- Interest rate “pause” is over for the time being as Bank of Canada surprises with a rate hike.

- Resilient economy (and real estate market) likely forced Bank of Canada’s hand and markets suspect the Federal Reserve is next.

- Short term, higher yields put pressure on bonds, but in due course they come due at 100 cents on the dollar, known as “par”.

- Long term, it sustains the best fixed income opportunities we have seen in years, rewarding savers after a decade of challenges.

- This certainty and ability to map cash flows is one of the reasons we prefer segregated bonds.

- The discounted bond opportunity continues to thrive, with tax-adjusted returns the likes we haven’t seen in a long time.

Bank of Canada presses “play” on further rate hikes

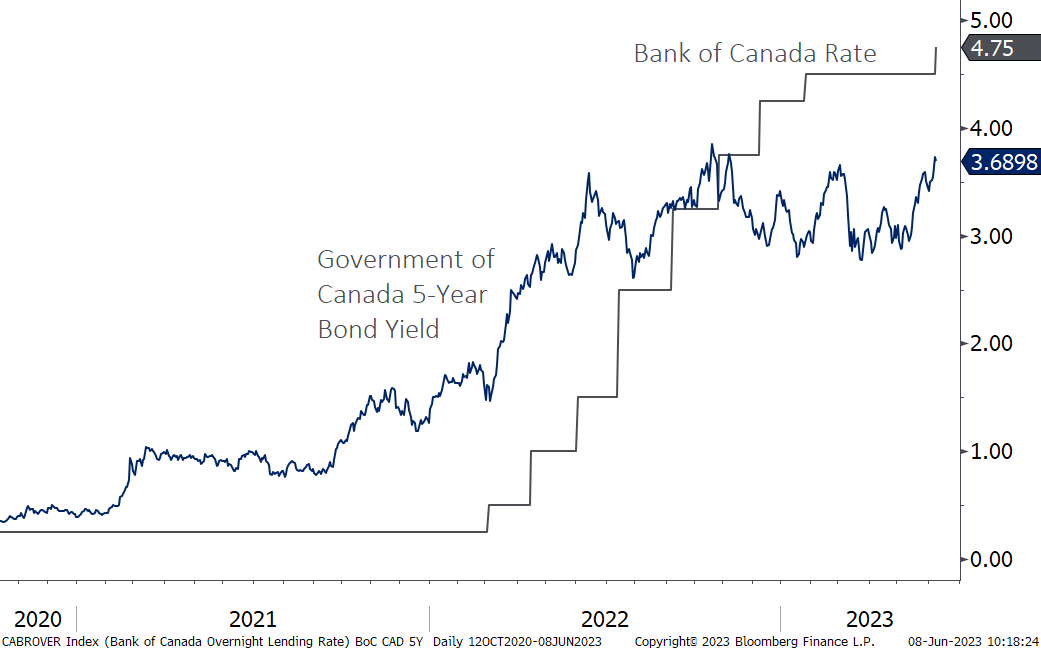

This past week saw a resumption of interest rate increases out of the Bank of Canada. The Bank of Canada was the first major central bank to signal a “pause” in its rate hiking cycle, waiting to see what the impact of a cumulative 4.25% of interest rate increases had wrought. Apparently they didn’t like what they saw, as employment and consumption remained strong. Perhaps most importantly, housing prices (and to a lesser degree sales activity) came roaring back, with many thinking a cessation of rate hikes was a flashing red “buy” signal, and we suspect this as much as anything else tipped the Bank to act, in a move that surprised markets and provoked a strong reaction in the bond market.

In the short term, bonds are under pressure again…

As seen above, 5-year bonds yields have accelerated in recent weeks as economic data pointed to economic resilience, with the Bank of Canada followed up on with this week’s rate hike. In the short term, these higher bond yields put pressure on bond prices, though we would note that the 5-year Government of Canada yield has been in a wide trading range since mid-2022. With yields now near their cyclical highs, savers are getting yet another opportunity to put excess cash to work in the bond market at yields unseen in over a decade.

…In the long term, they come due at par!

