Cue – the Haunting Whistle

The first question we would ask is – how did a German rock band that had been around for a quarter century with multiple line-ups and with album titles such as “Lovedrive” (apparently one word), “Virgin Killer” (thankfully two words), and “Animal Magnetism” for all intents and purposes end the Cold War?

We confess – we don’t have a great answer to this, but while so called historians and geopolitical experts will credits the likes of Ronald Reagan (Ronnie Ray-gun to his friends), Mikhael Gorbachev, Lech Walesa or just the general untenable-ness of the Communist system, we (and maybe the CIA) point to the 1991 hit single “Wind of Change” by the German rock super Gods (our emphasis) The Scorpions as the “solominka, slomavshaya spinu verblyudu” (straw that broke the camel’s back for those who do not care to use Google Translate) of the Soviet Union and the Cold War.

Now, for those who do not recall “Wind”, it begins with a haunting whistle and then goes on to describe how things are changing in Russia with lyrics such as “the world is closing in, and did you ever think, that we could be so close like brothers?”. Released in January of 1991, “Wind” was inspired by a trip that some of the bandmembers had taken to Moscow a few years before. It also may have been co-written by the Central Intelligence Agency, which inspired an entire podcast of the same name; although, the band and the CIA deny that the song was a CIA ploy to change hearts and minds (and the CIA never lies).

While the song initially had some success, it truly took off in the summer of 1991 after a failed coup in Russia by Soviet hardliners to overthrow Gorbachev. By December of 1991, the Soviet Union had, err, dissolved, and the Cold War was over. For its part, “Wind”, would go on to sell 14 million copies, making it the 19th best-selling single of all time, the 6th best-selling single since 1990 and the only song by a rock band in the top 20 (take that John, Paul, George and Ringo!).

Would the Cold War have ended without “Wind of Change”? Probably, but there is little doubt that lyrics such as “take me to the magic of the moment, on a glory night, where the children of tomorrow dream away (Dream away), in the wind of change” helped to accelerate the downfall by at least a day or two.

Down to Gorky Park

It is with winds of change in mind that we segue into this week’s missive. We are going to caution at the start that we do not wish to be political in any way (this is a family publication after all), but rather, we are going to try to focus on recent events and the potential implications for markets going forward. Let’s start with a chart and then comment:

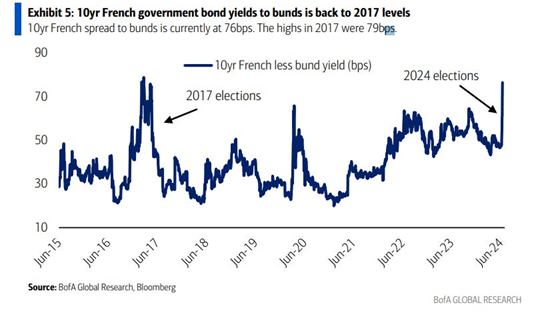

Following EU elections, which saw a shift rightward in many parts of Europe, France called a snap election with the first round to take place on June 30th. The chart above is the spread between French bond yields and German bond yields and can be viewed as the risk that far right parties take partial control of the French government post the election. Polls suggest Marine Le Pen’s far right National Rally Party will garner ~1/3rd of the vote, while Emanuel Macron’s Together bloc is closer to 1/5th of the vote; although, Le Pen is expected to fall short of the majority of seats needed to govern and Macron would remain President even if he loses the election (it is not for us to understand French politics). In other words, should polls prevail, there is a good chance that France is going to shift rightward.

As we saw with the U.S. in 2016 and with a number of former Soviet bloc countries over the past decade, the winds of change appear to be afoot. In fact, polls suggest that Donald Trump, despite 34 felony convictions and some other bad stuff (our editors put a 10,000 word limit on our rants, so we will not enumerate), is favored to return to the White House in November, so after a brief four-year reprieve from some version of populism, the world’s largest economy may be poised again to float on the winds of change.

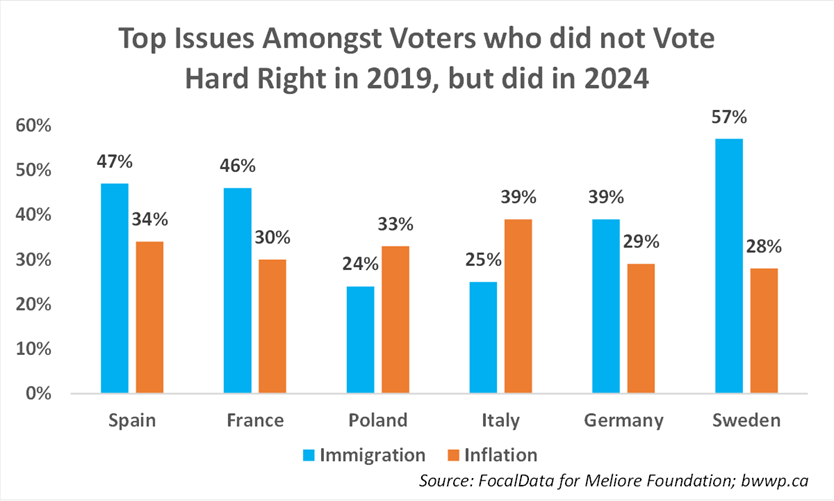

Let’s pivot to another chart and then comment:

