8-years ago …

8-years ago, when I was Chief Canadian Equity Strategist for RBC Capital Markets, I went into election night as many others did, expecting a Hillary Clinton victory. While polls were close, Clinton led fairly comfortably in almost any combination that would get her to 270 Electoral Votes, so as a Strategist, I naturally prepared a piece that discussed the impact that a Clinton presidency would have on Canadian stocks, the dollar, oil, gold and pretty much anything else that was relevant to Canadian investors.

And then around 10pm, it started to become apparent that Mrs. Clinton was not cruising to victory as many had expected, but rather that Mr. Trump, seemingly against all odds, was emerging as the likely winner. Rather than wallow in it (okay, I wallowed a little bit), I had a job to do – namely writing a piece about the impact a Trump presidency would have on all of the aforementioned things above – so, needless to say, it was a sleepless night. The piece, which is attached below, was called “The Sun Also Rises”, which was a bit of a subversive way of saying (Capital Markets compliance was notoriously fickle about allowing anything that amounted to political commentary) - regardless of what is about to take place, we will get through it.

So, here we find ourselves again – we will make no grand claims that everything will be fine, as the wounds for some are likely very raw. There will be some dark days over the next four years. But we are also somewhat eternally optimistic, as we do believe in the long run that humanities’ better angels will prevail, even if there are periods of time in which the angels desert us. Rather than dwell on the negatives, we will instead dive into the impact of Trump 2.0 on all things (okay, some things).

Let’s start with some general thoughts.

- Likely united government: while the House of Representatives has yet to be decided, betting markets are currently assigning a ~90% chance that Republicans will retain control. Add to this the flipping of the Senate and, of course, the White House and the Republicans look set to have at least two years of control of all the levers of power. This has generally meant more fiscal largesse as one party control tends to lead to what we call “the drunken sailor effect” in which all previous governors on spending and deficits are cast aside. Thus, while some in the Republican party have suggested a return to fiscal sanity in the U.S., we would be surprised to see this at least through 2026.

- 2017 tax cuts to be extended: While this was likely to happen in part under Harris, we are now likely to see a full extension of the cuts for another five years (note that it is unlikely to be longer than five years because that would likely require 60 seats in the Senate).

- Leading to bigger deficits: While deficits were likely to remain high under Harris, with no revenue offset from some rollback of the tax cuts, we are likely to see even larger deficits from the U.S. over the next four years. Trump has suggested that tariffs will offset these deficits, but we would need to see that before factoring it in.

- Potentially leading to higher inflation and rates: We have seen U.S. rates move higher post the election in part because of the risks that Trump’s policies will reignite inflation. Tariffs are generally bad for inflation (regardless of what Trump claims), while more stimulus through government deficits only adds to the problem.

Impact of Trump 1.0

Back in 2016, we focused on some of the risks/opportunities that Canada faced from a Trump win. These risks/opportunities centered on a few things, some of which are no longer as relevant because Trump 1.0 achieved some of his aims. To wit:

- Lower Corporate Tax Rates: We highlighted back then that Canada enjoyed a significant corporate tax rate advantage over the U.S. However, with Trump’s large 2017 tax cut package, Canada’s tax rate advantage was effectively neutralized.

- Increased Immigration: We pointed to an opportunity for Canada as the U.S closed off its borders to new immigrants. Again, this largely played out not only over Trump 1.0, but also post-COVID.

- Reopening NAFTA: NAFTA went the way of the VCR in favor of the USMCA.

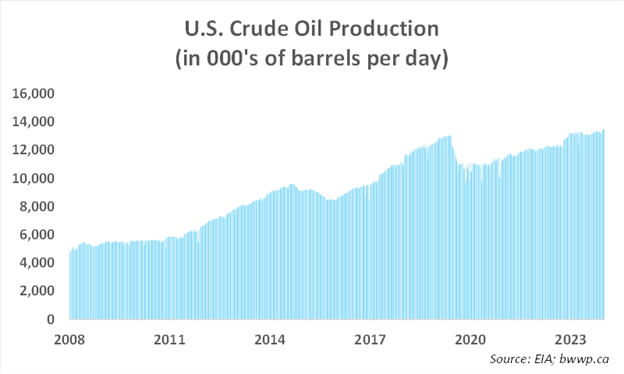

- Increased U.S. Oil Production: The U.S. had already seen a sharp increase of supply heading into 2016 as changes in technology unlocked the shale oil revolution, but as the chart below shows, this continued not only under Trump 1.0 (with a pause during COVID), but also right through the Biden Administration:

So, what about Trump 2.0?

