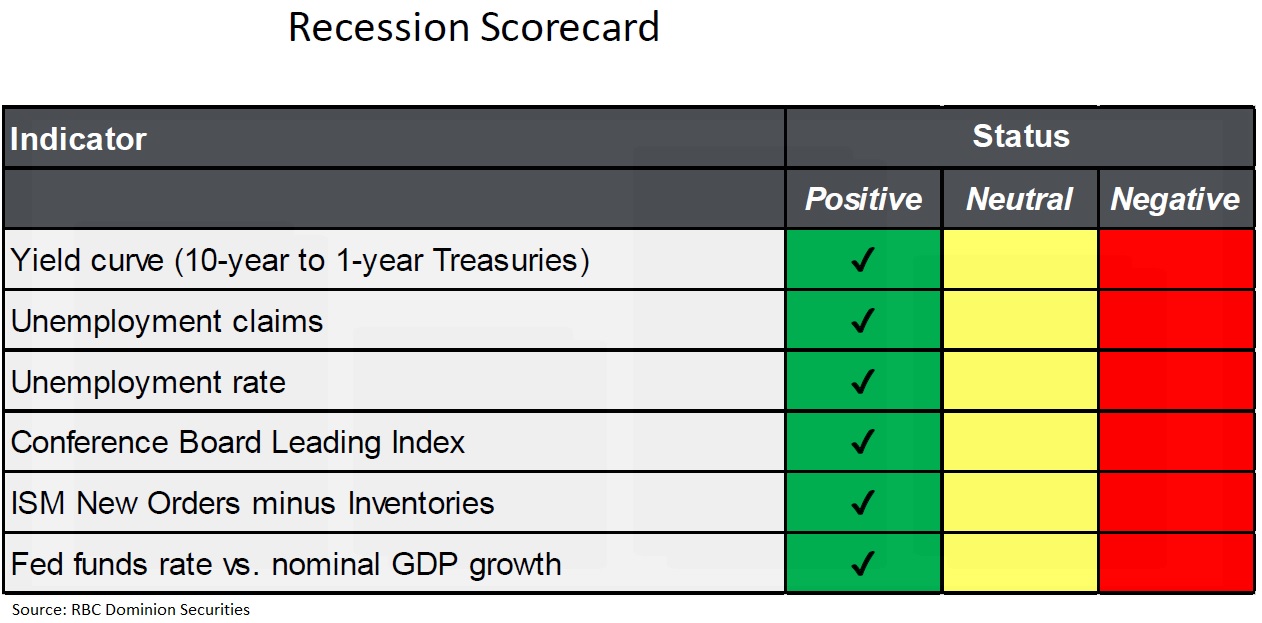

Although we subscribe to the “Don’t Fight The Fed” axiom, we closed the last blog highlighting that the pace of interest rate increases matters more than the direction of interest rate movements. At this moment, the Fed appears to be patient and we do not expect rapidly successive rate hikes. The current Federal Funds Rate (FFR) is the key tool that the Fed uses to adjust monetary policy as it is the reference rate that impacts short-term borrowing costs for businesses and financial institutions. Currently, the FFR is set between 0 to 0.25%. Should the fed hike rates 3 to 4 times, this still puts the FFR around 1%, which is far from creating a tight monetary condition. The recession scorecard, shown below, from RBC Dominion Securities Portfolio Strategist, Jim Allworth, also reiterates that the economy is still signaling positive expansion. Therefore, we do not believe the US is at risk of heading towards a recession. Rather, investors can continue giving equities the benefit of the doubt.

All this being said, how have equities performed around the arrival of the first Fed rate hike? To answer this, we examine the 18 fed rate hike cycles since 1958. For each cycle, we have charted out the 3-months, 6-months and 12-months performance of the TSX Composite and SP500 earned before and after the first rate hike. See charts below.

The following conclusions can be made:

Equity markets have historically performed well in the 12 months leading up to the start of Fed rate hike cycles, with the TSX Composite and S&P 500 posting average returns of 13.9% and 15.3%. The data also shows that around 80% of the time, markets provided a positive return outcome.

Volatility tends to emerge in the first six months after the Fed begins to hike interest rates. This is likely when markets are digesting the impact of the Fed’s move to tighten monetary policy on the economy. While returns were, on average, positive, it has historically been more volatile particularly in the first three months.

Looking past the short-term volatility, equity markets have historically maintained upward momentum through a 12 month time horizon, with the TSX Composite and S&P 500 delivering average returns of 10.1% and 8.4% respectively. Both markets provided a positive return outcome 72% of the time.

Historically, the first rate-hike does not appear to have spelled trouble for the equity markets. Investors with at least a 12-month time horizon should feel supported by the data above, along with the economic re-opening and strong consumer narrative. As we get deeper into the economic cycle, the Fed’s tightening policy can get more aggressive and at that time the axiom of ‘Don’t Fight The Fed’ may be more applicable.