Almost on queue for Halloween, a number of factors came to a head last week, spooking U.S. equities and other markets (and moderately into this week). While I’d argue that much of these factors were already priced in, our professional opinion and advice is to stay calm and invest on.

Pullbacks and corrections are routine when it comes to investing, but they seldom feel that way when they arrive. The U.S. equity market sold off last week with the NASDAQ posting its second biggest single-session selloff in seven years (falling 4.1% on October 10), behind only the Brexit-induced selloff in mid-2016 – hey, remember that?

Equity markets worldwide followed the U.S. lower, adding to their previous losses, while Asian and emerging markets have borne the brunt of the global correction. The U.S. fixed income market hasn’t been immune to the selling either - treasury prices fell and the 10-year Treasury yield climbed to 3.23% at one point, the highest level since 2011.

Boo! Who’s to blame?

Corrections typically have multiple culprits, and this episode is no exception:

• the spike in yields spooked global equities; the run-up in Treasury yields and related concerns about a higher interest rate regime;

• perceptions by some that the Fed may shift to an unnecessarily aggressive rate hike pace (we disagree);

• a decline in global Tech stocks primarily due to tariff risks, regulatory threats, above-average valuations, and signs of peak activity in bellwether semiconductors;

• the increasing likelihood the U.S.-China trade dispute will intensify, and the ratcheting up of overall tensions between the two countries;

• concerns about China’s slowing economic momentum;

• potential wrinkles in the U.S. Q3 earnings season related to margin pressure, tariff angst, and the strong dollar; and,

• the coming transition to a slower, more normal U.S. corporate earnings growth rate in 2019.

U.S. equities are usually volatile in October and are often wobbly in midterm election years—typically pulling back within the 12-month period ahead of the election and then rallying after the dust settles. It’s also important to keep in mind that this S&P 500 pullback follows the strongest quarterly performance in almost five years.

Why we’re keeping calm and investing on

The immediate risks facing equities have not changed our constructive longer-term view because the two pillars for stocks—economic and earnings growth—are likely to continue to provide a solid foundation. Forward-looking indicators are still signaling the U.S. economic expansion will persist for the next 12 months, at least, and some of these data points have actually strengthened recently.

While we expect S&P 500 earnings growth to slow from its robust 2018 pace of 20%+ y/y (including the boost from tax cuts), growth in 2019 should be average to slightly above average, in the high single-digit to low double-digit range. This should be enough to maintain the long-term bull market streak, in our view.

So what I’m really saying is …

Our view remains that investors should give equities the benefit of the doubt as long as the economic, credit, and earnings cycles remain favorable for stocks. We would not overreact to the recent moves. Corrections usually take some time to play out. They rarely end quickly. We think investors have time to be patient and make portfolio decisions thoughtfully, in line with long-term goals.

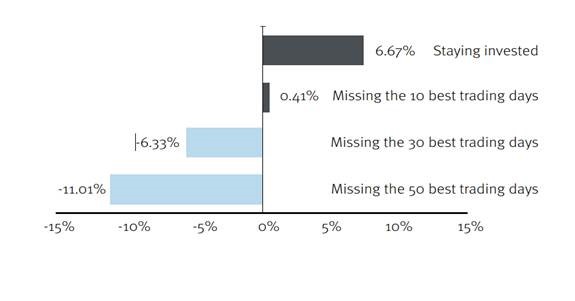

It’s ok to admit that investing is emotional – which is why there’s a natural tendency for investors to move into safer investments, hoping to avoid further losses, and wait until the markets recover. But unfortunately it’s nearly impossible to predict when the markets will recover. As a result, investors may miss out on the eventual recovery, which can negatively affect their long-term investment goals. As the chart below shows, the investor who stays invested tends to do better than the investor who bails out and misses even some of the recovery:

Time in the market is always better than timing the market

Some investors try to improve their returns attempting to “time” the market – selling right before the markets go down, then buying right before they go up again. In theory, this sounds great. But in practice, it rarely works, simply because it’s so difficult to predict when the markets will go up or down. Unfortunately, that doesn’t stop investors from trying, which is why the “average DIY investor” tends to underperform virtually every asset class.

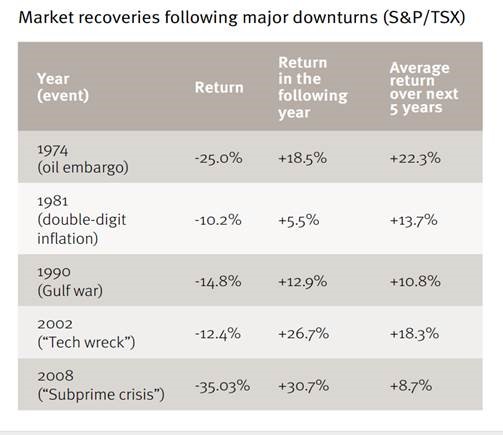

Maintain your sense of perspective

Unquestionably, stock market downturns can be painful, especially when you’re in the middle of one. It’s not always easy, but it’s important to remember that downturns have happened before – and will happen again – and that historically the markets have always recovered and reached new highs, as the table below shows:

Reassess your comfort level with risk

It’s one thing to say you are comfortable with a higher level of risk when the markets are only going up, and another thing when the markets are volatile. If you are finding it difficult to sleep at night because of market volatility, then it might be time to consider how much risk you are truly comfortable taking with your investments.

Now you are in-the-know with Word on the Street.

Enjoy the weekend.

D.

Dian Chaaban

Investment & Wealth Advisor

Chaaban Wealth Management Group

416.842.4234