Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q3 2025 edition covers Market Review for first half of 2025, the impact of tariffs, and alternative investments. Shiuman's Corner is about classical music as balm.

Markets

Market scorecard as of close on Friday September 5, 2025.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 29,051 | 1.7% | 17.5% |

| U.S. | S&P 500 | 6,482 | 0.3% | 10.2% |

| U.S. | NASDAQ | 21,700 | 1.1% | 12.4% |

| Europe/Asia | MSCI EAFE | 2,728 | 0.2% | 20.6% |

Source: FactSet

- TSX closed higher in Friday afternoon trading, near best levels and another all-time high. Canadian equities ended with a weekly gain of 1.7%, and year-to-date advance of 17.5%.

- US equites were mostly lower in Friday trading, though finished off worst levels. However, S&P 500 still posted fourth weekly gain in past five, while Nasdaq marked first weekly gain in three weeks.

- U.S. stock indexes opened their post-Labor Day trading with typical September weakness. The S&P 500 suffered its biggest single-day loss since the start of August, with concerns over seasonality, tariff upheaval, Federal Reserve independence and stretched valuations for AI-related stocks (again) stoking the negative sentiment. However, buyers returned as the week progressed, with the potential for an interest rate cut at the upcoming Federal Open Market Committee meeting on Sept. 17 serving to outweigh the early negative sentiment.

Economy

Canada

- In Canada, the unemployment rate rose from 6.9% to 7.1% in August, the highest in nearly a decade (outside of the pandemic). The negative job market report Friday increases the odds that the Bank of Canada could see fit to cut interest rates further. The next CPI print in Canada set to release on September 16, the day before the next BoC meeting, will bear an unusual amount of weight as a deciding factor.

- The Canadian economy contracted by 1.6% in Q2 on an annualized basis, a steeper decline than Bloomberg consensus expectations for a 0.7% annualized drop. This marked the first contraction in seven quarters, signaling that momentum has slowed after a resilient run of growth.

U.S.

- On Wednesday, the Federal Reserve’s Beige Book reported “flat to declining consumer spending because, for many households, wages were failing to keep up with rising prices.”

- At the same time, the ratio of job openings per unemployed person—a favorite metric of Fed chair Jerome Powell—continues to decline.

Further Afield

-

In Europe, there are also signs that industrial activity is finally picking up. The August HCOB Europe Manufacturing Purchasing Managers’ Index (PMI)—an economic activity indicator that measures the health of industrial activity in the bloc—breached the 50 no-change mark for the first time in more than three years, reaching 50.7.

-

India announced consumption tax cuts on nearly 400 consumer goods, excluding cigarettes, chewing tobacco, and select luxury vehicles. The goal is to stimulate domestic demand amid economic pressure from U.S. tariffs.

Special Report on Biotech Revolution and Longevity

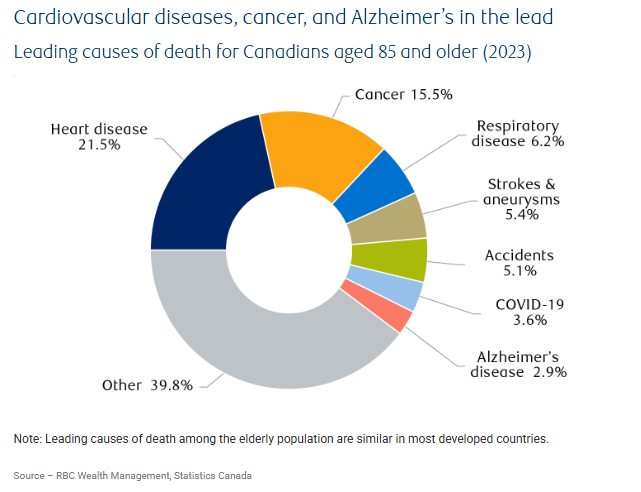

- RBC Wealth Management has released a report penned by Frédérique Carrier, Managing Director, Head of Investment Strategy RBC Europe Limited entitled “Life reimagined: The biotech revolution and longevity”. You can read it here.

- There’s more to a long life than simply a long lifespan. The number of years we spend in good health, or healthspan, is key. With biotech spurring promising medical innovations, we look at how it can fit into investment portfolios.

Feel free to contact me with any questions and/or to discuss investment ideas.

Regards,

Shiuman

PS: To unsubscribe, simply reply with “Unsubscribe” in the subject line.