Trump has indicated that he is going to double down on some of the above. Let’s deal with a few of his proposals one by one:

- Immigration: Trump has vowed to deport millions and shut down U.S. borders to new entrants. While humanity is the big loser here, we are not sure there will be much impact on Canada (unlike Trump 1.0) as Canada has significantly curtailed its own immigration plans.

- Drill, baby drill: We would note on the oil front that Trump has talked about increasing U.S. production even further, but we have our doubts about this, largely because: 1) most producers have gotten religion when it comes to production growth, with much more of a focus on shareholder returns than growth for growth sake; 2) at more than 13 million barrels of production per day, the U.S. may be near its natural cap in terms of what existing infrastructure can support;

- Across the board tariffs: while it increasingly looks like Republicans will control all levers of power, tariffs fall largely under the control of the Executive and thus Trump does not need Congressional approval to implement tariffs. Trump has talked about tariffs as high as 60% against China with lower, but still robust tariffs with the U.S.’s other trading partners, including Canada. While the USMCA is in place, it is open for renegotiation in 2026 and Trump has made it clear that he will exercise this clause, so some measure of increased tariffs for Canada are likely on the way.

- Repeal parts of Inflation Reduction Act (IRA): many renewable stocks are down sharply today on concerns over repeal of parts of IRA that deal with funding for renewables. While this would obviously be negative for the sector, it would likely be positive for natural gas demand, which would be a net positive for Canada given its natural gas production.

TSX Impact

Let’s start with a chart and then comment:

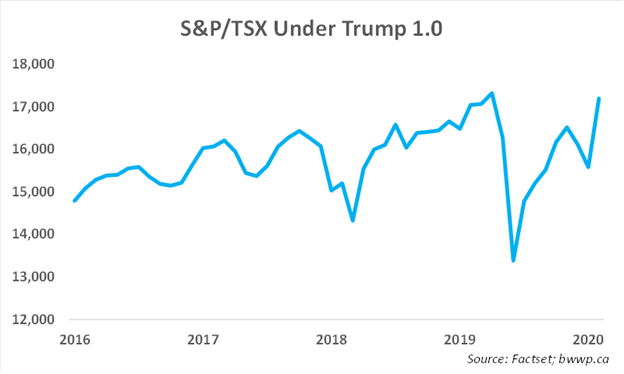

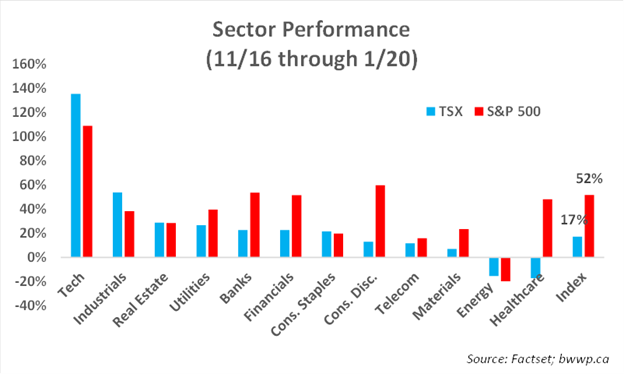

Under Trump 1.0, the TSX did reasonably well, rising ~17% between November of 2016 and January of 2020. COVID obviously derailed this for a time, but by the end of Trump’s administration, the TSX was close to all-time highs. However, if we take a look under the hood, there was a stark divide in terms of sector performance. Let’s take a look at the TSX and the S&P 500 sectors under Trump 1.0 to get a sense of where the winners and losers were (we will measure just through January of 2020 to strip out the COVID noise):

We would not be as bearish on Energy under Trump 2.0 for the reasons outlined above, while we would be skeptical that Technology and Consumer Discretionary are likely to be huge winners as they were under Trump 1.0 for the simple reason that they have continued to do well in the ensuing four-years and valuations are likely to be an issue. We would contrast that with banks (especially U.S.), which did well under Trump 1.0, but might now be even better positioned. Given that Trump 2.0 will be operating under higher interest rates than those that existed during Trump 1.0, this would have a positive effect on net interest margins. The more interest rate sensitive stuff – Real Estate, Utilities, Telecom – could face some potential headwinds from higher deficits and interest rates.

