May 10, 2019

The Innovation Environment: Environmental, Social & Governance (ESG) Investing

The evolution of social preferences can create new, interesting long-term secular growth investment trends.

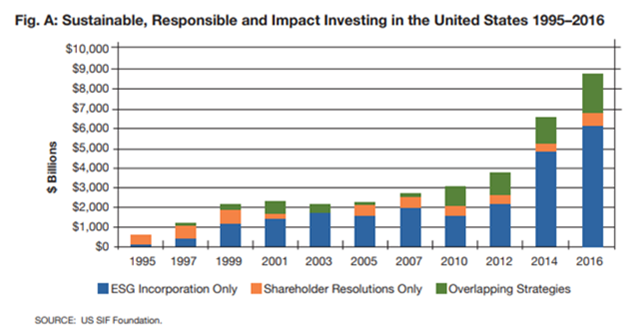

ESG, once a (often underperforming) niche area of the investment world, is growing in significance amongst institutional and retail investors.

The practice of ESG investing began in the 1960s (referred to them as socially responsible investing) and involves investors excluding stocks from their portfolios based on business activities such as tobacco production.

Today, ethical considerations and alignment with values remain common motivations of many ESG investors, but the field is rapidly growing and evolving, as many investors look to incorporate ESG factors into the general investment process alongside traditional financial analysis such as valuation and dividend growth rates.

In fact, according to research from PWC, ESG investing is expected to grow very rapidly in the future.

It estimates that by 2025, ESG will increasingly be accepted in the US due to rapidly increasing client demand (new investor groups i.e. Millennials and institutional investors etc.).

By the end of 2018, nearly US$9 trillion of assets in the US are following some form of ESG investing.

ESG is Feel Good Investing, But Does It Perform?

A common concern with this style of investing is the idea that incorporating ESG factors into the investment process will hurt performance.

A study from MSCI suggests that companies with robust ESG practices displayed a lower cost of capital (i.e. they can borrow at preferred rates) and, on average, have stock with lower trading volatility.

Adding to that, PWC highlights a growing body of evidence showing that public companies with strong ESG credentials outperform their non-ESG peers.

ESG Consumer Values are Starting to Change Industries…The Trend to Vegan Meat is a Key One

A massive industry soon to be disrupted by ESG is the meat business (a $1.4 trillion industry globally).

In fact, there’s lot wrong with the food system. Beyond the obvious slaughter of animals, producing meat by raising animals on factory farms is inefficient and produces tons of greenhouse gases. (Some analysts even think that we can’t tackle climate change without addressing agriculture industry emissions.)

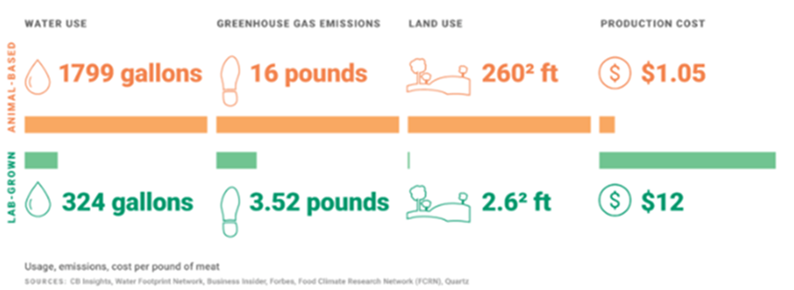

According to CNBC, 38 pounds of feed, 1,799 gallons of water and 260 square feet of land is required to produce 1 pound of beef. The process also generates 16 pounds of CO2 emissions.

‘Meat alternative companies’ endeavor to address these inefficiencies and have attracted high profile investors including Bill Gates, Richard Branson as well as the venture capital divisions of companies least expected to have them: Tyson Foods, Campbell Soup and General Mills.

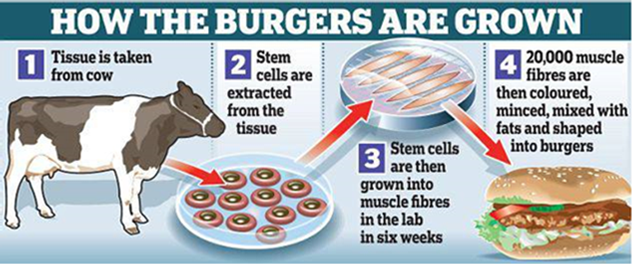

Meat alternative companies come in one of two types: Lab Grown (also referred to as cultured or clean meat) and Plant-Based Proteins.

Lab Grown

This is an exciting area of innovation, in its infancy and certainly worth describing here briefly, but unfortunately for investors there is no publicly listed investment (at least for now).

The meat product is entirely animal-based, but avoids the need to breed, raise, and slaughter huge numbers of animals (see diagram below). This process also results in a material reduction in water use and CO2 production.

There are several companies working on lab grown meats. Progress is being made. Costs per pound of lab grown beef have come down from $18,000 per pound to $2,400 (but clearly it’s still a few years away from the grocery aisle).

Plant-Based Proteins

Here, plant proteins are mixed with canola or coconut oil and seasonings to resemble various beef or chicken products.

While this might not appeal to everyone, the key trend here is that plant-based proteins are no longer just a meat replacement for a small group of vegetarians; it’s now its own (rapidly growing) category, driven by ESG consumer preferences.

NPD, a food industry research company, announced recently that case shipments of plant-based protein from distributors to restaurants increased by 20% in 2018.

This trend will surely pick up this year as McDonald’s this week announced that it will introduce a meatless burger and Burger King, after a brief test in select cities, announced plans to roll out its meatless burger across the US.