I was fortunate enough to ring the TSX opening bell this morning in support of my awesome friend Jeff Musson who established ‘Coding for Veterans’, a program to teach computer programming skills along with advanced course work in the areas of cyber security, data analytics to men and women from Canada’s armed forces. And while you always hope that the market will be positive on the day you cheer the open, today was more of the same when it comes to the (healthy) correction we’ve been experiencing.

While it was a thin week (lighter volumes thanks to our U.S. neighbours being away for Thanksgiving), the market continued to misbehave this week and when markets are particularly volatile, there’s a natural tendency for investors to move into safer investments, hoping to avoid further perceived losses, while waiting for the markets to recover. But unfortunately it’s nearly impossible to predict when the markets will recover.

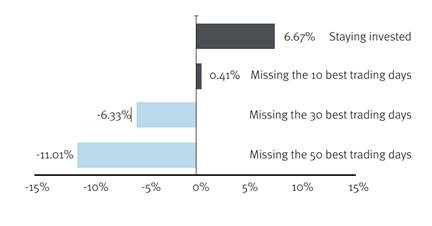

As a result of bailing out, investors make investment FOMO a reality and may miss out on the eventual recovery, which can negatively affect their long-term investment goals. The investor who keeps their chips in and stays invested tends to do better than the investor who bails out and misses even some of the recovery; missing just the 10 best days in the market over the past 10 years would have reduced your returns significantly:

Avoid market timing

Some investors try to improve their returns attempting to “time” the market – selling right before the markets go down, then buying right before they go up again. In theory, this sounds amazing. But in practice, it rarely works, simply because it’s so difficult to predict when the markets will go up or down. Unfortunately, that doesn’t stop investors from trying, which is why the “average investor” tends to underperform virtually every asset class. Remember, success comes from time in the market, not timing the market.

Maintain your sense of perspective

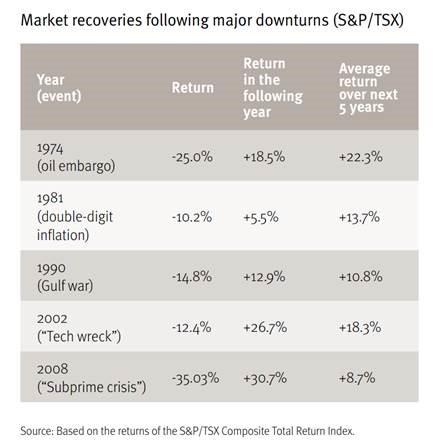

Unquestionably, stock market downturns can be painful, especially when you’re in the middle of one. It’s not always easy, but it’s important to remember that downturns have happened before – and will happen again – and that historically the markets have always recovered and reached new highs, as the table below shows:

Reassess your comfort level with risk

It’s one thing to say you are comfortable with a higher level of risk when the markets are only going up, and another thing when the markets are volatile. If you are finding it difficult to sleep at night because of market volatility, then it might be time to consider how much risk you are truly comfortable taking with your investments.

Whether this volatility continues for days or weeks to come is of course unknowable. We suspect that the volatility will likely continue in both directions over the next several months, in a more normal long-term pattern compared to the low volatility of the past few years. This could take some getting used to. Keep in mind that markets tend to over-react, which often causes a dislocation between stock prices and actual value. Fundamentally, your high quality portfolios are still comprised of high quality businesses – they are merely on sale if you consider yourself an opportunist. I know these times can be nerve-racking but these are the times when we all need to listen to our heads and ignore our hearts. Stay the course and remember that you have a written financial plan in place particularly for times like this.

Think ahead to stay ahead

My colleagues at RBC Capital Markets are constantly challenging us to be different by providing unique perspectives. They aim to add value for our clients by distinguishing our firm as thought leaders across all the industries they cover in the Research Department by encouraging debate and diverse perspectives, not for the sake of merely being provocative, but because we believe it fosters a more comprehensive discussion.

With their latest Imagine 2025 framework, RBC Capital Markets has gone further by thinking beyond the typical investment horizon. They incorporated the concepts of exponential change and disruption into their process to provide a creative construct for future investment. Together, we are encouraging clients to be more inventive as they think about the evolution of the state of commercial advancement. 2025 is a time period beyond most peoples’ current investment horizons, but not too far in the future that the world would be unimaginable as we know it today.

In other words, while we remain cautiously optimistic about all of the noise today, there is much more to be excited about in the future – especially if we focus in the right areas. To help define these areas, RBC Capital Markets embarked on an ambitious six-month study of the global drivers of parabolic change. They began by identifying a fairly large number of “change forces” that we believe will catalyze a metamorphosis of the world around us. Such forces include Social, Political, Technological, Economic and Environmental Change. These change forces encapsulate some of the major technological advancements that are becoming more pervasive every day, such as Artificial Intelligence, Big Data, Cyber Security, Autonomous Cars, etc. They also include plenty of societal changes that are becoming more universal, such as the Rise of Women, Urbanization, Climate Change, and Resource Shortages. The six themes that emerged from this work – The Calibrated & Augmented Self, The AI Race, Collective Action, Escalating Uncertainties, The Agility Imperative and In Cloud We Trust – formed the outline of Imagine 2025. In Imagine 2025 we envisioned some significant advancements that we believe will become the status quo in the (not-too-distant) future.

Click here to request the comprehensive 236 page report – it’s a very lengthy read but worth the investment in more ways than one. If you don’t feel like reading the report, you can always call me for the Coles notes.

Now you are in-the-know with Word on the Street.

Enjoy the weekend.

D.

Dian Chaaban

Investment & Wealth Advisor

Chaaban Wealth Management Group

416.842.4234