From Bellamy to HL & the N

Today, we are going to pay homage to two great individuals. Okay, to be honest, one of the two is really not that great (the other is truly magnificent) and, in fact, may even be borderline “meh”, but our view is that if one pays homage to someone, there is an implied greatness somewhere in there, so we will go with great for now.

The first such individual was a man named Edward Bellamy. For those of you not familiar with Mr. Bellamy (Eddie B to his friends), he was a lawyer, turned journalist and an avowed socialist. Mr. Bellamy was also an author and his book, Looking Backward, which was published in 1888 in the wake of a deep depression that had hit the United States in the early 1880s, became somewhat of a sensation, selling more than one million copies (the U.S. population was like two million at the time, so every family had a copy).

In Backward, Bellamy imagines Boston in the year 2000 (the title was obviously a bit ironic) with the U.S. operating under a socialist system of “cooperation, brotherhood and industry geared to human need.” While we are sure the book was and is riveting (okay, we are not sure about that, but Bellamy is dead, so we are trying to be kind), the more important takeaway from the book is Bellamy’s invention of the term “credit card”, which is used no less than 11 times in Backward. And while Bellamy’s credit card is not quite today’s version – his referred to a card designed to spend a guaranteed minimum income – when you swipe or tap or insert or go through one of those antiquated carbon-paper “wa-chang!” type machines that pre-dated the Internet, you, at least in a very small way, have Mr. Bellamy to thank.

The second such individual whose greatness is not in question (no “meh-ness” here) is Hugh Anthony Cregg III, better known to his fans and the world alike as Huey Lewis. Mr. Lewis was a smart cookie - he apparently scored a perfect 800 on the math portion of the SAT - whose mother was close friends with the manager of the Grateful Dead (she may or may not have consumed illegal substances, but we are going with may). Anyway, on the back of this familial relationship and a trip across the U.S. and Europe in the late 1960s where Mr. Lewis learned to play the harmonica and sing the blues, Mr. Lewis became a performer of sorts.

Upon his return to the U.S., Mr. Lewis enrolled at Cornell, but soon decided that the siren call of music and the San Francisco scene was too much to resist and so he dropped out and moved out west to make a go of it. Let’s just say that Huey’s initial forays were less than successful, and he toiled for most of the 70s on a variety of different gigs before forming Huey Lewis and the American Express in 1978. The band had some success, opening for Van Morrison, and one name change later – to Huey Lewis and the News – Huey and the boys were off and running.

The question that has probably been on your mind is – what do Edward Bellamy and Huey Lewis have in common? Well, while Huey and the News broke out with the album “Sports” in 1983 – spawning four top 10 hits (including three that strangely all peaked at number six) – they did not truly hit the big time until 1985 when they took part in a little movie called Back to the Future.

Future, like Backward, was a bit ironic in its title (although we suppose if one sees the movie, irony may not quite be the right word) with the lead character traveling back to 1955 and trying to get back to 1985, which is, err, the future, but, umm, also the present. Huey Lewis and the News recorded two singles for the Future soundtrack with one – The Power of Love – becoming a monster hit that went all the way to number one on the charts (a first for Huey and the boys) and was nominated for an Oscar (alas losing to Say You, Say Me by Lionel Ritchie, which is a banger). Now, as an aside, The Power of Love has the distinction of being the only song title ever to go to number one on the pop charts more than once as two different songs. There was the HL & the N version and the Celine Dion version, which was actually a cover of a Jennifer Rush song (also covered better by the late, great Laura Branigan). Anyway, in the Huey and the News version, which is likely an unintentional shout out to Mr. Bellamy (we are assuming Huey did not read Looking Backward, but we cannot confirm this) we learn that in the future, we won’t need money, we won’t need fame, nor will we need credit cards to ride the train.

