A Young Man Walks into a Bar …

144-years ago, a young man, not yet the age of 30, moved from Providence, Rhode Island to New York City. While this young man was wet behind the ears, he had accomplished much in his 20s, despite having no formal education, he made a name for himself writing for various publications in the Greater Rhode Island area. The young man was able to land a job with the Kiernan Wall Street Financial News Bureau (KWSFNB does not roll off the tongue, but this was the 1880s) and was then asked by the paper’s owner, John Kiernan, to hire another reporter for the Bureau. The young man reached out to a friend he had worked with in Providence, who happily agreed to come to New York, and the two set about to write in a fair and unbiased way about Wall Street (a rare feat at the time, as much of the writing was done to manipulate the stock market in some way). After a couple of years of working at the Bureau, the two men – one, now barely 30 with no formal education and the other, just 26 and a college dropout – decided that Wall Street needed another publication and they set out on their own.

In 1883, the two launched the Customers’ Afternoon Letter, which set about to provide a two-page recap of the day’s financial events, again in an unbiased fashion. The publication quickly became popular with investors, especially an index with its two-pages that tracked the performance of 11 stocks, nine of which were railroads and one of which was Western Union. Six-years later and with much success, the two decided that their little two-page daily publication needed to graduate to newspaper status and thus they remade and rebranded the Afternoon Letter and thus was born the Wall Street Journal.

While their original 11-stock index had a broad following, the 1890s brought about many changes in financial markets, including a wave of mergers. Not satisfied with a “transportation index”, the two decided that an index, which better captured the economic flavor of the United States was needed. And thus, in 1896, Charles Dow (our uneducated Rhode Islander) and Edward Jones (our dropout) created and launched the Dow Jones Industrial Average (“The Dow”, which sounds better than “The Jones”), which, at the time, was an average of 12 companies’ stock prices.

Today, the Dow is an index of 30 U.S. companies. These 30 are not necessarily the 30-largest companies in the U.S., but rather a cross section of some of the largest. It is a bit quirky, as the Dow is a price-weighted index, which means that the company in the index with the highest stock price has the biggest impact on the daily changes in the index. So, for example, a 1% move in the stock price of United Health, which has the highest stock price in the Dow at present, will have a bigger impact than a 1% move in any other stock in the index. This differs from the much more common market cap weighted indices, where the largest companies by market capitalization have the biggest impact on performance.

David Elias was Sorta Right

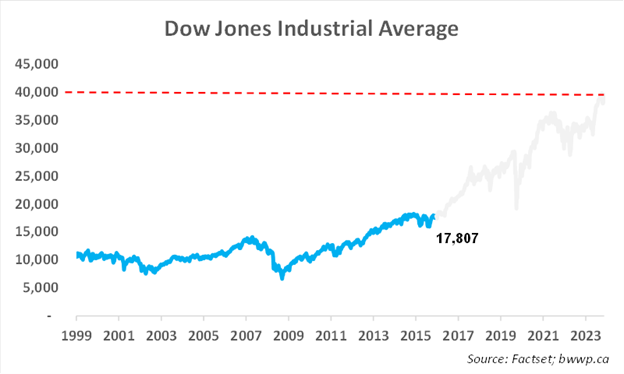

Fast forward a little more than 100-years, on June 26, 1999, David Elias published “Dow 40,000: Strategies for Profiting from the Greatest Bull Market in History”. Now, on June 26, 1999, the Dow was trading at 10,552. So, predicting Dow 40k was a bold claim and given that we were in the midst of a nearly 20-year bull market at the time, a claim that drummed a fair bit of interest and book sales. To his credit, Elias not only predicted Dow 40k, but he actually offered the exact date on which it would occur – June 2, 2016. This would have implied a compounded annual return of ~9%, which was ambitious, but considering the lofty levels that stocks enjoyed in 1999, not entirely crazy. Anyway, let’s look at a chart and then comment:

As you can see, Elias was a bit off. In fact, within 4-years of the book’s publication, the Dow had lost nearly 3,000 points and Elias had become a bit of a laughingstock (along with a few others) as the excesses of the late 1990s gave way to a vicious bear market. Exactly one decade after publication – June 26, 2009, the Dow was still 2,000 points below it’s starting point and any notion that Dow 40k might ever happen (let alone by 2016) seemed ambitious. That said – over the next ~8-years, the Dow rose ~9,000 points and Elias’ Dow 40k by June 2, 2016, dream, while not achieved, was, at least, not as embarrassing as it might have appeared on the 10-year anniversary.

For the record, a rise from 10,552 to 17,807 in 17-years is a compounded return of ~3.1%. If you factored in a dividend yield of ~2%, this would imply a total annual return of ~5%. Not bad, considering there were two bear markets in the first decade of Elias’ bold call, but certainly well short of the 9% price return Elias had predicted (we would note that if Elias had published “Dow 17k” in 1999, we don’t think he would have sold many copies of the book).

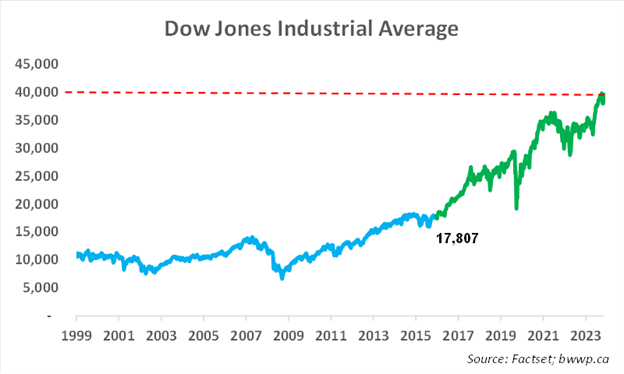

Okay, let’s advance the chart to today:

As you can see, almost 8-years to the day of the Elias’ prediction, the Dow finally (albeit briefly intra-day) hit the 40k mark. This ~8-year run in the index in which the price return compounded at ~10.4% annually, brought the overall 25-year return to ~5.4% annually. Again, adding in a ~2% dividend yield and even with four bear markets (2000/01, 08/09, COVID, 2022) not to mention five other 10%+ downward moves, and the Dow generated a compounded total return of ~7.4% per annum. So, while Elias was way off the mark in terms of timing, even a quarter century full of land mines of various sizes generated a healthy overall return.

As you can see, almost 8-years to the day of the Elias’ prediction, the Dow finally (albeit briefly intra-day) hit the 40k mark. This ~8-year run in the index in which the price return compounded at ~10.4% annually, brought the overall 25-year return to ~5.4% annually. Again, adding in a ~2% dividend yield and even with four bear markets (2000/01, 08/09, COVID, 2022) not to mention five other 10%+ downward moves, and the Dow generated a compounded total return of ~7.4% per annum. So, while Elias was way off the mark in terms of timing, even a quarter century full of land mines of various sizes generated a healthy overall return.

Bottom Line

While Elias was way off on his prediction (considering we did not even get halfway to 40k by 2016, we do not think “way off” is hyperbole), we think the illustration of Dow 40k in 25-years has some merit. Stock investing can be a really bumpy ride as the past quarter-century has illustrated in spades, and yet, despite all of this tumult, the Dow still generated an annual total return of greater than 7%, which would have handily beat bonds over that period. Having the fortitude to stay invested during these periods of uncertainty is one of the long-term keys to success and one of the biggest struggles when times get tough.