A goalie's job is to stop pucks... Well yeah, that's part of it, but you know what else is?... You're trying to deliver a message to your team that things are OK back here [...] You take it [the puck] now and go.

-Ken Dryden

goaltender, politician, lawyer, businessman and author

Just like a goalie reassures the team, a portfolio manager reassures their clients by giving them the confidence to move forward and achieve their goals. A strong portfolio strategy creates the freedom to focus on long-term opportunities.

Highlights

- Current Outlook

- Economic Implications

- Our investment strategy

Current Outlook

Following recent signs of softening labour market conditions in both Canada and the U.S., central banks have reduced their benchmark interest rates. This marks the resumption of monetary easing cycles that had been on hold due to uncertainty in the global economic and trade policy environment.

The Federal Reserve (Fed) lowered its benchmark rate by 0.25%, the first cut since December 2024. The decision followed weaker labour market data over the summer and lower-than-expected inflation readings, which gave the Fed room to act. The move is designed to cushion against downside risks to U.S. economic growth.

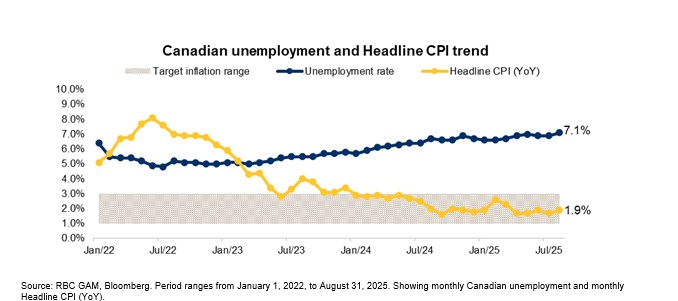

The Bank of Canada (BoC) also reduced its overnight rate by 25 basis points, bringing it to 2.5%. The decision was driven by a weakening economy, softer inflation pressures, and a labour market showing signs of stress. While the vote to cut was unanimous, policymakers emphasized caution and offered little forward guidance on future moves.

What to Expect?

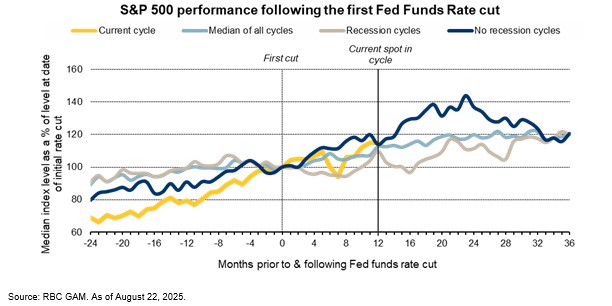

Rate cuts are one factor influencing markets, but history offers other useful lessons. In recessionary environments, central banks typically cut more aggressively, bond yields tend to decline further, and stocks often struggle for prolonged periods. Conversely, in periods where recessions are avoided, cuts are more modest, bond yields remain relatively stable, and stocks usually recover after a brief period of volatility.

RBC’s base case assumes modest economic growth with gradual monetary easing. In this scenario, stocks and bonds are both positioned to benefit. Equities in particular have historically performed well after the first rate cut in non-recessionary cycles, while bonds tend to provide stability as inflation expectations remain anchored.

Economic Implications

Rate-sensitive areas of the economy should be the primary beneficiaries of easier financial conditions. Housing is one example, with Canadian home sales reaching a 2025 high this month as lower borrowing costs combined with better inventory dynamics supported activity. With that said, important headwinds such as affordability challenges, slower population growth, and broader uncertainty remain.

More broadly, central banks are seeking to strike a balance between supporting the labour market and keeping inflation under control. The renewed focus on stabilizing employment highlights the shift in risks toward growth, as slowing job creation has become more evident.

Our Investment Strategy

Markets will always move in ways that generate headlines and emotions. Rather than reacting to every shift in interest rates, changing inflation data, or political developments, we stay anchored to the principles we can control. This includes maintaining disciplined asset allocation, aligning portfolios with long-term client goals and time horizons, and managing risk in a way that balances protection with opportunity.

We continue to emphasize diversification across asset classes, ensuring portfolios are resilient enough to withstand volatility while remaining flexible enough to benefit from periods of growth. Within equities, we focus on high-quality businesses with strong balance sheets and durable cash flows.

Equally important is behavioural discipline. By avoiding reactionary decisions driven by short-term market noise – for instance when Donald Trump announced his tariffs last April – we aim to reduce uncertainty and help clients stay on track toward their financial objectives. Our strategy is designed to strike a balance: defensive enough to protect capital, yet opportunistic enough to capture growth when conditions improve.

Final Thoughts

Looking ahead, we believe it remains prudent to keep some defensive holdings in portfolios while maintaining exposure to opportunities that can benefit from economic recovery. Our focus will continue to be on identifying resilient businesses that can navigate volatility and deliver long-term value.

As always, we are available to answer your questions.

Benoit Legros, B.A.A., CIM, FCSI

Senior Portfolio Manager and Wealth Advisor