-

Current Economic Outlook

-

Our investment strategy

Current Economic Outlook

North American Investors have been closely focused on the U.S. election in recent weeks, with Donald Trump elected 47th president of the United States. Both U.S. and Canadian equity markets reached new all-time highs after a post-election boost, while markets overseas have trended lower. Amid this election rally, U.S. economic data has largely surprised to the upside. This, in addition to some suggestions that inflation and interest rates may remain higher under a Trump administration, has contributed to rising bond yields, even as the U.S Federal Reserve cut interest rates for a second consecutive time at its latest meeting. Stock markets often rally when uncertainty decreases, which likely partly explains recent gains.

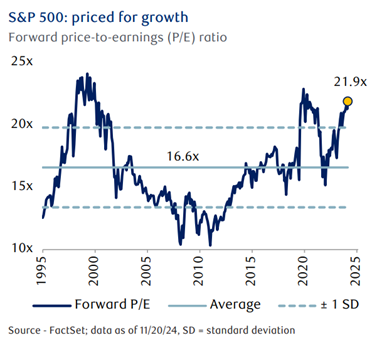

The strength witnessed by North American equity markets this year have been impressive, with stock indices strongly up. Ironically, these gains have put forward one of the main concerns we have had around stocks: valuations. From a valuation perspective, the U.S. stock market’s price-to-earnings ratio—a key measure reflecting how much investors are willing to pay per dollar of expected earnings—stands just above 22 times the profits. This is well above its average of the last 30 years of 16 times the profits. And while this tells us little about how equities will perform in the months to come, it does suggest that the U.S. stock market is reflecting a lot of positivity, optimism, and lofty expectations for future earnings growth.

We have often used periods like this to recalibrate and lower our expectations around longer-term returns from a specific asset class when it has traded at similar premium levels. Fortunately, this particular dilemma is more tied to U.S. stocks and less so to the Canadian equity market, where valuation levels are less demanding at around 15 times the estimated profits.

Finally, the American president-elect announced his intention to impose customs duties of 25% on products imported from Canada and Mexico, and 10% on those coming from China. Although this announcement is very worrying and the political class was quickly outraged, it remains to be seen whether it could be a negotiating lever. We will monitor the evolution of the situation.

Our investment strategy

Since no one can predict the pace of stock returns, our best defense against turbulence in any given asset class or strategy remains diversification.

Our goal is therefore to prepare portfolios in anticipation of the next volatile period. One thing is sure, it will come. How do you prepare a resilient portfolio focused on the long term? By following these few rules:

-

Stay disciplined and focus on your long-term personal goals.

-

Increase the quality of securities held in the portfolio.

-

Ensure solid diversification of investments.

-

Continue to collect dividends from financially healthy companies which continues to increase it over time.

Overview of some recent transactions

In Canada, we added Stella Jones Inc. (SJ-TSX); a company specializing in pressure treated wood. With the stock trading at a 52-week low, we view this as a great buying opportunity at a discounted price.

On the United States side, we added the pharmaceutical stock Eli Lilly and Co (LLY-NYSE). As the price weakened, this allowed us to add it as a long-term investment.

Although we bought and sold it profitably the first time this year, we bought Lockheed Martin Corp (LMT-NYSE) again on recent price weakness.

“On any given day in the stock market, your chances of earning a positive return

are only 53%, a little better than a draw. Increase your

time horizon of one year and your chances of success rise to 75%.

Over a 20-year holding period, there has never been a negative return

for investors in North American stocks.

Play the long game.”

- Charlie Bilello, Host of “The Week in Charts” on YouTube and

co-host of the podcast “Signal of Noise?”

Our priority is to preserve your capital over the long term, while remaining well-positioned to benefit from sufficient returns to meet your personal objectives, and without taking unnecessary risk.

As always, we are available to answer your questions.

Benoit Legros, B.A.A., CIM, FCSI

Senior Portfolio Manager and Wealth Advisor