Below is a summary of some of the relevant news items from the Capital Markets and the Economy from the past week extracted from RBC Global Insights and FactSet Research.

You can catch up on the past four weeks’ Weekly Update in the link to my Blog.

Read my latest Smart Investor newsletter on my website. The Q4 2024 edition covers Market Review for first nine months of 2024, a discussion about lower interest rates, as well as the U.S. presidential election. Shiuman’s Corner is about my first ride in the RBC Granfondo Whistler.

Markets

Market scorecard as of close on Friday December 6, 2024.

| Country | Equity Indices | Level | 1 week | YTD |

| Canada | S&P/TSX Composite | 25,692 | 0.2% | 22.6% |

| U.S. | S&P 500 | 6,090 | 1.0% | 27.7% |

| U.S. | NASDAQ | 19,860 | 3.3% | 32.3% |

| Europe/Asia | MSCI EAFE | 2,355 | 2.3% | 5.3% |

Source: FactSet

-

TSX closed higher on Friday, though near worst levels. Sectors mixed. Canadian equities finished with a very modest 0.2% weekly gain.

-

US equities mostly higher Friday. Major indexes mixed for the week with tech driving S&P and Nasdaq strength.

-

The S&P 500 Index continued to move higher during the week, recording the year’s 58th new high on Dec. 4. The drivers of the rally were nothing new: the outperformance of technology stocks due to artificial intelligence tailwinds and the prospect of less regulation and lower taxes following the election. November posted the biggest monthly gain of the year, with the S&P 500 up 5.7%.

-

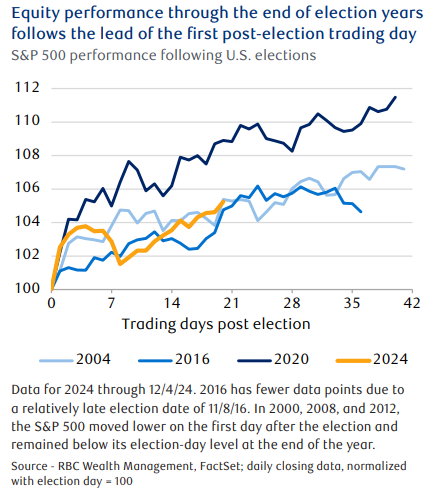

Stocks rallied on the first post-election trading day in 2020, 2016, and 2004 and continued to move higher through the final trading day of the year. In contrast, stocks moved lower the day after the 2012, 2008, and 2000 elections and remained below the election-day levels through year’s end. This suggests 2024 may also see a strong finish for stocks if history repeats.

Economy

Canada

-

Prime Minister Justin Trudeau announced a multi-billion-dollar package of direct funding and tax breaks to help Canadians offset higher living costs. According to the federal government, the initiative will cost CA$1.6 billion.

-

Canadian economic activity grew at an annualized pace of 1.0% q/q in Q3 2024, well below the Bank of Canada’s (BoC) expectation of 1.5% and less than half of the 2.1% pace recorded in Q2. The softer growth backdrop amidst easing inflation pressures is among the reasons RBC Economics maintains its base case of another 50 basis point rate cut from the BoC in December.

U.S.

-

Friday’s employment report matched consensus expectations with a 227k employment gain and a tick higher in the U.S. unemployment rate, to 4.2% (consensus was for 190k employment gain and 4.2% unemployment rate).

-

U.S. President-elect Donald Trump warned that he would impose a 25% tariff on all imports from Mexico and Canada unless both nations take steps to curb the flow of drugs and illegal migrants across U.S. borders.

Further Afield

-

French equities have underperformed and weighed on the broader European equity market since Macron called a snap election in June. Political uncertainty in France has been one of several factors driving the underperformance of European equities versus the S&P 500 in 2024, which has been one of the worst years on record for relative returns for the region versus the U.S.

-

South Korean President Yoon Suk Yeol shocked the world by imposing martial law late Tuesday night, the first attempt to do so in over four decades, only to lift it hours later after lawmakers voted to oppose the unexpected declaration.

Notes About Companies in Model Portfolio

-

BMO Financial Group (BMO) For the fourth quarter ended October 31, 2024, BMO recorded net income of $2,304 million or $2.94 per share on a reported basis, and net income of $1,542 million or $1.90 per share on an adjusted basis. Concurrent with the release of results, BMO announced a first quarter 2025 dividend of $1.59 per common share, an increase of $0.08 or 5% from the prior year, and an increase of $0.04 or 3% from the prior quarter. The quarterly dividend of $1.59 per common share is equivalent to an annual dividend of $6.36 per common share.

-

Dollarama (DOL) reported its financial results for the third quarter ended October 27, 2024. Comparable store sales increased by 3.3%, over and above 11.1% growth in the corresponding period of the previous year. Diluted net earnings per common share increased by 6.5% to $0.98, compared to $0.92. 18 net new stores opened; long-term store target in Canada to 2,200 stores by 2034.

-

Royal Bank of Canada (RY) reported net income of $16.2 billion for the year ended October 31, 2024, up $1.6 billion or 11% from the prior year. Diluted EPS was $11.25, up 9% over the prior year reflecting growth across each of our business segments. The inclusion of HSBC Bank Canada (HSBC Canada) results increased net income by $453 million. Adjusted net income and adjusted diluted EPS of $17.4 billion and $12.09 were up 10% and 8%, respectively, from the prior year.

Feel free to contact me with any questions and/or to discuss investment ideas.

I appreciate the opportunity to serve you and look forward to continuing to help you accomplish your long-term financial goals.

Regards,

Shiuman