"I made 5,127 prototypes of my vacuum before I got it right. There were 5,126 failures. But I learned from each one. That’s how I came up with a solution. So I don’t mind failure." – James Dyson

Note that the contents of this memo are all my thoughts, and not the views of RBC Dominion Securities. As well, no part of this content was AI-assisted or created.

Friends & Partners,

Taking from this month’s quote above, most of us aim to learn from our failures, and use them to improve ourselves and our approach moving forward. It’s not clear that markets do the same – collectively, we may not always learn from our mistakes. History may not repeat, but it tends to rhyme.

2024 has started similar to how 2023 went out. The economy remains relatively resilient, and the markets are struggling to figure out the timing and extent of interest rates.

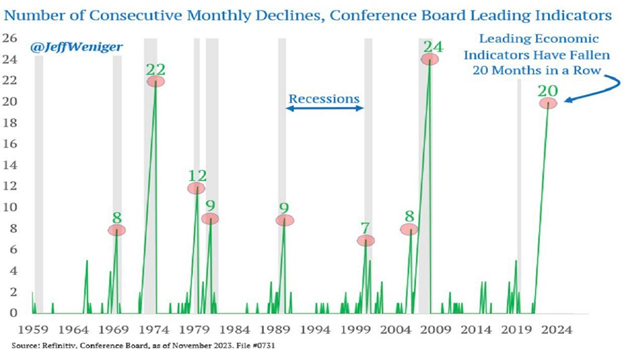

A recession could still be coming, or it could have already happened. Recall that we did see two straight down quarters in US GDP in the first half of 2022, which is technically a “recession”, though wasn’t official. However, it could have released enough pressure to extend the expansionary period we are in. We still need to remain vigilant on this front though – the US leading indicator index has never experienced such a large 6-month decline without a real recession:

Some think that perhaps mild but steady growth will be the ‘new normal’, punctuated by occasional weak quarters, almost like a short recession here and there – so more of a ‘muddle through’ period over the next few years.

We really just don’t know.

We do know that markets will likely remain volatile while it tries to figure things out, which it always is to a point. Look at last year (2023) - The S&P 500 went up 9% in January and early February, then dropped 8% on the US regional banking tremors, rallied 20% through July, then dropped 8% between August and October, and finally rose 14% over the final two months of the year. This sort of volatility is not what most investors strive for. There are solutions for that – we aim to minimize the noise.

Stocks are usually inherently volatile, and bonds can be too as many have learned in recent years. Since 1928, the S&P 500 Index has experienced, on average, roughly three corrections of at least 5% per year, one of at least 10% per year, and a bear market where prices fall more than 20% every 3–4 years. Despite this recurring volatility, however, the S&P 500 has generated positive annual total returns roughly 75% of the time over the past 95 years. The average annual return for global equities is about 11% over the past 70+ years. But would you care to guess how many of those years are within +/- 5% of that average. Or in other words, how many years are within +6% and +17%? About 30%, which means 70% of the time, equity returns were below 6% or over 17%.

So, we may see something that brings a scare to markets near-term, such as a surprise inflation uptick, weak labour market data or a seemingly ‘sudden’ consumer retrenchment which could tests the market's resolve and the prevalent ‘soft landing’ thesis. It is also not clear that Central Banks will cut interest rates as much as the market still seems to think. It seems unlikely that the Central Banks can thread the needle perfectly in a return to 2% inflation without a bit more economic pain, or sporadic reacceleration data points in prices. But on the other side of that is $6 TRILLION of cash on the sidelines to buy dips…

Equity market returns tend to be more modest during election years, and they tends to start with a sell off, followed by volatility during the election, before bouncing back. So far so good in 2024.

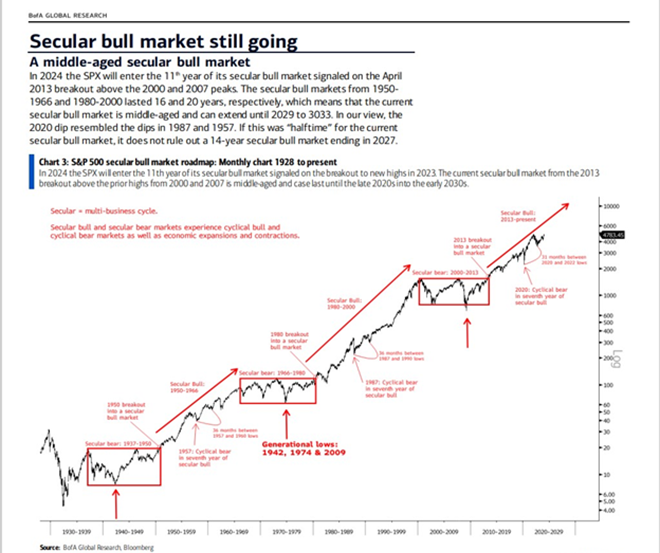

Ultimately, we are likely to remain in a longer-term bull market at this point, as BofA shows below. My old friend Bob Decker highlighted that the cyclical bear markets that we have felt in the past few years are hardly visible when viewed in the bigger context, and that cyclical pullbacks are a 'feature not a bug' of secular market moves:

The goal for most of us should be to live a relatively stress-free financial life, so you’re not in a position where you aren’t comfortable going out to dinner once a week, or saving money by not buying your overpriced coffee every day. Saving money in these places is not how wealth is built. This is where we help.

