Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q1 2024 edition covers Market Review for 2023, a Turning Point on interest rates, and advantages of Bonds. Plus my Book List for 2023.

Markets

Market scorecard as of close on Friday March 22nd, 2023.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 21,984 | 0.6% | 4.9% |

| U.S. | S&P 500 | 5,234 | 2.3% | 9.7% |

| U.S. | NASDAQ | 16,429 | 2.9% | 9.4% |

| Europe/Asia | MSCI EAFE | 2,352 | 1.1% | 5.2% |

Source: FactSet

-

Canadian equities finished lower Friday, near worst levels. TSX posted a 0.6% weekly gain and narrowly eked out a record closing high on Thursday (first in nearly two years), though came up well shy of its intraday all-time high from 5-Apr-2022.

-

US equities closed mostly lower in very quiet Friday trading, though major indices still logged good gains for the week. Big tech drove S&P strength, with equal-weight index notably underperforming the official index. U.S. equities have continued their march higher following the Federal Reserve’s decision to keep interest rates flat—a move that had been widely anticipated by market observers.

Economy

Canada

-

Canadian CPI growth was lower than expected in February, dropping to 2.8% year-over-year from 2.9% in January (expectations were for a 3.1% reading.) The downside surprise was broad-based as core CPI ex-food and energy inflation eased further to 2.8% from 3.1% in January. Overall, RBC Economics continues to expect a persistently soft economic backdrop to further slow inflation readings in Canada in the months ahead, allowing for the Bank of Canada (BoC) to start lowering interest rates around mid-year.

-

In a recent speech, BoC Deputy Governor Toni Gravelle noted that Canada’s central bank will likely end its quantitative tightening (QT) program “sometime in 2025,” though he acknowledged the program might end earlier than expected depending on how liquidity conditions in the banking system evolve. Deputy Governor of the BoC Carolyn Rogers will deliver a speech on Tuesday on Canada’s productivity.

U.S.

-

On Wednesday, as universally expected, the Fed held the fed funds target range unchanged (at 5.25% to 5%) for a fifth consecutive policy meeting. Inflation has surprised on the upside in recent months, but Powell reiterated that policymakers are also concerned that higher interest rates could ultimately cause the economy to soften more than necessary and interest rates are already at levels that should be enough to slow inflation over time.

-

Both U.S. housing starts and building permits were higher than FactSet consensus expectations in February. After falling 12.3% m/m in January due, in part, to cold weather across the country that made it difficult to break ground on new projects, U.S. housing starts rebounded sharply in February—climbing 10.7%. This represents the largest month-over-month increase since May 2023, and equated to an annual rate of 1.521 million units.

Further Afield

-

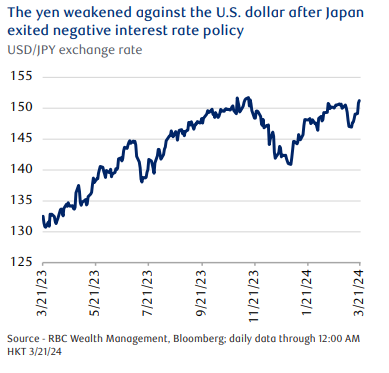

The Bank of Japan (BoJ) decided to discontinue its negative interest rate policy, yield-curve control, and quantitative and qualitative easing, signaling the end of an era of aggressive monetary easing. The yen weakened to 151.82 against the U.S. dollar after the news. We expect the USD/JPY to trade around 150 until the end of 2024, supported by the wide yield differentials between U.S. and Japanese bonds.

-

UK inflation surprised to the downside, decelerating faster than economists’ consensus expectation. Data for February showed headline Consumer Prices Index (CPI) inflation fell to 3.4% y/y from 4% in January. In line with our expectations, the Bank of England (BoE) held the Bank Rate at 5.25%.

Notes About Companies in Model Portfolio

-

Apple (AAPL) The Justice Department, joined by 16 other state and district attorneys general, filed a civil antitrust lawsuit against Apple for monopolization or attempted monopolization of smartphone markets in violation of Section 2 of the Sherman Act. The complaint alleges that Apple illegally maintains a monopoly over smartphones by selectively imposing contractual restrictions on, and withholding critical access points from, developers.

-

-

[From J.P. Morgan’s analyst report] While it remains tough to predict outcomes particularly given upcoming elections and potential administration changes, we would like to ask investors to keep the following in mind:

-

1) the typical time to reach a resolution on outcomes is 3+ years and while that will limit investor focus on this issue on a regular basis, it also implies an overhang on the stock for the medium-term;

2) the other headwinds in relation to the EU DMA changes are yet to be completely in the rear-view mirror, with the increasing possibility of further changes needed for the App Store practices in the region to get approval; and;

3) in the short-term, the focus for investors will shift to the potential for AI-led upgrade cycle once the valuation multiple reaches a more sustainable level incorporating the overhang from potential outcomes a few years out, and we expect a range of low 20s to mid-20s P/E multiple to drive investor interest back towards the stock.

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman