Highlights

- Our Observations

- Current Economic Outlook

- Our Investment Strategy

Our Observations

Despite ample reason for pessimism this year, the global economy and markets have largely exceeded expectations. This has concentrated attention on corporate financial results and guidance, as investors look for insight on how firms are navigating the more challenging operating environment caused by unpredictable U.S. trade policy, how tariffs are feeding into inflationary pressures in the U.S., and the potential impact on monetary policy.

Current Economic Outlook

A reassuring Q2 earnings season

With the U.S. earnings season now largely complete, results were generally better-than-expected, with the realized earnings growth rate handily surpassing consensus estimates. While analysts have attributed the solid earnings performance to effective tariff-mitigation strategies and a weaker U.S. dollar, they also cautioned that the full effects of tariffs have yet to be felt given that front-loading of goods earlier in the year has likely deferred the impact.

U.S. inflation readings flash mixed signals

Elsewhere, markets are closely watching the transmission of tariffs throughout the economy. However, the latest consumer price data was relatively benign. The divergence between consumer and wholesale prices underscores the difficulty in assessing the true trajectory of inflation, a factor that is complicating the outlook for U.S. monetary policy.

What about Canada?

Meanwhile, consumer price pressures in Canada have eased, largely due to the unwinding of the consumer carbon tax back in April. On trade, the USMCA free trade agreement continues to backstop duty free access to the U.S. market for most Canadian exports. The Bank of Canada (BoC) has held its benchmark rate steady at 2.75% for three consecutive meetings since March and RBC Economics expects the BoC is unlikely to cut again during this cycle.

Our Investment Strategy

Tune out the noise

Financial media tends to be relentlessly fixated on the latest news. For long-term investors, however, most daily headlines and market moves are far more likely to be noise than they are to contain useful and/or relevant information. Given short-term market swings often reflect considerable noise and randomness, moderating one’s focus on the day-to-day news cycle can help investors mitigate the risk of pursuing potentially unnecessary trading activity that can undermine their long-term investment objectives.

Time is on the investor’s side

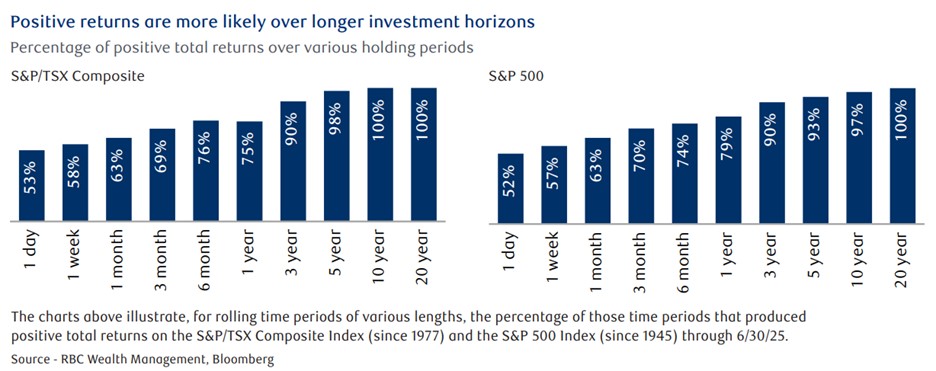

In a world where investors are frequently enticed to play the short game, adopting a long-term mindset can offer an enormous advantage. As illustrated in the charts below, the probability of earning a positive return on any given trading day is essentially the same as flipping a coin. However, as the time horizon is extended, investors can be increasingly confident of attaining a positive outcome. The probability of the TSX Composite and S&P 500 generating positive returns improves substantially over longer periods, rising to about 75%–80% for one-year rolling periods, nearly 90% for three-year rolling periods, and approaching 100% for rolling periods beyond five years. Stated differently, the likelihood of experiencing losses in equity markets diminishes markedly as the investment horizon is lengthened.

The quiet power of long-run compounding

Because uncertainty is ever present, we believe investors should always think in terms of probabilities. Time horizon is a practical tool for managing unavoidable volatility when participating in the stock market, which tends to track the upward trend in earnings and the economy over the long haul. A longer time frame not only increases the probability of earning positive returns in stocks, but also allows the benefits of compounding to accumulate over time for investors.

"'The essence of portfolio management is the management of risk,

not the management of returns. Well-managed portfolios start with this precept."

- Benjamin Graham, One of the fathers of value investing and of

main influencer of Warren Buffett

companies' strong performance so far, combined with a series of constructive business developments, has paved the way for cautious optimism. Nevertheless, we are keeping in mind that equity markets are near record highs and valuations are high, especially in the U.S. Therefore, we are taking a precautionary approach toward the coming months.

As always, we are available to answer your questions.

Enjoy the last days of summer!

Benoit Legros, B.A.A., CIM, FCSI

Senior Portfolio Manager and Wealth Advisor