Life these days has many benefits, but the accelerating pace of change and speed at which we digest and exchange information can be a double-edged sword, especially for investors.

Market volatility hasn't actually increased materially in the Age of Twitter, but it certainly feels more pronounced. Recently, markets have exhibited a pattern that's growing more familiar with each day (including this afternoon): a hasty knee-jerk reaction to a negative news headline (or tweet from Mr. Trump), followed by exaggerated market movement downwards as investors digest the information, and then a relief rally before reacting to the next news item on the menu.

This sequence isn't necessarily new — markets have always climbed a "wall of worry" — but it feels like the pace of market inflections has accelerated dramatically over time, and investors are feeling the g-forces.

When it comes to headline risks like trade negotiations – or tweets about them, I tend to sound like a broken record when I suggest that everything is going to be ok while recommending the news be viewed through the lens of a well-diversified global portfolio, proper asset allocation and comprehensive financial planning.

This can be difficult to digest because the media often focuses on the performance of a single asset class, like U.S. equities, which should make up only a portion of a well-diversified portfolio. As such, headlines or the occasional tweet can often lead investors to believe their portfolios will be impacted on a whole (or to a larger extent than they actually are).

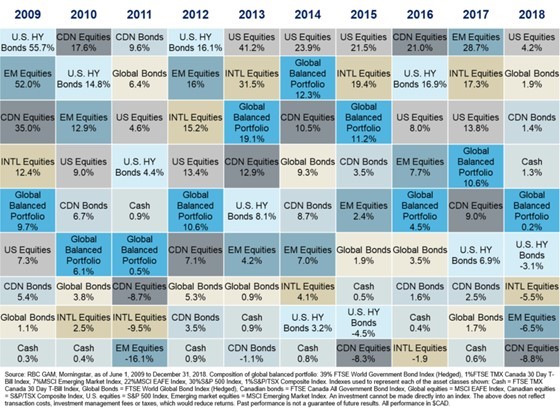

The below chart shows the annual returns for various global asset classes and markets in each of the past 10 years. Even a quick glance shows that all of these markets go up and down in the short term and that no single market has outperformed others consistently (this is what we mean when we talk about diversification).

Keep in mind that markets tend to over-react, which often causes a dislocation between stock/bond prices and actual value. Fundamentally, your high quality portfolios are still comprised of high quality businesses – they are merely on sale if you consider yourself an opportunist (and especially if you have time on your side).

Always remember that your asset allocation, diversification and patience are the key to your long-term success. Investing in a globally diversified mix of equities and fixed income can help steer you through various market conditions including short-term market declines in any one asset class or region. So, as the news of tariff disputes, European concerns, fed meetings, political drama and tweets continue to flood your newsfeed, while they can be nerve-racking, we all need to listen to our heads and ignore our hearts. Stay the course and remember that you have a written plan in place particularly for times like this.

All that said, my team and I are constantly monitoring the changing macro environment and potential implications for your investment portfolio – because while headlines come with a shock value, it’s the real empirical data, technical trends, and economic indicators that we’re watching even more closely behind the scenes in determining when to rebalance and become more defensive.

If you have any questions as to how your current investment portfolio is positioned, or if would just like to chat further on the topic, I am available any time to discuss your investment plan to not only offer some reassurance that your plan is sound, but also to discuss whether any adjustments might be warranted.

Now you are in-the-know with Word on the Street.

Enjoy the weekend,

D.

Dian Chaaban

Investment & Wealth Advisor

Chaaban Wealth Management Group

416.842.4234