In my last newsletter we started out looking at the odds for each NHL team to win the Stanley Cup and although Edmonton had slightly better odds going into the post season they were edged out by Florida. Game 7 had the highest TV ratings since Chicago beat Boston in an original six matchup in 2013. Connor McDavid won the Conn Smythe Trophy because of his 8 goal & 34 assist performance, passing Gretzky’s record of 31 helpers in the ’88 campaign.

US Markets

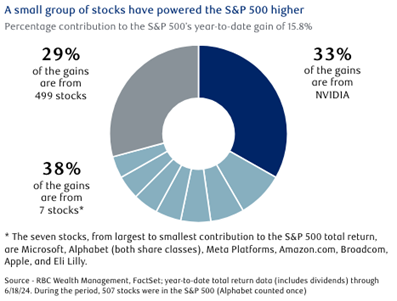

The S&P 500 has surged 15.8% including dividends year to date through June 18. While the price gain is almost 1.5 times that of the average annual return of the past 40 years, the rally has been rather narrow. Just eight stocks represent 71% of the index’s return, seven of which are leveraged to artificial intelligence (AI), led by chipmaker NVIDIA. This leaves the other 499 stocks in the index during this period combining for only 29% of the total return. Now is not the time to chase the biggest winners, in our view.

date through June 18. While the price gain is almost 1.5 times that of the average annual return of the past 40 years, the rally has been rather narrow. Just eight stocks represent 71% of the index’s return, seven of which are leveraged to artificial intelligence (AI), led by chipmaker NVIDIA. This leaves the other 499 stocks in the index during this period combining for only 29% of the total return. Now is not the time to chase the biggest winners, in our view.

Volatility has all but vanished. The S&P 500 has gone more than 335 trading days without a 2% or more single-day decline, according to a study by RBC Global Asset Management. This is the longest stretch since 2018 and much longer than the 23-day average since 1999. We think volatility could increase in coming weeks and months. First of all, this data indicates a volatility episode is overdue. Second, the U.S. presidential campaign season—largely ignored by investors heretofore—could generate market swings as institutional investors start to focus on the debates and political party conventions this summer. Typically, during election years volatility perks up at some point.

Canada

Slower-than-expected economic growth, a cooling labour market, and ongoing disinflation make a compelling case for the Bank of Canada’s continuation of its interest rate cuts. RBC Economics anticipates a total reduction equivalent to four 25-basis point cuts throughout the remainder of 2024. These cuts should afford domestic consumers some relief.

market, and ongoing disinflation make a compelling case for the Bank of Canada’s continuation of its interest rate cuts. RBC Economics anticipates a total reduction equivalent to four 25-basis point cuts throughout the remainder of 2024. These cuts should afford domestic consumers some relief.

Fiscal second-quarter earnings from the Canadian banks suggested a relatively benign consumer backdrop, but there were pockets of stress in certain areas, with credit card and auto loan delinquencies rising. We expect that headwind to continue for the foreseeable future. However, we note that this dynamic has been well-anticipated by the market and is reflected to some degree in the banking industry’s below-average valuation multiples.

Clouding Over

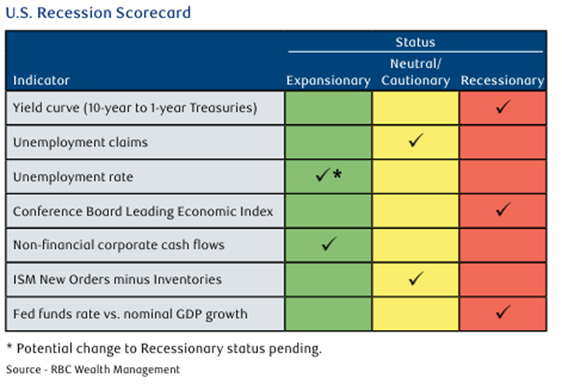

Just two years ago, the Recession Scorecard was flashing nothing but expansionary green lights for the U.S. economy. Starting in summer 2022 that unequivocally unanimous rating began to deteriorate. First, the Treasury yield curve inverted in July 2022—i.e., the 1-year Treasury yield rose above the 10-year yield— signaling that credit conditions were tightening in a serious way. Every recession in more than 100 years has been preceded by such a yield shift. A couple of months later a second of our seven indicators—the Conference Board’s Leading Economic Index— changed to recessionary red by falling below where it had been a year earlier. This has occurred before the onset of every U.S. recession since the late 1950s or for as long as this indicator has been around. In the months that followed, three more Scorecard series shifted out of the expansionary green zone to the cautionary yellow rating. Now a third indicator in the Scorecard has been rerated to the recessionary red column. As of Q1, the growth rate of U.S. nominal GDP has fallen below the fed funds rate. Such a crossing point has occurred either before or just after the start of every recession back to the 1950s.

