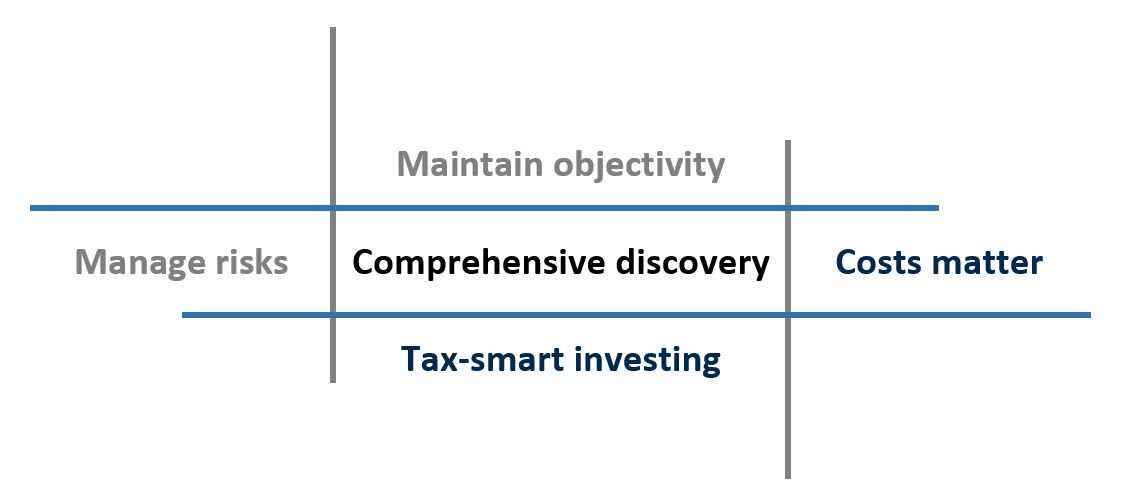

Investment Principles That Guide Our Decisions

While we will continue to have bull and bear markets, we rely on core principles and a proven process to guide our investment decisions.

Costs Matter

Focusing on cost efficiency is important.

It is one of the reasons that we prioritize competitive costs in our client relationships. However, what matters most are net returns after all costs have been paid. Incremental net returns make a big difference in the potential to build long term wealth.

Tax-Smart Investing

It’s not what you make, it’s what you keep.

Not all investment income is taxed in the same way, so it makes sense to evaluate what’s in each portfolio to ensure it's minimizing what’s taxable. Our tax-smart approach considers investment techniques to help clients keep more of what they earn.

Manage Risks

The markets will move up and down.

Investors often think of risk and volatility as synonymous and use them interchangeably. However, we take a long term investment approach and think of risk as avoiding permanent loss of capital or the loss of purchasing power, a belief that is paramount to ensuring clients keep what they’ve spent a lifetime working hard for.

Maintain Objectivity

Sound knowledge and strong judgment.

It is imperative to keep emotion, personal bias, and competing priorities out of the decision making process, and instead, base recommendations on an understanding of a client’s goals, objectives, and most importantly, their best interests.