November 23, 2018

MARKET ENVIRONMENT

Understanding the S-Curve

A prominent (and surprising) feature of the current market correction has been the sharp decline of the leading technology companies.

Apple, Facebook, Netflix, and other leading NASDAQ companies, previously viewed as outstanding investments over many years, underwent sharp declines (20%+) over the past several weeks.

To understand the sudden market sentiment reversal towards these long time leading companies, it is important to understand the concept of the S-curve.

The general S-Curve shape is indicated below.

This pattern occurs frequently in charting natural growth patterns and is especially relevant to describe the adoption of any new technology.

The X-axis displays the passage of time; the Y-axis displays the penetration (% usage) of the technology by the general population.

Consider the introduction of cell phones as a new technology.

a) Beginning Stage

When first invented, they were large bulky, expensive and quite inefficient. The value of wireless communication was not well understood. Only technophiles (“early adopters”) bothers to buy them at first.

The flattish lower left side of the curve charts this extended period of slow adoption.

However over time, the technology improved, costs came down, and more people became familiar with the benefits of mobile communications. The “social buzz” started to grow and usage increased gradually.

b) Ascent Stage

At the “inflection point” (when the curve slope starts to rise sharply) cell phones finally achieved the pricing, convenience and social acceptance to be a well sought after item by the general population;

In fact, the more cell phones became popular, and the more features added, they became a “must have”. Not having one became almost unthinkable.

Sales and profits grew almost exponentially.

Shareholders also made great profits.

c) Maturity Phase

Inevitably, after years of increasing public usage, almost everyone had one. They were no longer a novelty but were rather now considered a basic utility of life.

At the same time, the features of cell phones matured. All had music capabilities, GPS services, internet connections, extensive app stores, etc.

At this point, since there was no longer a significant number of new buyers, (or new features) their growth leveled off. The top section of the S-curve is essentially flat.

Cell phone companies can remain strong and profitable indefinitely in the maturation phase.

However, once the growth curve flattens, growth/momentum investors quickly exit these companies.

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

The S-Curve pattern applies to the introduction of new technologies across all industries.

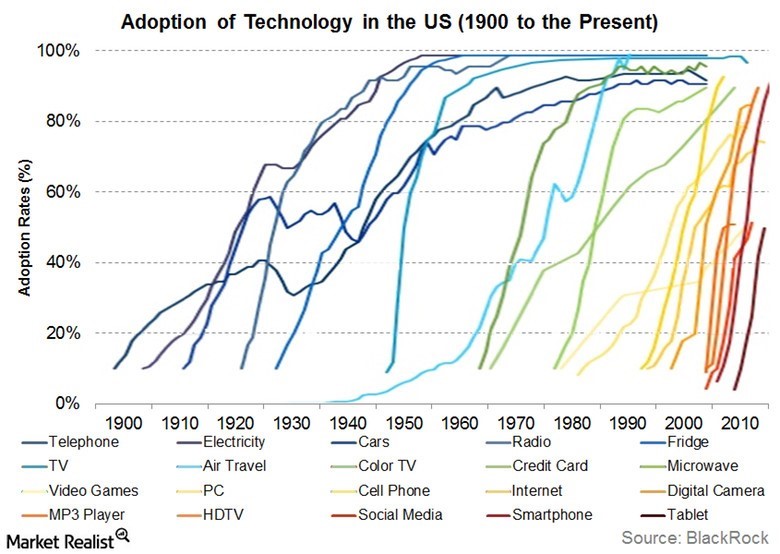

The below chart reviews the growth curves of the major tech innovations since 1900.

As per the left side of the below chart, innovations of 100+ years ago - like electricity, telephones and automobiles - took decades before their maturity.

If the pace of life (and change) seemed slower in the past … it was.

In contrast, (as per the right side of the chart) recent tech innovations like smartphones and social media have required only a few years to achieve maturity.

Very recent technologies (like Snap and Instagram) are only taking several months. Life is truly accelerating.

From an investment perspective, only the most risk tolerant investors (speculators) would invest in a company at its earliest stages. Most start-ups fail. Most expected innovations do not survive exposure to real world conditions.

Of course, the payoff for early investors can be huge if the new company proves successful.

(Note that established private equity companies, who specialize in early stage investing, succeed by making smaller investment in dozens of beginning companies. Even with their vast experience they cannot forecast the eventual winners and so spread their bets around widely).

Companies that have succeeded and are firmly in the ascent stage are very attractive to “growth” oriented investors. Ever increasing revenues and profits lead to ever increasing share prices. This describes several leading technology companies.

Note that these companies are largely US based and their growth has been a major factor behind the world-leading performance of the US equity indices.

However, now, the apparent maturation of certain leading technologies (smart phones, social media) has become a key factor in the recent market decline.

The need to upgrade smartphones each year is disappearing. Certainly, new features are added each year. But the extra cost is increasingly not seen as worth the switching price.

Much like earlier technologies (automobiles, washing machines, microwaves) the “product life cycle” has lengthened. At this point, the product is usually kept for its useful life, and, when a new purchase is necessary, then a choice is made among current models based on their features which are available at that time.

There are no media-broadcast lineups, when a microwave, fridge or laundry dryer is updated.

Maturation also seems to describe social media companies (like Facebook and Twitter).

Part of the concern is that privacy issues will dissuade people from using them. Also, fears of their being coopted by malevolent foreign governments or radical and groups is causing the threat of government regulation.

Perhaps the biggest concern is simply that if everyone has an account, then there is no room to add more. Further, there is a limit to the amount of ads that users will accept to interrupt their “free” service.

At any rate, social media is entering its mature phase. It will remain an essential part of most people’s lives; ad revenues will continue. But it is no longer “the latest thing”.

……………………………………………………………………………..

As a general rule, in nervous markets, a “sell first, think about it later” mentality can exist.

In recent weeks, recognition of the maturation of two major technologies (smartphones, social media) was quickly extended to include all technology companies regardless of their specific field of innovation.

However, several fields of tech innovations remain clearly in their ascent stage. These include: ecommerce (and related logistics), the Cloud, Big Data (and data storage), cybersecurity and artificial intelligence.

Yet, they too were sold down – as if they all hit the top of their own S-curves simultaneously.

This error in market pricing will allow for eventual “Buy Low” opportunities.

That said, in the current market environment, good investment strategy requires increasing emphasis on defence (higher cash levels, more defensive, high dividend equities).