Annus horribilis: 2022 a historic year for the wrong reasons!

In a speech given in November 1992, Queen Elizabeth II described that year as year ‘’annus horribilis” or “horrible year”.

For most investors, 2022 was indeed an ‘’annus horribilis’’. 2022 has been one of the most difficult years that we have faced in the past four decades.

For the first time in 150 years, stock and bond markets fell at the same time by more than 10%. 2022 will also mark the end of what can be called "cheap money" (money borrowed at very low interest rates). This popular feature of modern finance has led to asset inflation, speculative trading, and ridiculous booms like meme stocks and non-fungible tokens (NFTs).

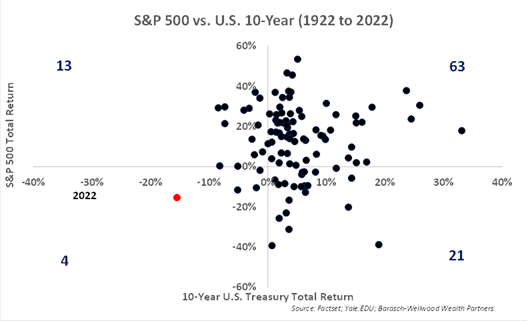

To illustrate this, we would like to draw your attention to the graph on the next page where each point represents the annual performance of the US stock market (S&P 500) against the 10-year US Treasury bonds over the past 100 years.

In the upper right quadrant we can find the 63 years in which the stock market and the bond market generated positive returns. The lower right quadrant shows the 21 years where stocks rose while bonds lost value. As for the upper left quadrant, it shows the 13 years where the stock market was down while the bond market was up. Finally, the lower left quadrant is of particular interest to us since a drop in the stock market AND the bond market had only occurred 3 times before 2022. The red dot in this quadrant represents 2022. As you can see, 2022 was a major outlier, as it not only represents one of four years in the last century in which stocks and bonds have fallen, but it is also the ONLY year in which both have simultaneously fallen by more than 10%.

The return of inflation, which had disappeared since the beginning of the 1980s, surprised many and the aggressive increases in interest rates by the world's central banks that followed, in order to curb inflation, are the root causes of the stock and bond markets declines.

The overstimulation of monetary and fiscal policies during and following the pandemic, as well as the disruption of supply chains due to the pandemic and the war in Ukraine are the main causes of inflation. Fortunately, the rise in inflation seems to be easing and some signs of an economic slowdown lead us to believe that the rate cap will be soon. We therefore agree with the consensus of economists for 2023, namely that interest rates will peak during the first half of 2023 and there could be a lull, or even a decline during the second half.

We also agree with an inflation peak in 2023, but we must remain realistic, namely that inflation rates and interest rates close to zero, as we have experienced from 2018 to 2022, won't come back. Inflation will continue to be affected by demographic and de-globalization factors as well as growing geopolitical conflicts between democratic and autocratic countries. Interest rates affect economic growth and asset values because rates affect the cost of capital and, therefore, the value of assets.

That won't necessarily mean a revival of cheap money and all that goes with it, but at some point in 2023, beaten down stocks will likely emerge as an attractive alternative.

We remind you that in 2022, the US central bank and its president, Jerome Powell, changed directions in the face of inflation four times, so it is with great humility that we write these lines on our outlook for 2023!

Wall Street strategists tracked by Bloomberg expect the S&P 500 to end 2023 at 4,078, about 6% higher compared to the end of 2022. This gain would bring the index back to where it was in early December 2022.

The 60/40 Portfolio

Due to low interest rates for several years, the paradigm of a balanced portfolio of 60% stocks and 40% bonds has been undermined. The 60/40 combination, created at a time when bond yields were 5% and above, an investor targeting a 6-8% return could put 40% of their portfolio in relatively safe bonds to generate 5% with the hope that the remaining 60% invested in equities would generate 8-10%, bringing the overall portfolio return to that 6-8% range.

