What a Feeling

The 1980s were a glorious time to be a moviegoer. This was not necessarily the case if you were a “highbrow” moviegoer, but if you enjoyed tentpole franchises – Rocky, Rambo, Police Academy (kidding), Diehard, Alien, Beverly Hills Cop, et al – or one-off bangers – Predator, Top Gun, Rainman (we stand by Cruise should have won the Oscar over Hoffman), Risky Business or 14 other movies featuring Tom Cruise running – the 1980s basically had a movie every week that fit the bill. One other strange fascination of the 80s and moviegoing was an obsession with musicals that were not really musicals, but kind of felt like a musical when you were watching the movie.

Now, it’s important to note that the technical definition of a movie musical (according to Tobin’s Spirit Guide) is one in which the characters all sing most of their lines rather than speak to them. The 80s did not have a lot of those – but the 80s specialized in what we like to call the “Wannabe Musical”, where music played such a prominent role that the movie was really a musical even if the lead character was saying “I love you”, rather than crooning “I love-uh-ah-uh-ah-uh-ove you”. These “wannabe’s” included such notables as Purple Rain, La Bamba, Spinal Tap, Eddie and the Cruisers (a personal fave) and a more controversial inclusion – Flashdance.

Flashdance does not quite fit in the same way as our other films. Unlike the others, where there is at least some singing by the characters, Flashdance tells the story of a welder and exotic dancer (because all welders, both male and female, were exotic dancers in the 80s) who aspires to be a ballerina. Thus dancing, which really does not look much like ballet, takes the place of singing in the film. The soundtrack for the film features prominently in those dance sequences and became nearly as big a success as the film (Flashdance was the third higher grossing movie of 1983, which is bonkers when you consider it was about a welder/exotic dancer who aspired to be a ballerina), selling 20-million copies worldwide.

Leading off the soundtrack was a sort of title track called “Flashdance … What a Feeling”. This cool ditty was released a month before the film to try to build up excitement for the film and would go on to spend six-weeks on the top of the charts, eventually winning an Oscar and a Grammy (one-half of the fabled EGOT). Only to be slightly outdone – the second single from the soundtrack – “Maniac”, would spend two weeks at number one, receive Oscar and Grammy nominations and make a temporary star out of its performer – Michael Sembello (we did say “temporary”).

It is with dance in mind that we now segue to our weekly discourse.

A Delicate Dance

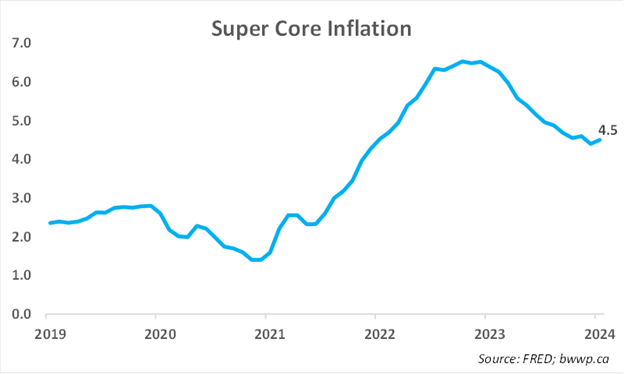

Unlike Canada, where the course appears to be set for an interest rate cut by the Bank of Canada in the next couple of months, the U.S. continues to deal with inflation that remains stubbornly high. Let’s look at a chart and then comment:

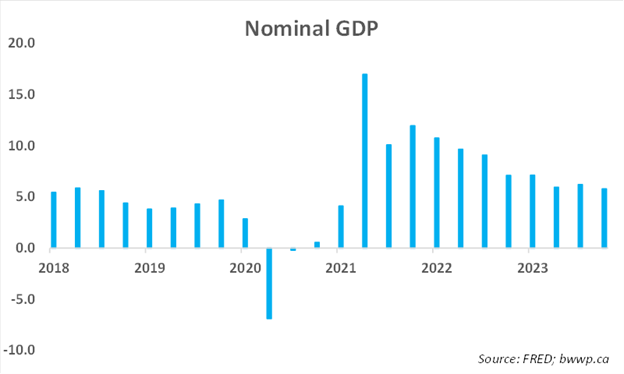

Here, we are looking at the Fed’s preferred measure of inflation – so called “Super Core Inflation”. As you can see, super core saw a sharp drop from mid-2022 to the end of 2023 but has since stalled (and actually inflected slightly higher) in the mid-4% range. Now, inflation should and generally will come down when interest rates are raised, and the economy slows. This occurs because demand drops and when supply outpaces demand, prices will be pushed lower. However, this is not occurring in the U.S. largely because the economy refuses to slow down, despite higher rates:

We have discussed some of this in the past – because most mortgages in the U.S. are done at a 30-year fixed rate and because most corporations have termed out their debt, the U.S. economy is simply not that sensitive to rates – at least in the short to intermediate term. Thus, while the Fed can hem and haw about keeping rates high unless inflation comes down, the impact of its rhetoric on the economy is somewhat muted. Add to this that the U.S. is in an Election Year and the Fed has generally adopted the mantra of – thou shall not interfere in an Election Year to any great extent. Further, while the Fed did a good job of tightening financial conditions in 2022 with 500 basis points of hikes and a fair bit of hawkish rhetoric, conditions have loosened quite a bit of the past year with overall conditions close to neutral at the present time:

Financial Conditions captures several different inputs, including equity and debt markets, access to credit and how bullish/bearish investors are at the present time. As you can see, conditions have continually loosened over the past year (although, there has been a recent pause), which makes the Fed “dance” even more complex:

There is no great solution to the above other than trying to get as close as possible to the right balance of – keep the economy growing, but not so fast that inflation remains a problem, while not saying anything overly hawkish that markets and the economy to overreact (oh, and it’s an Election Year, so be extra careful to not seem political). A Delicate Dance in other words.

Final Thoughts

We have fielded a few calls recently on the general negative state of affairs in the world and the potential impact on portfolios. Our sagely advice, passed on to us from prior sages, is – Page 1 does not make the market, but page 8 might. The single best predictor of the performance of global stock markets is the U.S. economy because of its massive size and its impact on so many different things. If the U.S. economy is growing (and corporate earnings with it), then the risk of permanent damage will tend to be exceedingly low.

Despite 500 basis points of rate hikes and lots of negative page 1’s, the U.S. economy continues to grow at a good pace. This is not to suggest that we might not go through a corrective phase (which tend to be buying opportunities) as 10% or so corrections in the market are not uncommon. Despite the seeming daily bombardment of negative headlines, we are not concerned about sustained market impact.

As for the Dance, we expect it to continue until we see definitive signs that inflation has been beaten back. A year ago, we thought this would have occurred by now, but our confidence has frayed. In some ways, this is not a bad thing as the “fraying” has mainly been caused by a U.S. economy that refuses to slow down. Until then, we will continue to look for opportunities to add to good businesses at attractive prices.