The Credit Card Looks Maxed Out

Speaking of credit cards, let’s start with a chart and then comment:

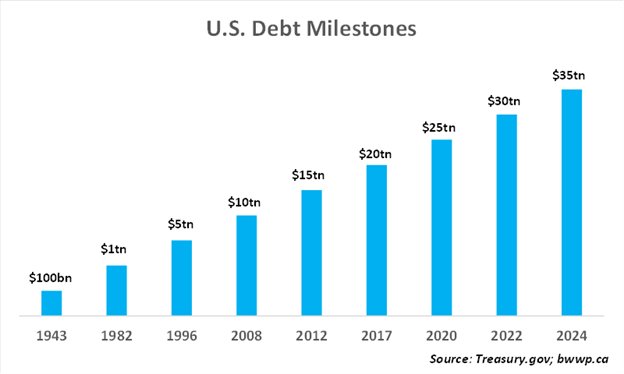

Here we are looking at the outstanding debt of the United States Federal Government since it first issued debt obligations in 1790. As you can see (or not see because of the scale), the debt really does not register until around 1970, rises gradually in the 1980s and 1990s, actually dips a bit around 2000 and then has two parabolic stages beginning around 2010 and then again around 2020. To put this in a different perspective, it took the United States 218 years to accumulate its first $10 trillion of debt, nine years to accumulate its next $10 trillion of debt and just seven years to accumulate its next $15 trillion of debt:

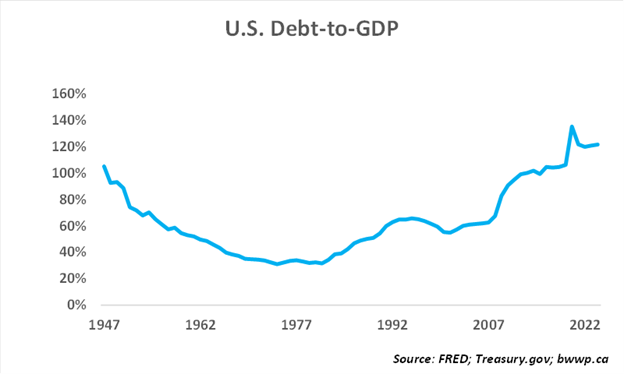

Now, we would note, borrowing in times of crisis – World War II, the Global Financial Crisis, COVID – is generally good economic policy as borrowing is supposed to be counter-cyclical. That is – when the economy is facing a slowdown or more importantly a crisis, the government can and should step in to mitigate the downside and help to restore order and confidence. But when the crisis is over, things should be returned to some sense of normalcy. What does this sense of normalcy generally mean? While there is no tried-and-true metric, an easy way to think about it is – an economy that is growing faster than its debt outstanding is generally in a good place, so if the annual deficit is less than GDP growth, the overall picture is pretty good. Under this sort of scenario, while overall debt would continue to grow, debt-to-GDP – a more important metric – would continue to shrink. With that in mind, let’s take a look at another chart and then comment:

Debt-to-GDP now stands at ~120% and with annual deficits coming in at around $2 trillion and annual GDP growth coming in at around $1-$1.5 trillion, this is only expected to grow over the next several years. Further, whether it is Kamala Harris from the spending side or Donald Trump from the revenue side, it is unlikely that either party is poised to fix this.

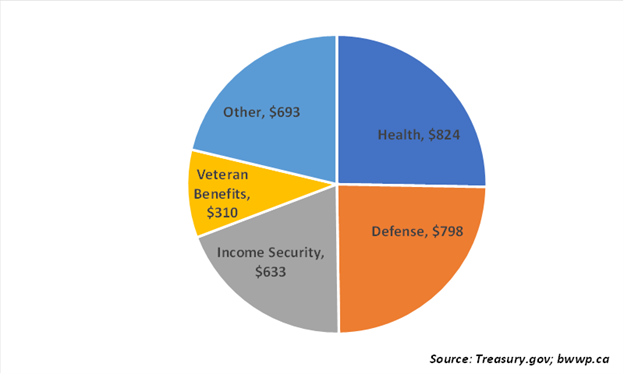

A $3.3 trillion dollar problem

The U.S. is running a ~$1.7 trillion annual deficit. If we strip out spending on Social Security and Medicare, which are mostly self-funded through payroll taxes, and spending on interest on the debt, there is ~$3.3 trillion of spending that could be cut in some way to reduce the annual shortfall. However, this might not be so easy:

We can probably assume that Defense spending is not going to be cut, while Veteran Benefits are also locked in. That leaves ~$2.2 trillion of other spending to reduce a ~$1.7 trillion deficit. Some progress could probably be made, but imagining a world in which these programs are cut more than a little bit is hard to do.