United U.S. Government

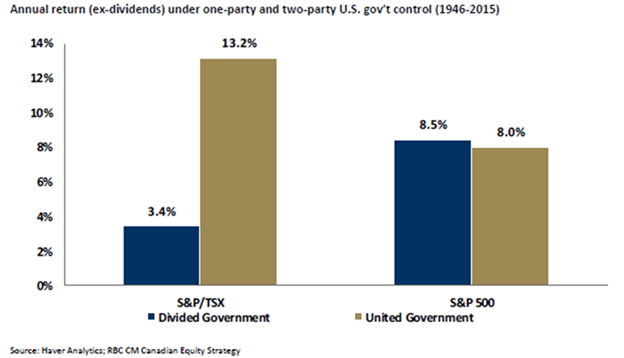

While the House of Representatives has yet to be decided, it appears likely that the Republican party will control all three branches of government through at least 2026. We would note that while the general view is that divided government is best, the TSX has actually faired significantly better under one party U.S. control than under two party control:

The Loonie

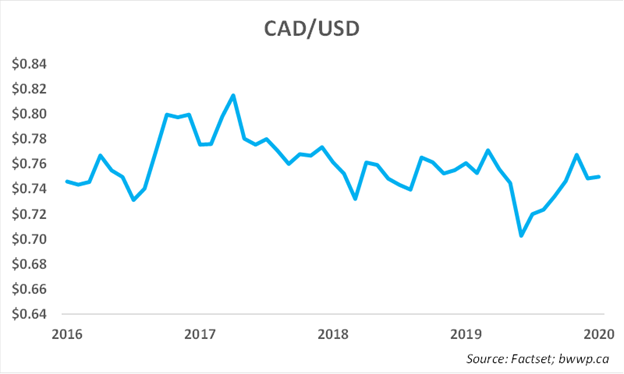

Let’s look at a chart and then comment:

While one might have assumed that CAD lost value during Trump 1.0, it was actually up slightly over the four years (and even more so if we measure pre-COVID). This occurred despite a ~10% drop in oil prices and the aforementioned NAFTA to USMCA flip. The initial reaction of CAD post the 2024 election has been negative, but the move thus far has been modest. While the backdrop for Canada is different than it was eight years ago (the Canadian economy is in a much worse position than it was in 2016 as we have discussed ad nauseum), we would note that if Trump 2.0 does lead to better U.S. growth, even with higher tariffs, this is likely to be a net benefit to the Canadian economy. As a result, we would be cautious about assuming much downside for the loonie from current levels (around $0.72) and would reiterate our view that CAD is likely rangebound between ~$0.70 and ~$0.78.

Final Thoughts

Our biggest concern, which is not captured in the above relates to the deck that Trump has been handed. Unlike 2016, when the Chinese economy was in good shape, the world was generally in a geopolitical state of calm, the U.S. job market was strong, inflation was low and interest rates were near historic lows, the deck in 2024 looks starkly different. While the U.S. economy remains an area of strength (something the Democrats were unable to articulate to voters), the risks of an inflation flare up – especially with across-the-board tariffs and potentially more tax cuts – is reasonably high, while the Chinese economy is in a much more perilous spot than it was eight years ago. In other words, while the world and the U.S. economy was well positioned to “take it” in 2016, we are not as confident that the same set of circumstances are currently in place.

Thus, while today’s initial market reaction has been positive, we would not necessarily buy into the idea that it will be a straight-line higher from here. Our focus always remains on owning good businesses that are immune to many of the above issues; although, general market sentiment can and will drag stock prices in one direction or another for periods of time. Some stocks that are more negatively impacted by the above have been hit post the election and within this group there are some good businesses that we have begun to “kick the tires” on.