- Returns on cash in Canada have likely seen their best days as the Bank of Canada’s interest rate cuts eat into future returns.

- Many investors maintain above-target cash weightings as a buffer to volatility, but over the long term cash has underperformed a balanced portfolio.

- The future for cash looks brighter than in the post-financial crisis years but somewhat worse than what we have seen recently, suggesting that investors focused on beating inflation will need to take more risk.

- For those with dedicated cash strategies, discounted bonds remain a viable option, and we recommend extending term.

- The past three years have been anything but smooth for the TSX but it nonetheless has materially outperformed cash on a headline basis and even more so once taxes are taken into account.

- The recent market correction certainly won’t be the last, which is why equity investments are best suited for long term investors, but history shows they have been rewarded for riding out the occasional bumps in the road.

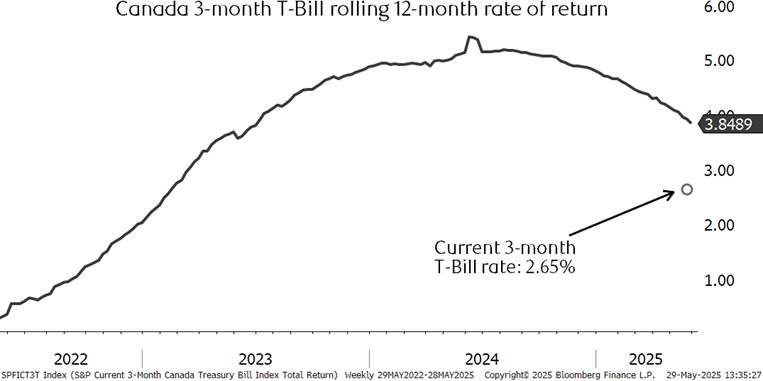

With all the hype about cryptocurrencies, one might think the title above suggests that physical cash is on its way out. While we don’t have a strong opinion one way or the other on an all-digital future, we do think cash has become much less attractive from a returns perspective! It was a long decade for risk-averse investors after the Global Financial Crisis and then the COVID crisis pushed short-term interest rates to near zero and kept them there until inflation erupted in 2021. While central banks were slow to react to the post-pandemic inflationary impulse they wasted no time normalizing interest rates (and then some) in 2022 and 2023, ushering in a golden age for cash and GIC investors. As seen below, the 12-month return on Canadian treasury bills peaked at over 5% last year, but has been fading since. In fact, today’s three-month T-Bill rate of 2.65% is about half of the highest rate of return seen recently and suggests forward looking returns leave much to be desired and will have a much more difficult time outpacing inflation.

Past few years have been volatile for stocks, but they have won out nonetheless

Below we have plotted the total return path (price gains plus income) for both cash (measured by treasury bills) and Canadian stocks. While cash took an early lead during the volatility seen in 2022 and 2023, the gains over the past 18 months have put stocks on top once again by a wide margin. Indeed, the TSX’s return is near triple that of cash, and would be closer to four times as high after taxes at the highest marginal rate are taken into consideration.

Cash is comforting (and has its place)…

After a long fallow period for cash returns we can understand why investors want to hold on to these positions as the returns are still much better than they were before the pandemic. As demonstrated above we believe the returns on cash will continue to deteriorate especially if the Bank of Canada resumes interest rate cuts later this year as markets are pricing in. For those holding dedicated cash strategies, tax-efficient discounted bonds (see chart below, and more detail here) remain a viable option, and we recommend extending term to capture today’s rates for a longer period of time.

… but balanced portfolios have won out over time

This year has shown that volatility (sometimes extreme!) is never far away so one’s time horizon has to match up with their asset allocation as equities are a long-term proposition. Despite a bumpier ride, history shows that a balanced portfolio with a healthy allocation toward stocks has done a much better job of protecting from inflation and fulfilling the promise of a financial plan. We think investors who are overweight cash as returns shrink should be prepared to get invested when the opportunity arises.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.