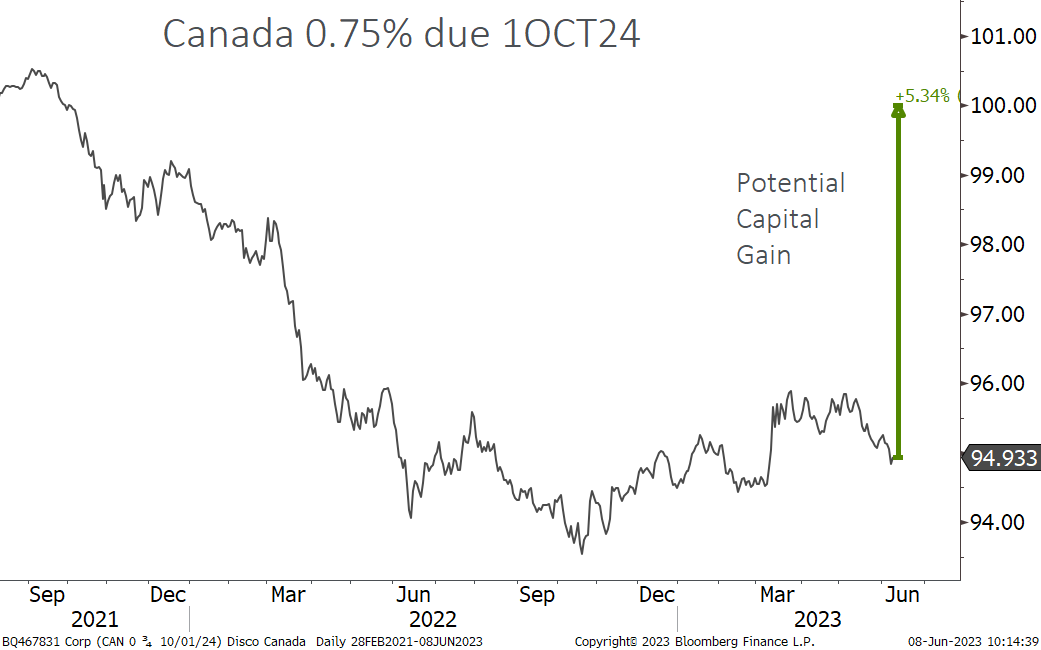

Despite all of the volatility and stress created by the bond market in the past 18 months, one rule has held true – barring an issuer default, no matter what happens to their price in the interim, bonds mature at par, or 100 cents on the dollar. While price moves can be disconcerting, the great feature of holding individual bonds in our portfolios is that we can map out their cash flows and maturity values. This not only provides peace of mind in the midst of volatility, but can also allow us to match cash flows with anticipated expenses.

Why are so many bonds trading under their par value?

After many years of being unable to find bonds trading near par, today we face the opposite issue. Most bond are trading at discounts to their par value, which is terrific from a tax perspective, but more challenging for those seeking current cash flow. That will be rectified in time as more bonds are issued at today’s higher yields, but for now, discounted bonds dominate. Why are so many bonds today at a discount (trading under 100 cents on the dollar)? Simply put, these are old bonds which were issued when yields were very low. In order to entice a buyer at today’s higher yields, these bonds need to offer a capital gain (in the form of a starting price under 100 cents) on top of the interest to bring the return potential in line with today’s new bonds.

A great time to re-evaluate cash holdings

While we think that in the fullness of time, stocks will outperform even today’s attractive yields, this doesn’t mean there is no action to take. With GIC and high interest savings accounts significantly lagging the recent move in bond yields, we feel it is an opportune time to move out of those instruments and into the bond market; this is true even for short terms of under one year. As an added bonus, the fact that nearly all short-term bonds are discounted today means that there is a tax advantage for investors who invest in discounted bonds and hold them to maturity. A portion (sometimes a large portion) of the return has the potential to be treated as a capital gain, resulting in an after-tax return that can be significantly ahead of what is available on a GIC, with the added benefit of market liquidity as bonds can be sold at any time. This is not to say it will be a smooth ride form here – central banks have proven they can be unpredictable, and this will keep volatility in the bond market elevated. However, for those invested in high quality bonds, we feel today’s opportunities are quite attractive for those who can remind themselves that their bonds will come due at par.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.