2025 TFSA Contribution Information

You can now make your Tax-Free Savings Account (TFSA) contribution for 2025 (up to $7,000.00).

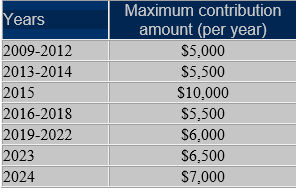

If you haven’t maximized your TFSA contributions in the past, you can also catch up on your 2009-2024 contributions.

The maximum possible contribution room for all years (including 2025) is $102,000 (assuming you were at least age 18 in 2009).

TFSA Contribution Options:

To arrange your 2025 TFSA contribution, please contact Abby Huang, at 604-257-2540 or by email at abby.huang@rbc.com.

Online Transfers: If you have a bank account with RBC, you can also make a contribution by transferring funds to your RBC Dominion Securities TFSA account directly from any RBC Royal Bank account through DS Online. Please find detailed instructions for making real time contributions here

2024 RRSP Contribution Deadline

The RRSP contribution deadline for the 2024 tax year is March 3, 2025. Your contribution limit for 2024 is 18% of your 2023 earned income, to a maximum of $31,560 with certain adjustments (e.g. less any Pension Adjustment appearing on your T4 tax slip and plus any unused contribution room carried forward from previous years).

For your exact contribution limit, check your latest Notice of Assessment, Notice of Reassessment or T1028 form, or log on to your Canada Revenue Agency account at MyCRA

You can also make your 2025 contribution any time starting January 1,2025 to benefit from additional tax-deferred compounding. The maximum RRSP contribution room you can earn for 2025 is $32,490.

RRSP Contribution Options:

To arrange your 2024/2025 RRSP contributions, please contact Abby Huang, at 604-257-2540 or email at abby.huang@rbc.com.

Online Transfers: If you have a bank account with RBC, you can also make a contribution by transferring funds to your RBC Dominion Securities RRSP account directly from any RBC Royal Bank account through DS Online. Please find detailed instructions for making real time contributions here