As you can see, the table below shows the low returns achieved in 2021. Thus, achieving a 4% return using this golden rule had become an almost impossible challenge!

|

| December 31st 2021 |

| High Quality Dividend Stocks ¹ | 3.50%¹ |

| Canadian Banks ² | 3.50%² |

| Investment Grade Bonds ³ | 2.42%³ |

| Canada 1 year Bonds | 0.75% |

| Canada 5 years Bonds | 1.25% |

| Canada 10 years Bonds | 1.40% |

| GIC 1 year | 1.55% |

| CIG 5 years | 2.50% |

| Average | 2.11% |

| Source : Factset; Groupe Picard – de Beaumont – Foley Gestion de Patrimoine RBC

| ¹ dividend yield BMO EQUAL WEIGHT BANKS INDEX ETF (ZEB) ² dividend yield BMO Canadian Dividend ETF (ZDV) ³ average yield to maturity iShares Core Canadian Corporate Bond Index ETF (XCB) |

Today, the 60/40 income investor can not only meet their 4% goal, but also significantly exceed that goal. The table below shows the yields achieved at the end of 2022. Although bond yields have already started to fall, particularly in the 5-10 year range, rising incomes have created opportunities that did not exist for nearly 20 years.

|

| December 31st 2022 | Allocation |

| High Quality Dividend Stocks ¹ | 4.20%¹ | 40% |

| Canadian Banks ² | 4.65%² | 20% |

| Investment Grade Bonds ³ | 5.25%³ | 20% |

| Canada 1 year Bonds | 4.61% | 2% |

| Canada 5 years Bonds | 3.40% | 3% |

| Canada 10 years Bonds | 3.30% | 5% |

| GIC 1 year | 5.00% | 5% |

| CIG 5 years | 4.45% | 5% |

| Total 60/40 Portfolio | 4.50% | 100% |

| Source : Factset; Groupe Picard – de Beaumont – Foley Gestion de Patrimoine RBC | ¹ dividend yield BMO EQUAL WEIGHT BANKS INDEX ETF (ZEB) ² dividend yield BMO Canadian Dividend ETF (ZDV) ³ average yield to maturity iShares Core Canadian Corporate Bond Index ETF (XCB) |

|

Looking forward to 2023

The start of a new year is an important time to update you on our outlook, but we remain alert to changes throughout the year.

Our investment style remains unchanged, namely to identify companies that generate highly predictable results with good balance sheets and managed by experienced leaders. We also believe that peak interest rates will be favorable for our holdings in the technology, real estate and utilities sectors.

Indeed, the stock market valuation of companies in the technology sector drops by around 10% for each 1% increase in interest rates, a pause in the rise could push the market to review the valuation of these securities.

Currently, we remain positive on the energy sector. As in 2022, we believe that companies will continue in 2023 to opt for returning excess capital to shareholders rather than spending on exploration and development. We also remain positive on consumer staples companies and companies with the ability to pass on inflationary pressures to their customers, such as railroads.

We believe we have chosen three high quality Canadian banks that compare very well with the best global financial institutions in the world. In addition, banks currently have much less loan risk and much more regulatory capital compared to the 2008 financial crisis. Loan portfolios, including mortgages, should therefore not be a cause for concern for investors.

During 2022, we performed the most portfolio reviews in our career and we recorded the most proactive calls to our clientele to discuss your portfolios. In addition, for almost all of the families we work with, we have done or updated a retirement analysis to put 2022 returns into perspective with your financial plan. Following this exhaustive work, we are confident in the direction of your portfolios in relation to your retirement objectives and the maintenance of your lifestyle, which is our main priority.

In the event that you do not have a financial plan or would like to discuss it, we are available for you to position your portfolios in connection with your wealth management.

In conclusion, we must stay on course for the long term, not let our emotions dictate our actions and continue to evaluate existing investments while maintaining an open mind to generate the best possible returns while managing risk.

Thank you for your trust, looking forward to seeing you again in 2023!

Steve, Alexandre & Philippe