I was asked an insightful question by a client this week, in response to my “Rising US Debt Levels” piece (LINK). I thought the response would be informative, so I have cleaned it up and reproduced it here.

The gist of the question was “What happens if the Chinese stop buying US Treasuries in the face of the rising Trump deficit, or worse, start selling them off?”

It’s an interesting thought experiment. The Chinese ownership is something that starts to worry people every so often (as direct ownership by Japan did a generation ago).

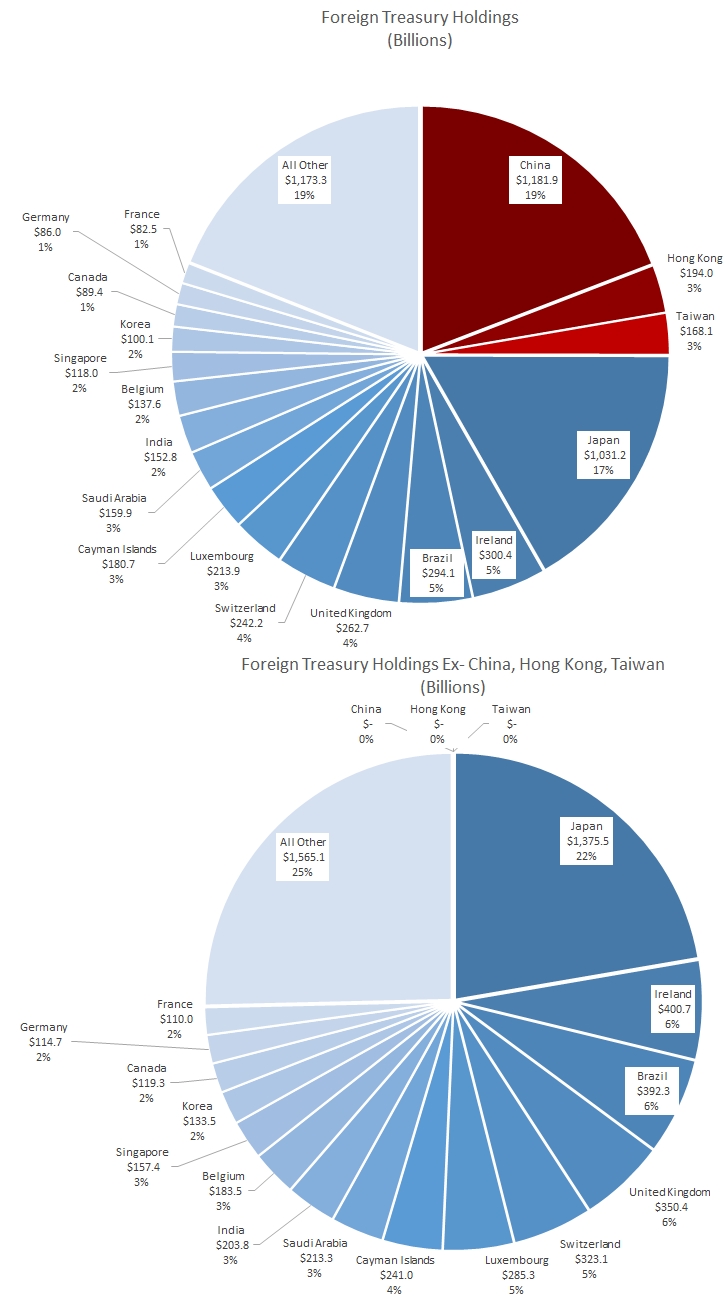

The main way to get out of deficits is by growing GDP, all else being equal. Current borrowing for 10 years is 0.7% real interest rate, with real GDP growth of 2.8% y/y and with U.S. interest costs currently at 1.3% of GDP. There’s plenty of room for the economy to absorb higher interest costs as long as the denominator doesn’t shrink too much (eg: as long as he doesn’t blow up economic growth too much). As far as *who* would absorb the extra financing, look to the rest of the world, probably. China may be the biggest holder of US debt, but they currently hold 19% of the overall US debt (25% if you include Hong Kong and Taiwan for good measure). It would take higher rates, but the other 81% could absorb the debt, surely.

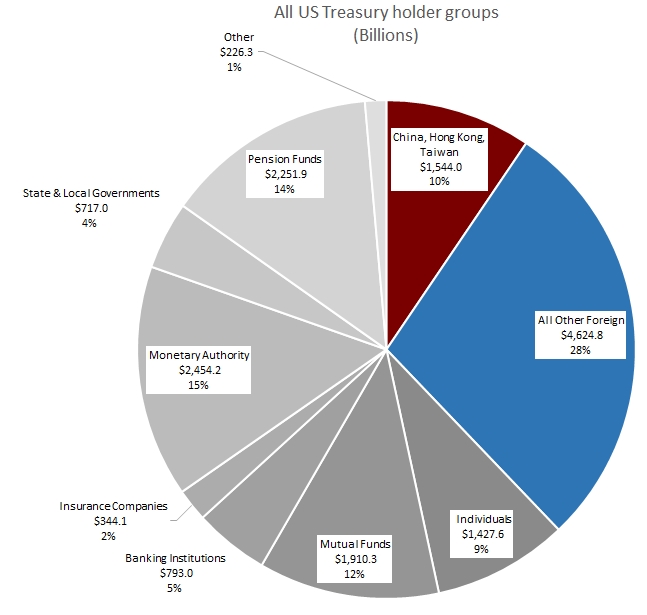

Don’t forget, that’s just the foreign holders, who currently make up 38% of the total owners. Most of the Treasuries are owned domestically. Mainland China is 7.2% of total ownership (all of China is 10%). At the right price, banks, insurance companies, mutual funds, and pension funds—as well as individuals to a lesser extent—would probably be happy to increase their Treasury holdings, especially given a more productive [higher] yield.

All charts are from public data provided by the U.S. Department of the Treasury, the U.S. Federal Reserve Board, and the Securities Industries and Financial Markets Association (SIFMA).