June 5, 2020

THE INNOVATION ENVIRONMENT: Fintech Digital Wallets

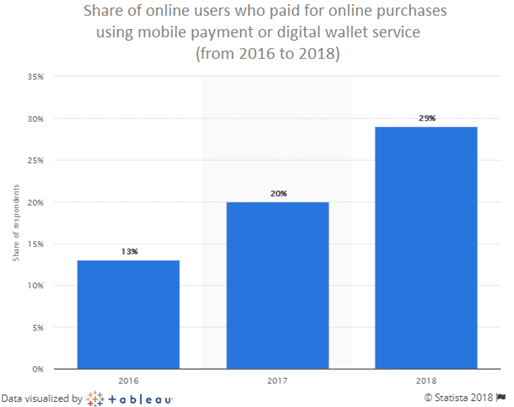

In the US, the mobile payment market increased by just over 40% from 2018 to 2019 (and has been growing rapidly for several years as per the chart below).

Mobile payments are increasingly being used by consumers as comfort levels grow in step with broader acceptance among retailers.

While we still await data for early 2020, we can be sure that, due to the pandemic, the appeal of contactless payments has compressed years of offline-to-online migration into the past several months.

The backbone of mobile payments is the known as the “digital wallet”.

So What is a Digital Wallet?

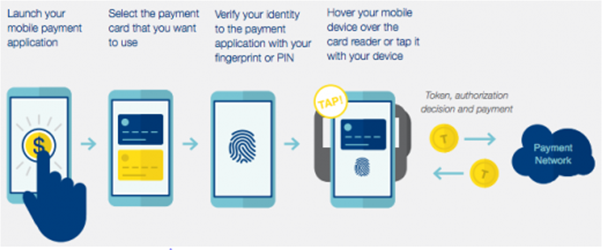

Simply put, this is a service that allows you to pay for things through a mobile phone app (going further, the most popular apps also have options for currency exchange, bitcoin purchases and stock trading).

It also stores a number of other items a traditional wallet would hold, such as a driver's license, gift cards, tickets for entertainment events, and transportation passes.

Digital wallets are not only easier to use in some cases but are also generally considered to be more secure than a traditional wallet.

Digital wallets have a lot of benefits over a physical wallet:

Convenience

Rather than digging a card out of a wallet, users can simply hold their smartphone up to a terminal at checkout and go.

Online transaction processes are also streamlined.

Organization

Most apps allow you to easily organize all of your information in an easy-to-access way, saving time shuffling through a wallet.

More Security

Physical wallets can be lost or stolen and it is time consuming and stressful to replace lost cards and ID.

A digital wallet negates these problems.

Even if a phone is stolen, the thief would need to break your password on your phone, then any passwords or biometrics used to protect your digital wallet app.

Who Provides and Profits from Digital Wallets?

Typically, the most popular digital wallet apps have been created by tech companies, not the traditional banks.

For example, the Royal Bank of Scotland recently shut down its digital bank after investing 100 million pounds and only attracting 11,000 users in 6 months (other traditional banks have followed suit).

In contrast, a fintech stock trading start-up Robinhood (a private company) reported a tripling in its year-over-year revenues.

Further, validating the agility of administration and value-add services of fintech companies, the US Treasury turned to them to help facilitate the second tranche of payroll protection loans.

With more innovations in fintech paired with strong mass adoption during the pandemic and broader acceptance in both the digital and physical worlds, we should see continued strong growth in the sector.