nothing but expansionary green lights for the U.S. economy. Starting in summer 2022 that unequivocally unanimous rating began to deteriorate. First, the Treasury yield curve inverted in July 2022—i.e., the 1-year Treasury yield rose above the 10-year yield— signaling that credit conditions were tightening in a serious way. Every recession in more than 100 years has been preceded by such a yield shift. A couple of months later a second of our seven indicators—the Conference Board’s Leading Economic Index— changed to recessionary red by falling below where it had been a year earlier. This has occurred before the onset of every U.S. recession since the late 1950s or for as long as this indicator has been around. In the months that followed, three more Scorecard series shifted out of the expansionary green zone to the cautionary yellow rating. Now a third indicator in the Scorecard has been rerated to the recessionary red column. As of Q1, the growth rate of U.S. nominal GDP has fallen below the fed funds rate. Such a crossing point has occurred either before or just after the start of every recession back to the 1950s.

Bonds

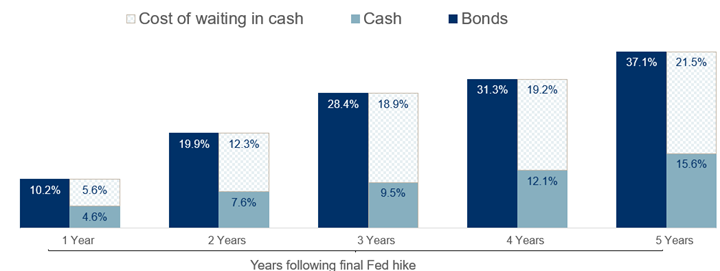

Over the last number of months, the Canadian economy has shown signs of weakness, growing at a slower pace than it did over the last three years, while the unemployment rate rose steadily. As macroeconomic weakness materialized and inflation moved lower, the Bank of Canada (BoC) was ultimately compelled to deliver its first interest rate cut of 2024, while guiding to additional cuts ahead. We view the potential for a BoC-induced drop for interest rates as supportive of longer-duration bonds in portfolios, i.e., those bonds with a higher price sensitivity to interest rate movements and most positively exposed to a drop in interest rates.

Though a tactical shift to longer duration bonds in anticipation of additional BoC interest rate cuts is reasonable, in our view, another strategy seems more appropriate given the lingering uncertainty regarding the timing and magnitude of rate cuts. Bond investors should focus on yields which are still hovering at the upper end of their 20-year historical range, moving away from an investment thesis that is heavily dependent on interest rate forecasts. This “yield” approach was much more difficult to implement when bond yields were sub-2% not long ago.

Changes

A special update was sent out in May explaining why we decided to ‘fire’ a Canadian value manager after working with them for over 6 years. Although the decision was difficult it was the right choice to make as we’ve reduced costs and gained exposure to sectors in the market we previously missed out on.

