Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q4 2024 edition covers Market Review for first nine months of 2024, a discussion about lower interest rates, as well as the U.S. presidential election. Shiuman’s Corner is about my first ride in the RBC Granfondo Whistler.

A Special Note

This will be the last Weekly Update from me in 2024, and we will return early in January 2025. Thank you for reading throughout the year; perhaps you skimmed through the occasional Update, or read every one, I hope you have found some useful nuggets.

You may be interested in reading our firm’s Global Insight 2025 (attached). It contains a review of the major markets, with the Focus article describing four “powerful, highly predictable trends… [that would] transform the way we live, work and interact with each other over the coming decades…”

We extend our warmest wishes to you and your loved ones this holiday season and look forward to supporting you in the year ahead.

Markets

Market scorecard as of close on Friday December 13, 2024.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 25,274 | -1.6% | 20.6% |

| U.S. | S&P 500 | 6,051 | -0.6% | 26.9% |

| U.S. | NASDAQ | 19,927 | 0.3% | 32.7% |

| Europe/Asia | MSCI EAFE | 2,319 | -1.5% | 3.7% |

Source: FactSet

-

TSX closed lower in Friday afternoon trading, bit off worst levels. Most sectors down. TSX recorded a 1.6% weekly drop breaking five consecutive weekly gains streak.

-

US equities finished narrowly mixed in quiet Friday trading. S&P finished lower for the week after three consecutive weekly gains; Nasdaq was up for the fourth straight week with help from tech.

-

This year, while not yet complete, has been another strong one for equity markets. Global stocks are up over 20% so far, led by North American equities. International and emerging markets have also seen above-average returns, though these have been less pronounced. Market gains were led by the artificial intelligence theme, as investors anticipate a potential step change in future productivity and growth. The U.S. mega-cap “tech” stocks – commonly referred to as the “Magnificent 7” – have been the most direct beneficiaries, accounting for roughly half of U.S. equity market returns this year.

-

Notably, the financial sector contributed the most to the Canadian stock market’s strong returns. While performance varied, sometimes widely, across individual banks, the group as a whole performed well as recession fears eased and businesses and households demonstrated greater resilience under the weight of high interest rates.

-

Looking ahead to 2025, we want to highlight our firm’s Global Insight 2025 Outlook. In it, our firm’s investment team is mindful that valuations – particularly in the U.S. equity market – are relatively high following another year of strong performance. Yet, valuations are supported by healthy earnings growth and solid economic projections for both 2025 and 2026.

Economy

Canada

-

As expected, the Bank of Canada cut the overnight rate by another 50 bps to 3.25%. Governor Macklem’s opening statement made clear that with interest rates no longer “clearly in restrictive territory,”, the central bank will take “a more gradual approach” to monetary policy adjustments moving forward. That’s in line with our own forecast that expects the BoC will downshift to 25-bps reductions in their future meetings in 2025. We continue to expect that a weak economy will push the BoC to cut the overnight rate all the ways down to a stimulative 2%.

-

Canada’s debt servicing ratio fell by nearly three-tenths to 14.7% at the end of Q3 from 15.0% in the prior quarter. By September, the Bank of Canada had cut interest rates by 75 basis points (with another 100 bps of accelerated cuts following over the rest of the year). Debt payments continued to rise, but not as quickly as household incomes (+2.3% in Q3).

U.S.

-

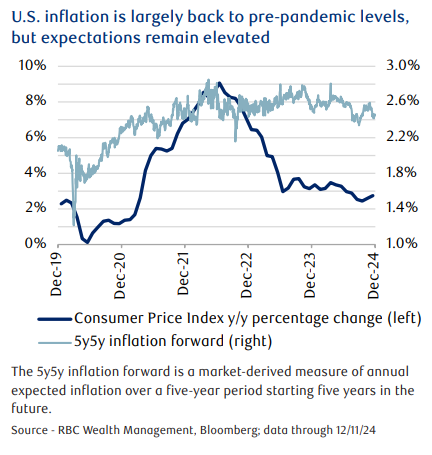

U.S. headline CPI growth increased marginally in November, with the year-over-year rate climbing to 2.7% from 2.6% in October, driven primarily by a slower pace of energy price declines. Inflation has still slowed from where it was earlier this year and, combined with gentle softening in labour markets (unemployment rate edging higher, job openings lower) supports the view that current interest rates are still higher than needed to achieve the Fed's 2% target sustainably.

-

November jobs data published last week showed a weakening—but still solid—jobs market. U.S. nonfarm payrolls grew by 227,000 jobs last month. The unemployment rate (which is based on a different data source than payroll counts) rose slightly to 4.2% from 4.1%.

Further Afield

-

The European Central Bank (ECB) cut interest rates by 25 bps, as we expected, bringing the deposit rate down to 3%. ECB staff forecasts for annual GDP growth were trimmed by 0.1%–0.2% each year over 2024–2026, with the European economy now expected to grow by 0.7% this year, and by 1.1% and 1.4%, respectively, the following two years.

-

China’s Politburo surprised the market with strong pro-growth signals at its December meeting. In a statement published on Monday, the country’s top decisionmakers pledged to implement a “moderately loose” monetary policy in 2025, the first major shift in stance since 2011.

Notes About Companies in Model Portfolio

-

Costco Wholesale Corporation (COST) announced its operating results for the first quarter of fiscal 2025 (twelve weeks), ended November 24, 2024. Net sales for the first quarter increased 7.5 percent, to $60.99 billion from $56.72 billion last year. Net income for the quarter was $1,798 million, $4.04 per diluted share, compared to $1,589 million, $3.58 per diluted share, last year.

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman