Fall is one of my favorite times of the year, it’s beautiful watching the colors change and we’ve also enjoyed several evenings watching the Northern Lights. Of course, hockey is also back in season so not only do my 2 boys get back on the ice, but the NHL season is underway. After coming oh so close to the Stanley Cup my Oilers have started the season with a disappointing 3 game losing streak.

Proceed with caution

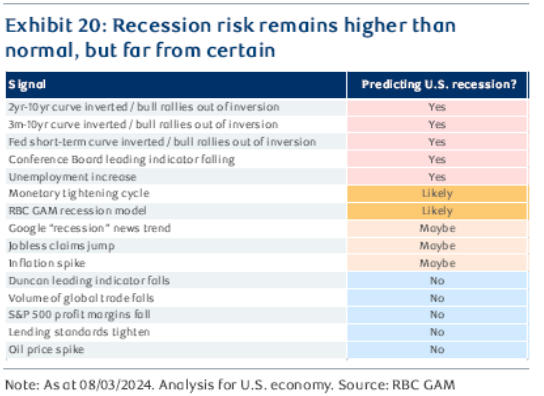

Corrections can arrive seemingly “out of the blue.” It would be tempting to predict one will arrive soon, given today’s rich valuations together with the prevalence of investor optimism or, at least, complacency. However, we will resist that temptation, acknowledging that the odds of being wrong are high either way. That said, we will again point out that one very reliable precursor of an impending bear market (as opposed to a correction) is so far nowhere in sight—namely, a trend breakdown in market breadth. Both the S&P 500 advance-decline line and the “equal-weighted” version of the S&P 500 have been racing ahead making a succession of new highs, with the more closely followed S&P 500 capitalization-weighted index quickly following suit. Things proceed differently when a bear market is in the offing.

The advance-decline line turns lower as the majority of stocks fall into downtrends, even as an ever-smaller number of heavily weighted, high performing stocks push the index on to a final cycle high. No such divergence is apparent today. As long as market breadth remains “in gear” with the broad averages, we are inclined to give stocks the benefit of the doubt. However, if a new market up-leg were to emerge, wherein breadth measures failed to participate and moved into a downtrend, a deeper, broader retrenchment for equity markets might be in the works. All the more reason why we believe a cautious, watchful approach is called for.

Rates

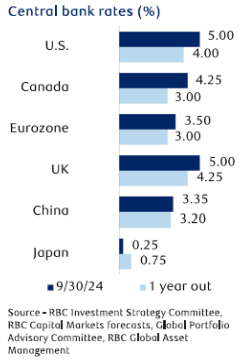

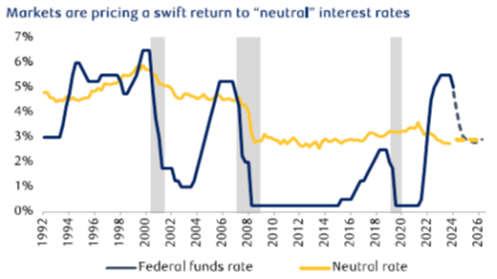

The Federal Reserve cut its overnight policy rate by 50 basis points in September, bringing the target range down to 4.75%–5.00%. Bonds have rallied in anticipation of the Fed’s rate cut cycle with the Bloomberg U.S. Aggregate Bond Index returning nearly 6% over the past six months, one of its best runs of the past 20 years. Our base case is that the Fed cuts rates by a further 75 basis points this year to a 4.00%– 4.25%, range, which is largely already priced into markets. We expect bonds to continue to perform well, but after the recent rally we see more muted returns for the balance of the year.

Fed cuts rates by a further 75 basis points this year to a 4.00%– 4.25%, range, which is largely already priced into markets. We expect bonds to continue to perform well, but after the recent rally we see more muted returns for the balance of the year.

The Bank of Canada (BoC) has cut its policy rate by 75 basis points (bps) since June and suggested further rate cuts are likely if inflation continues to decline as it expects. Headline inflation slowed to the BoC’s 2% target in August, for the first time since 2021, but core measures remain slightly higher. The BoC has put greater emphasis on downside risks to the economic outlook recently, noting it could cut interest rates slightly faster if growth doesn’t pick up as the BoC expects. Recent indicators suggest Q3 GDP could disappoint relative to the BoC’s July forecast, which in our view opens the door to a 50 bps rate cut later this year.

Canadian dollar: USD/CAD The Bank of Canada (BoC) delivered a third consecutive 25 bps rate cut in September, in line with market expectations. It kept the door open to more cuts. RBC Economics sees the BoC cutting rates by a total of 125 bps until end-2025, similar in magnitude to the Fed, but with the BoC already cutting three times in 2024, we think the relative rate dynamics still favor the greenback, with some upside risk to USD/CAD into early next year.

Changes

We increased exposure to fixed income to remove some risk from the portfolios implementing an unconstrained credit strategy, RP Alternative Global Bond (AGB). Managed by RPIA who currently manages over $13 billion and has a goal of offering Canadians a better approach to fixed income. AGB can invest in investment grade debt securities from anywhere around the world and seeks to generate capital gains through active trading.

We also increased exposure to high quality dividend paying Canadian companies through a low-cost ETF solution, Vanguard Canadian High Dividend Yield. This ETF is generating dividend income of 4.34% with exposure mostly in the financial and energy sectors. The largest 2 stocks in this ETF are currently RBC & TD making up roughly 25% of the ETF’s holdings.

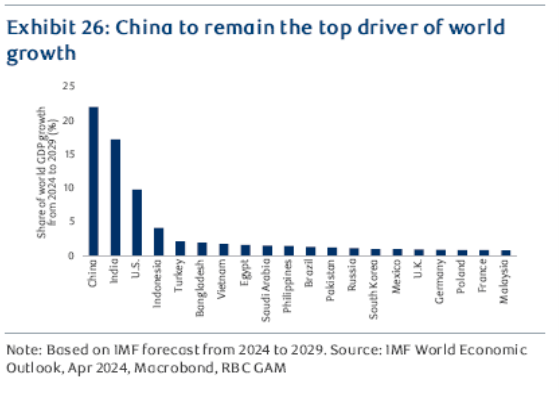

Some exposure to emerging markets was also added using RBC Multi-Strategy fund. Chinese policymakers surprised the market with stronger-than-expected stimulus measures in late September. The People’s Bank of China announced a coordinated package of policies aimed at lower interest rates and increasing liquidity in the stock market. The September Politburo meeting, a gathering of the Party’s top decision-makers, conveyed a clear message: more aggressive fiscal and monetary policies are on the way to stabilize the property market and support the equity market. Additionally, with the Federal Reserve cutting its fed funds rate by 50 basis points, we think there is further room for China to ease its policies.

Charts of Interest