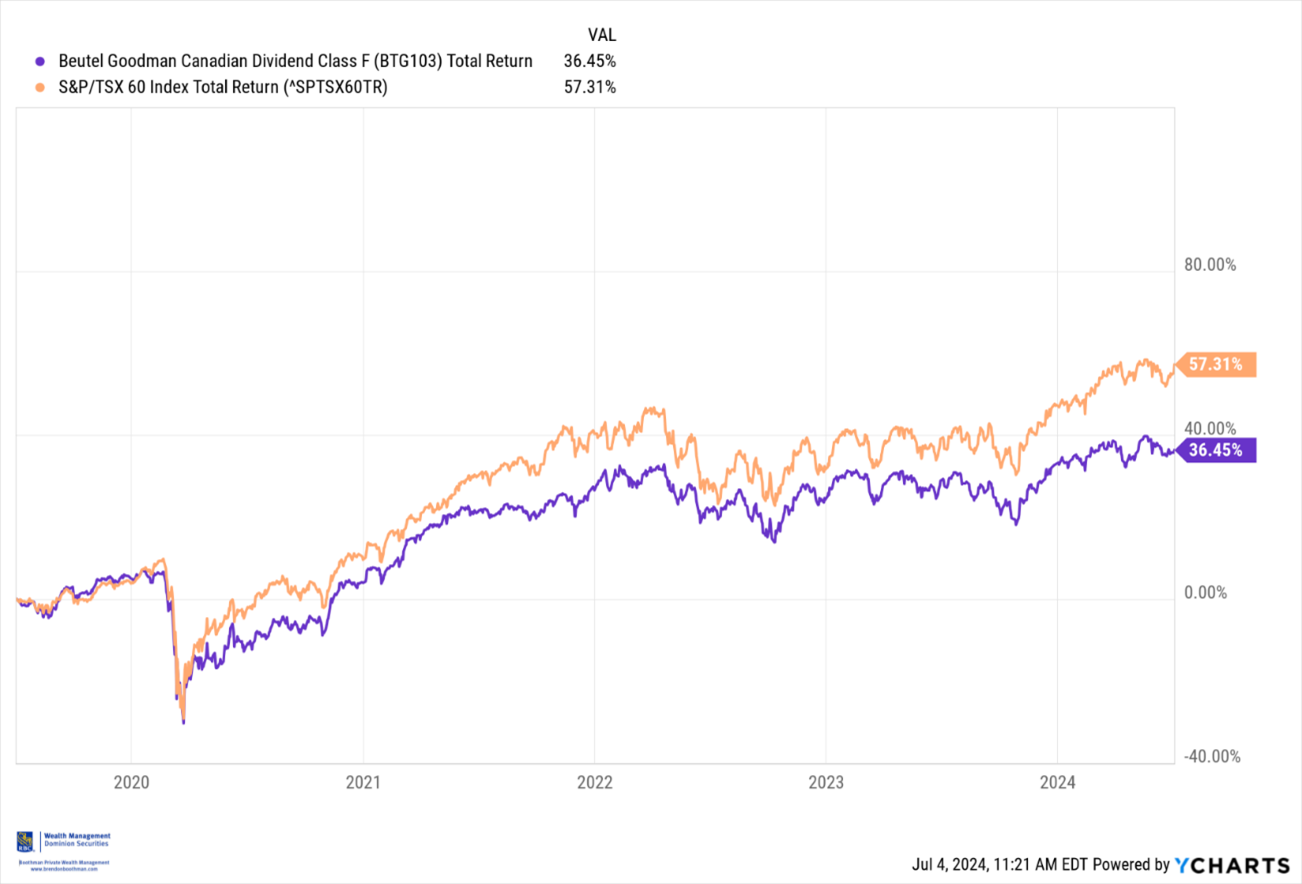

How did we reduce costs? For smaller accounts or accounts that did not want 30+ securities in statements we replaced Beutel Goodman Dividend fund with iShares S&P/TSX 60 saving 0.92% in imbedded management fees. XIU is also a core Canadian strategy with broad sector exposure which has also helped with better performance, particularly recently, as noted in the chart. This exposure to sectors like technology and industrials was another reason for the change as we wanted to obtain exposure in these areas which was limited in the Beutel strategy.

core Canadian strategy with broad sector exposure which has also helped with better performance, particularly recently, as noted in the chart. This exposure to sectors like technology and industrials was another reason for the change as we wanted to obtain exposure in these areas which was limited in the Beutel strategy.

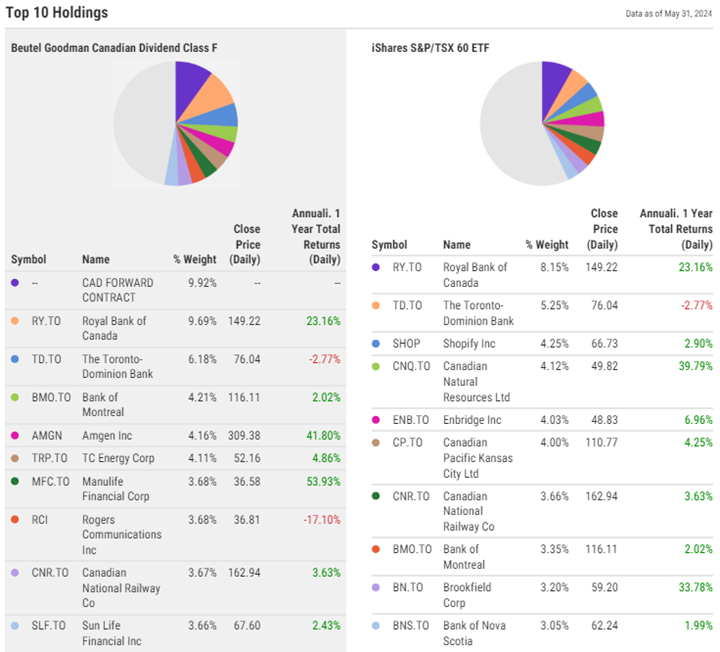

If you look closer at the top holdings you will notice some overlap, mainly in the Canadian banks, but the exposure in XIU now includes companies like Shopify & Brookfield Corp

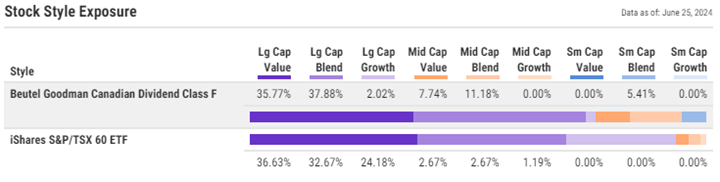

The Beutel fund did also hold up to 30% of foreign (US) stocks whereas our focus in the strategy is now limited to Canadian stocks only. This core strategy will also increase our exposure to more growth-oriented companies versus a more value-oriented tilt that Beutel has.

Thanks again for trusting our team to take on these responsibilities. We hope it allows you to spend less time worrying about your portfolio and more time with your families and loved ones. Enjoy your summer!

BB