- Donald Trump’s return to the presidency has unleashed a wave of optimism in equity markets as investors price in tax and regulation cuts, but are curiously ignoring potential downsides from tariffs.

- One factor that may be helping boost stocks over and above the election results is the fact that we are now in a strong seasonal period for both the TSX and S&P 500.

- The six months starting in November have produced both the highest six-month return and the highest probability of a positive return in both markets that we are primarily invested in.

- This track record does not preclude a return of volatility, in fact we would count on it at some point given the unconventional approach being taken in putting together the next U.S. administration.

- In the short term, the probability of U.S. recession seems to be receding further, but tariffs will loom large in 2025.

- Markets are always changing, and a new U.S. administration is at its core another change we will need to manage.

The media has spent the past two weeks deeply focused on the results of the U.S. election, with talking heads on TV pontificating endlessly about the potential impact of each proposed policy announcement and cabinet pick. Many surmise that rising stock markets are acting as an endorsement of these policies, and to some degree that is likely true – after all, stocks tend to like lower taxes and less regulation. Curiously lost in translation is the bond market’s firm signal that potential tariffs and bulging deficits portend future inflation, but for now stocks are taking it all in stride.

While we can’t discount the value of having the uncertainty of the election spectacle behind us, we would note that we are also entering what has historically been a very strong seasonal period for the stock market. Over long periods of time, stocks on both sides of the border have shown defined performance trends that shift with the calendar, and once Halloween passed we entered what has historically been the most fruitful six-month period for equity investors in both Canada and the United States.

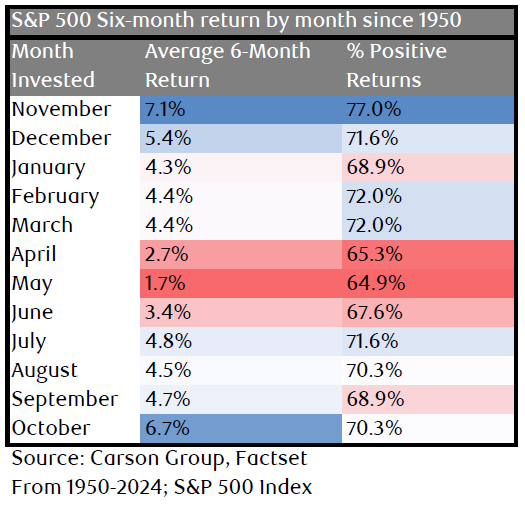

Headed to what is typically a wonderful time for U.S. stocks…

As seen below, starting in November, the S&P 500 has historically returned 7.1% over the next six months with positive returns 77% of the time. This table also somewhat validates the popular “sell in May and go away” strategy suggested by market watchers every spring, but note the returns are still positive on average and up more than half of the time.

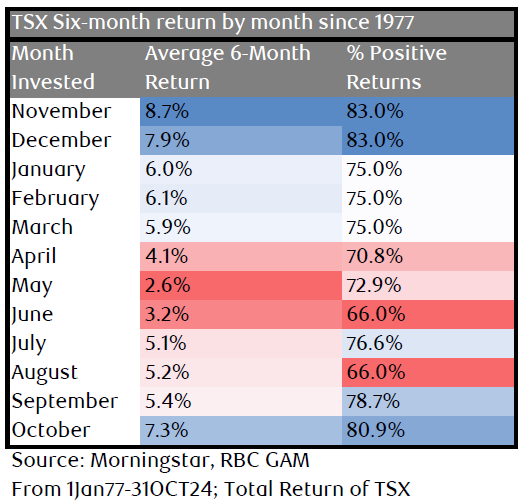

… and Canadian ones as well

The figures are just as impressive in Canada, with the TSX up 8.7% in the six months from November over the long term, reporting a gain 83% of the time. We would note that in the aftermath of the election the TSX is also trading higher despite being one of the countries most likely to be impacted by tariffs, which suggests to us that leaving that uncertainty behind and the seasonal effect are at play here.

Seasonal trends are far from the only consideration we make when constructing and managing portfolios. They do however give us a sense as to when the odds are on our side, and right now they appear to be. In our view, the near-term probability of recession has likely fallen a bit more as “animal spirits” seem alive and well, but we know the ride won’t be smooth. Today’s election enthusiasm may well be followed by tomorrow’s tariff tantrum. We saw a great quote this week that said the markets are the same today as they were five years ago and ten years ago in that they are always changing. We have received a lot of questions from clients asking if we are taking material actions in portfolios in response to the election result. While it has created a lot of headlines, at its core it is another change that we will need to manage through as we have so many others.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.