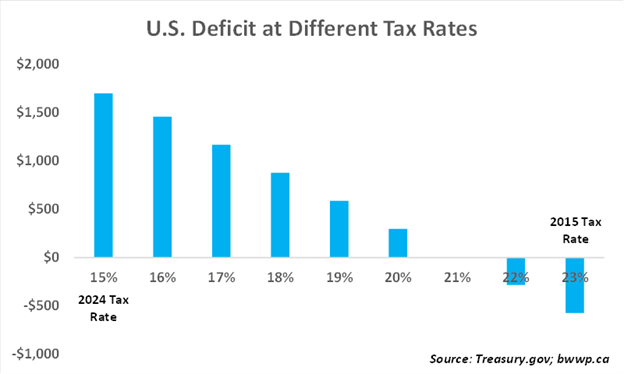

On the flip side, revenues are ~$4.4 trillion, which is roughly the same as 10-years ago ($4.2 trillion). In other words, while the U.S. has upped its spending quite a bit over the past decade, there has been no effort to raise the revenue side. Put another way, in 2015, tax revenue of ~$4.2 trillion amounted to ~23% of GDP, while today revenue amounts to ~15% of GDP (the economy has grown from ~$18 trillion to ~$30 trillion over the 10-years). Had tax revenue dropped to say 21% of GDP, but not as far as it did, there would be no deficit:

We acknowledge that lower tax rates likely helped to contribute to growth, so the economy would likely not be ~$30 trillion today without lower rates. But even if the economy were 10% smaller (extreme in our view) and tax rates were 20% of the economy, you would knock ~$1 trillion off the annual deficit.

So, the U.S. is doomed?

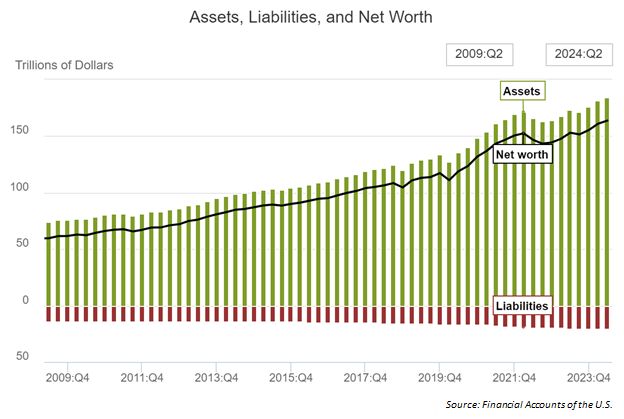

The natural response to the above might be – sell your worldly possessions, buy lots of canned goods, move as far north as you can and wait for the zombie apocalypse. However, before you do, we would caution that while the U.S. government fiscal situation is in a bad state with no obvious solution from either major party, there is a rather large reason to consider delaying the, umm, Apocalypse Now plan. Let’s look at another chart and then comment:

Let’s say you were a banker, and a would-be client came in to borrow some money. Let’s say this person needed to borrow $35 million and after you probed him/her for some information, you learned that he/she was spending about 30-40% more each year than he/she was making. Your reaction would probably be – umm, sorry, this is not going to work out (CIBC bankers might disagree, but we will ignore them for now). As the would-be client was leaving the branch, he/she made the comment, “that’s too bad, my family has wealth of $184 million and not much debt, but thanks anyway for your time.” In all likelihood, you would probably have the security guard bar the door and make sure this would-be client does not leave the branch before you provide him/her with copious amounts of the bank’s dollars.

U.S. households have total assets of ~$184 trillion and liabilities of ~$20 trillion. In other words, U.S. households collectively have a net worth of ~$164 trillion or ~ 5x Federal debt. This staggering amount of net national wealth provides a safety valve of sorts to any major crisis. This does not mean that the budget deficit is not a problem, but rather that it is not a problem that should cause widespread panic.

Bottom Line

Like Steady Eddie Bellamy and later Huey Lewis and his close friends – the News – the U.S. has a credit card problem. Over the past ~15-years, we have seen two major crises – the Global Financial Crisis and COVID – that have significantly increased the spending side of the ledger, sandwiched around a major tax cut in 2017 that gutted the revenue side of the ledger with no effort from either party to address the shortfall that this spending/revenue burger created. While neither party seems to have much interest in talking about it, we suspect in the coming years that this will become a bigger and bigger issue that the U.S. government will be forced to address. That said – while the fiscal situation is worrisome, we would not downplay the massive wealth that backstops the U.S. economy. While this wealth does not solve the problem, it provides a salve that helps to prevent any undo worry.