I realized at a young age that I was more of a mathlete than an athlete (I was that kid who you picked last in gym class because I could barely catch a ball) which wasn't so fun during recess but my grade 8 graduation encouraged me to stay the course when it came to good grades and working hard because I walked away as the recipient for every subject award (except for gym, obviously).

Still a nerd in disguise, I love learning new things, reading as much as I can and avoiding sports that require hand-eye coordination – except for golf which is the only sport I’ve ever really seen any sort of progress in (I’m convinced it’s because the ball isn’t moving until I hit it).

A true nerd at heart, this time of year still makes me smile when I think of the excitement the first day of school would bring. So, with all of the students back at school this week, I thought it would be timely to share some fast facts about paying for education along with some valuable tax planning strategies for students.

Fast Facts:

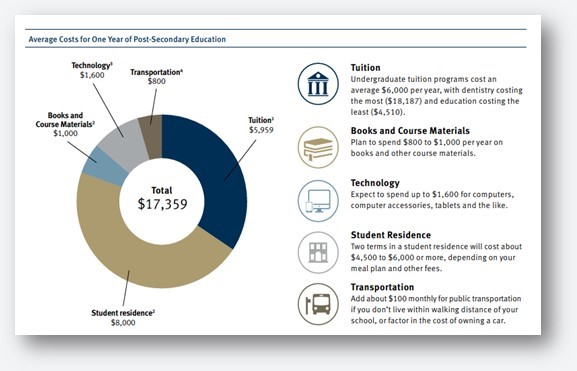

$17,359 - That is the average cost for one year of post-secondary education for students in Canada; here is how we came up with that:

$6,838 - That’s the average undergraduate tuition fee in Canada this academic year, up 3.3% from last year. But fees vary widely depending on the program pursued: average tuition comes in at $5,773 for the humanities, $8,466 for engineering and $23,474 for dentistry.

6.3% - This is the average annual increase in university tuition costs since 1990.

$1,340,105 – ROI. That is what a student’s bachelor degree translates to in terms of total cumulative earnings. Compared to $963,075 for a college certificate and $749,975 for a high school degree.

20% - This is perhaps the biggest advantage to contributing to an RESP: the CESG — a powerful grant incentive from the federal government. With the basic CESG, the government will add 20% annually to the first $2,500 contributed to an RESP. That adds up to $500 per year. The maximum CESG over the life of the plan is $7,200 per beneficiary. Click here to request our report out giving the gift of knowledge and remember that we can manage your family’s RESP here as well.

15% - You may be eligible to claim a 15% non-refundable credit for tuition fees you paid. Read more about this and 11 other handy tax planning tips for students by requesting the ‘tax planning checklist for students’ article. Click here to request a copy.

Now you are in-the-know with Word on the Street.

Enjoy the weekend,

D.

Dian Chaaban

Investment & Wealth Advisor

Chaaban Wealth Management Group

416.842.4234