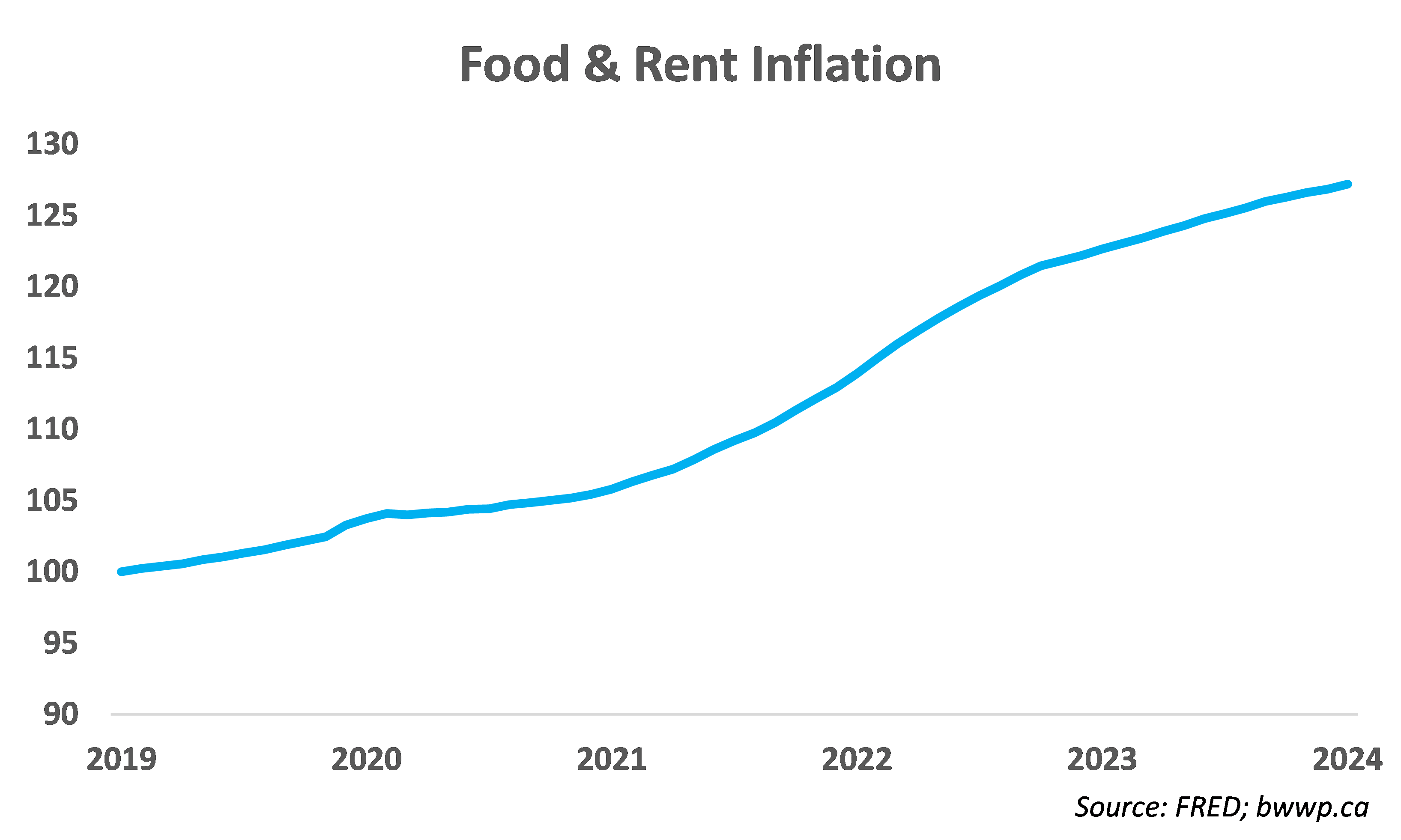

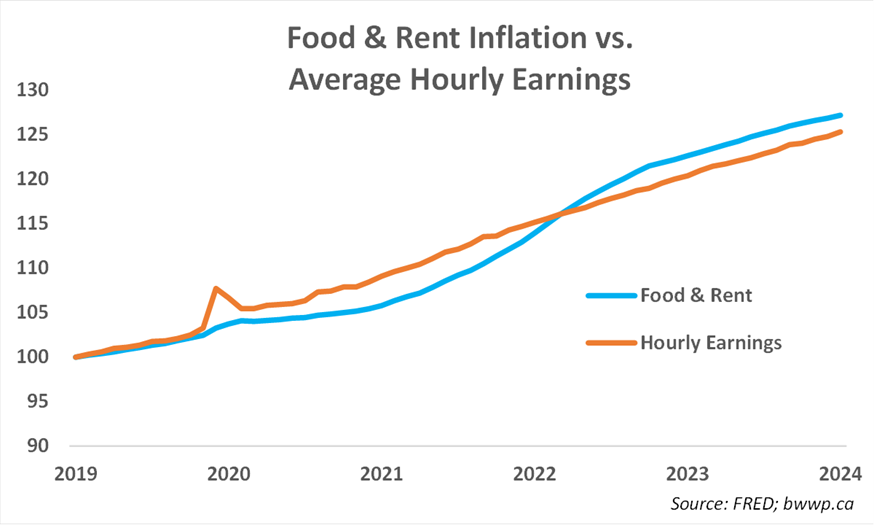

Now, we have waxed poetic about inflation a number of times, but the above might get to the heart of what resonates with a vast majority of the populous. The true “cost of living” as it relates to most folks is ~30% higher than it was 5-years ago. Now, we would note that wage inflation has roughly kept pace …

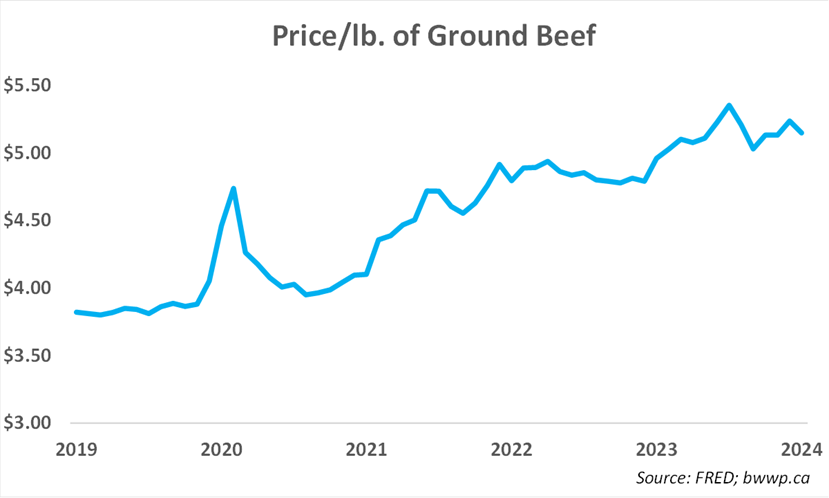

… however, we don’t think that most people care. Rather, they go out and spend money on stuff that they need (as opposed to want) and it’s a lot more expensive than it was a few years ago. Further, while many (including us) have trumpeted that inflation has slowed significantly, for most – it is no longer inflation that matters, but rather the fact that prices are already very high. In other words, inflation could slow to zero, but if a pound of ground beef was under $4/lb. 5-years ago and it’s over $5/lb. now, the fact that it has not gone up in price over the past year is not going to cheer anyone up.

This makes winning in November more challenging for Biden (or frankly any incumbent) as most people are generally oblivious to the level of the equity market or to the state of GDP growth or to a whole host of other positive indicators for the economy. Rather, it’s so called “kitchen table” issues such as ground beef, or, for various reasons – immigration.

Immigration is similarly nuanced – on the one hand, the U.S. or Canadian economies would not be growing as they are without significant contributions from immigration – but immigration and the demand it puts on goods and services has undoubtedly had an impact on inflation, especially in Canada, where very little investment has occurred in infrastructure or the housing stock.

