The longevity of wealth health

Highlights

- Our Observations

- Current Economic Outlook

- Our Investment Strategy

- Our Community Involvement

Our Observations

Not so long ago, investors across the world wanted more U.S. holdings in response to U.S. exceptionalism. At present, this is no longer the case. U.S. stocks are rapidly disappearing from portfolios, such as hedge funds, which have sold more U.S. stocks this month than any other throughout the past 25 years (source: Bank of America).

It is important to remember that stock markets are, by nature, volatile. At the moment, this instability is extreme because it stems mainly from the many decisions of the President of the United States. Even more so, Donald Trump's continuous presence in the media increases emotion and mental fatigue.

Nevertheless, our portfolios are showing strong resilience during this time. They are less impacted since they are built according to rigorous criteria, including the following:

- No exposure to overvalued companies: stocks with ultra-expensive ratios such as Tesla

- A selection of companies that are leaders in their respective industries

- A preference for companies with strong balance sheets and dividend growth

Currently, the structure of our portfolios places us in a buying position because we have ample liquidity. This will allow us to make cheap acquisitions when others sell in a panic and will eventually pay off for a long-term growth objective.

Current Economic Outlook

The U.S. Federal Reserve kept interest rates unchanged at its recent meeting. Nevertheless, it revised a few of its economic projections. Its forecasts for economic growth (i.e. GDP) were revised lower: to 1.7% (from 2.1%) for 2025, and to 1.8% for both 2026 and 2027, respectively (from 2.0% and 1.9%, previously). Meanwhile, its inflation projection for this year was revised higher, to 2.7% from 2.5%, but its estimates for 2026 and 2027 were left unchanged. In summary, it expects lower growth through the next few years, and a temporary bump in inflation this year before it reverts to lower levels. The Fed also revealed that, on average, its policy makers expect two interest rate cuts this year, followed by two more in 2026, and one in 2027, which was unchanged from its previous assessment late last year.

The Federal Reserve’s official statement suggested it felt that U.S. economic activity was “solid”, with a healthy labour market, and inflation that remained “somewhat elevated.” It acknowledged that uncertainty had risen, and it was paying close attention to the risks on both sides of its dual mandate: managing unemployment and inflation.

Chairman Jerome Powell’s comments during his press conference were more interesting, in our view. He acknowledged some slowing in consumer spending, recent deterioration in sentiment, and higher levels of uncertainty resulting from a U.S. government that is making big changes in policy. But he reminded people that the U.S. economy was at least starting from a position of strength. Meanwhile, he was less concerned about an uptick in consumer inflation expectations and characterized any potential inflation stemming from tariffs as “transitory”. The latter remark was not particularly comforting as he also used the same term to describe inflationary pressures that emerged during the early stages of the pandemic.

Our simple takeaway is that the Fed is nearly as uncertain over the trajectory of the U.S. economy as everybody else. It is hard to fault them as government policy has been erratic throughout the first few months of the year. As a result, the Fed now finds itself in a more difficult position where growth is slowing, and inflation is rising.

We are not necessarily only watching from the sidelines. Given our more cautious mindset, we continue to review portfolios, ensuring that asset allocations are in-line with the targets set in our investment policies and financial plans. As a general rule, we tend to get more enthusiastic about investing opportunities when negative sentiment is extreme and valuations are cheap. The current sentiment indicators – while not yet at an extreme – have tended more negative this year, but valuations still have a way to go in our view.

"The trouble with tariffs, to be succinct, is that they raise prices,

slow economic growth, cut profits, increase unemployment,

worsen inequality, diminish productivity and increase global tensions.

Other than that, they’re fine.”

-David Kelly, American bank JP Morgan’s Strategist

Our Investment Strategy

Since the beginning of the year, we have increased the amount of cash in our portfolios through the sale of certain securities that had significantly exceeded expectations. In the short term, markets will be more volatile, as is often the case in times of uncertainty, and they could go in any direction.

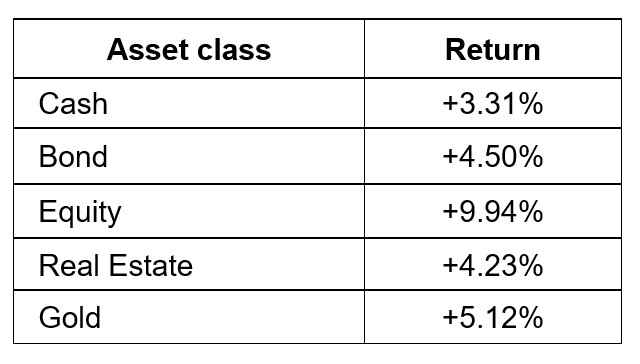

Now, the most important thing is to look to the future and position oneself for the long term. Here are the average returns of the different asset classes from 1928 to 2024:

Over the past 97 years, inflation has averaged about 3% per year.

The lesson here: to be able to fully benefit from long-term returns, you need to be able to withstand periods of turbulence. The constant babbling of the media will test one’s ability to adhere to their strategy. Diversification remains the best method of getting through episodes of negative news.

Investing and regular physical training are two pursuits which require discipline, a long-term perspective, and a strategic approach. Whether it's building wealth or building muscle, the principles of consistency, patience, and smart planning are essential for sustainable success.

Our Community Involvement

True to our dedication to community involvement, my team and I are proud to announce our participation in La Soirée des Grands 2025 for the benefit of the young people of the DYP coming up on May 15th.

In line with our commitment, it is a pleasure to make our contribution. Indeed, the Foundation finances programs which would have usually been provided by parents or family. Through its six divisions, the Foundation acts in tandem for the benefit of young people in vulnerable situations.

" It's as if life had told me: Pierre, you're going to be lucky in life,

but the counterpart is that you're going to give back.”

- Pierre Lassonde, Franco-Nevada founder & philanthropist

As always, we are available to answer your questions.

Benoit Legros, B.A.A., CIM, FCSI

Senior Portfolio Manager and Wealth Advisor