Love and emotions have nothing to do with the market – but as intelligent human beings we are naturally and justifiably very emotional with our money – which is where the lines become blurred. A financial blog I came across recently came to the conclusion that there are five ways people behave in relationships:

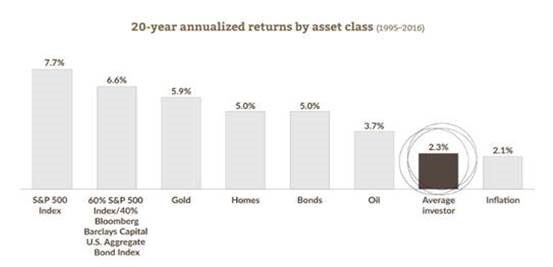

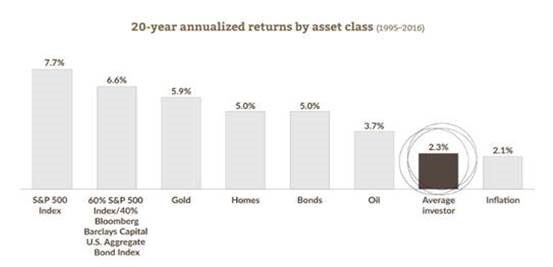

The chart above (source: Bloomberg LP) is probably the most used in our business. We’d love to never use it again but that won’t happen until this harmful behaviour stops. Face it, as tempting as they are, short-term relationships aren’t all they’re cracked up to be. Just look at how the returns of the average investor were negatively impacted by emotions and short-term thinking.

Finding the way to my heart

In addition to my favorite sipping scotch, my team and I are looking for long-term relationships. And we’re dedicated to working hard for you throughout the many years, regardless of performance. There will undoubtedly be some really tough and rocky times (we got a glimpse of them again recently when volatility shook markets in October all the way until Christmas eve), and when they happen again, will you stay a part of this long-term relationship? I know you will.

I know this because I tell all of my clients (especially before we make it official) that liking and trusting one another is critical to our long term relationship because of the innate risk inherit to the entire market (known as systemic risk). The market will misbehave. Your portfolio will go up and down in value but with trust comes the ability to provide the professional (and emotional) guidance to keep you on track. That, along with strategic research, proper diversification, a disciplined asset allocation, generating tax-efficient income and a proper financial plan, your investments will show you that love you expect today, over time.

Also, in the spirit of

Family Day this upcoming Monday, Feb 18th, a Canadian holiday which celebrates the importance of families and family life to people and their communities, I’ll point your direction to a great publication our Wealth Management team has put together which outlines

10 strategies to building and protecting your family’s wealth. For your complimentary copy of the Family Wealth Management Guide,

just say the word.

Now you are in-the-know with Word on the Street.

Enjoy the long weekend.

D.

Dian Chaaban

Investment & Wealth Advisor

Chaaban Wealth Management Group

416.842.4234