A Strange Mash-up of Extrema

Before discussing some of the investment implications, we would note that this new “wind” brings with it what we would call “a strange mash-up of extrema”. While the media is focused on the rightward shift in many of these elections, we would note that some of the policies embraced by these rightward groups have a far leftward smell to them.

Take Donald Trump, whose MAGA movement obviously embraces many right leaning views as it relates to immigration and social policies, but many of their economic proposals as it relates to tariffs (100% proposed tariffs on China) and “worker-first” have a traditionally leftward tilt to them. Thus, while pundits will try to categorize what is happening in a certain way – we would note that we are experiencing a strange bastardization of ideologies that does not fit neatly into one category or another.

Investment Implications

We could be on the precipice of another “Wind of Change” moment. Markets do not generally like uncertainty (see the French bond market reaction above) and many of these elections look like veritable coin flips at this point. Add to this policy platforms that brings in many of the things that are generally bad for businesses – anti-immigration, pro-tariffs, anti-C-Suite – and the outlook for 2025 and beyond is a bit muddied. Our view remains the good businesses with strong management teams, barriers-to-entry, and a history of both reinvesting and returning capital to shareholders will be able to stickhandle through any trouble, but we would not be surprised to choppier markets than we have seen over the past 18-months (we would note that the first Trump presidency was marked with big highs and lows in markets, despite some narratives suggesting it was all rosy until COVID).