Private Markets & Alternatives

For many years the typical split of a balanced portfolio of 60% stocks and 40% bonds, gave an investor diversification to lower risks. Some would say the only free lunch with investing is diversification. However, over the last number of years we have seen the correlation between stocks and bonds become very similar, even though stocks and bonds are very different in nature they started to trend in similar patters, thus reducing the objective of diversification. We however have been using alternative investments in our client portfolios since 2010. Some of the alternatives we have used are gold, silver, market neutral strategies, and seasonal strategies. More recently we have started to incorporate Private Market alternatives, in addition to our already public market alternatives. The addition of Private Equity and Private Credit, we have added increased uncorrelated diversification to portfolios.

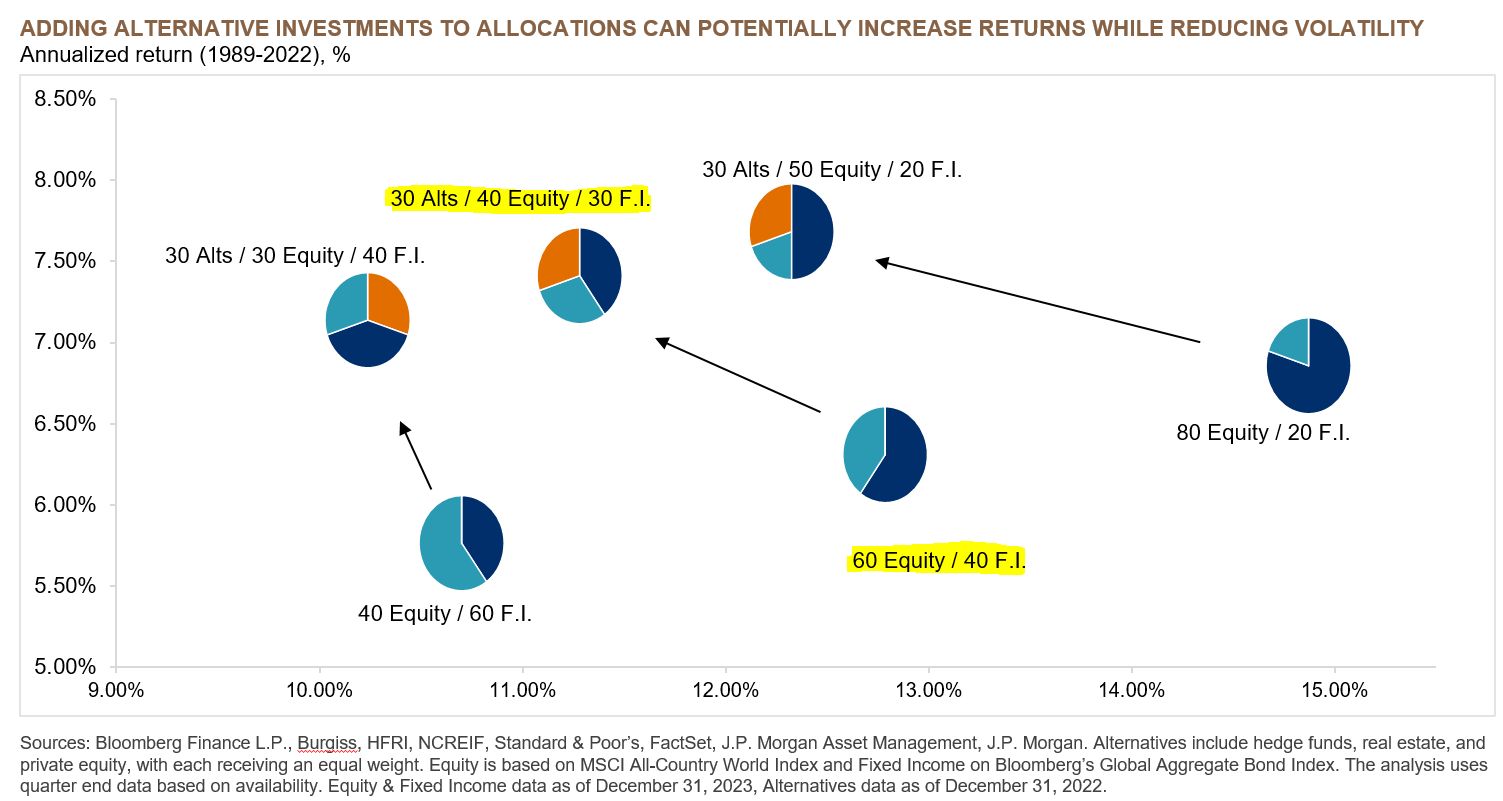

As you can see by the chart from JP Morgan, the addition of Alternatives, can potentially increase returns, while reducing volatility, and providing true diversification.