Some Other Interesting Things to Highlight + Events

Firstly, I am honoured to have been able to (hopefully!) inspire and educate some of our youth on the topic of financial literacy, something that I am focused on and is generally lacking in the general educational system. The Hanley Institute is an amazing small charity that helps support youth empowerment, growth and mental wellbeing in Grey County. Check them out at https://thehanleyinstitute.ca/.

If you’re looking for a very impactful financial literacy short online course for family or friends, young and old alike, RBC teams up with McGill to create this: https://www.mcgillpersonalfinance.com/

|

|

|

Secondly, our extended team is hosting a Commercial Mortgages Virtual Lunch and Learn Wednesday, February 7, at 12:00 - 1:30 p.m. EST. Join the RBC Commercial Mortgage team for updates on the commercial mortgage market, lending requirements and RBC's commercial mortgage product. You can RSVP HERE.

Finally, I will be hosting Olympic Bronze Medalist Marion Thenault to speak at Beaver Valley Ski Club on March 2nd (Silver Creek Room, 4:30 pm) which should be interesting and enlightening! Marion is an exceptional person and has gone through a number of pivots and transformations over her career, an experience that landed her on an Olympic podium in a sport she didn’t originally know existed.

When Central Banks Finally Cut Rates, Markets Often Cheer*

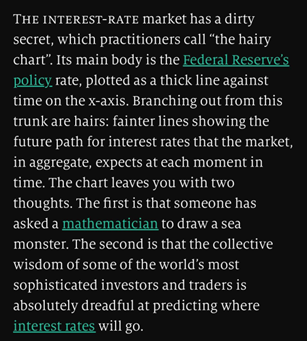

Think the markets have a solid grasp on when and how much rates will get cut this year? They don’t exactly have a great record of accurate forecasting:

|

|

|

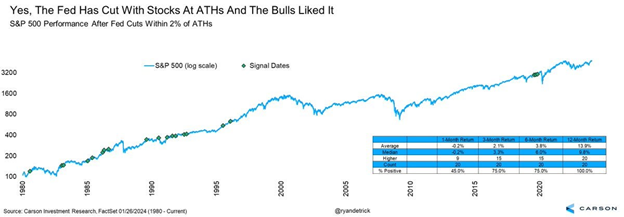

Conventional wisdom would dictate that Central Banks only cut rates when there are issues in the economy, but interestingly, if you look at the period since 1980, there have been 20 rate cuts when the market was within 2% of market highs at the time. In those instances, markets were higher a year later 100% of the time. This could be similar to the situation we may see ourselves in soon:

Source: Carbon

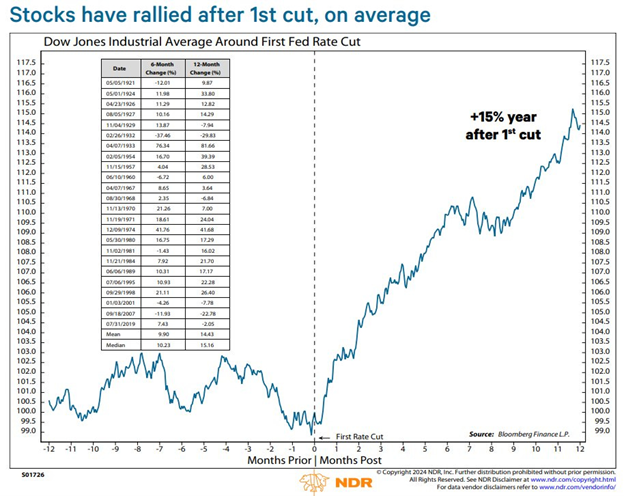

If we go further back, the stock market typically moves higher after the first rate cut (with a few notable exceptions in 1932, 2001 and 2007). In the context of those exceptions, we may need a fairly disastrous backdrop to break this rule of thumb.

Source: NDR

Since 1974, the S&P 500 has seen price returns of 1.9%, 5.0%, and 7.5% in the respective 3, 6, and 12 months after the first rate cut on average, though the overall range of outcomes is wide. The path of performance is largely dependent on other macro elements. For instance, cuts made to reinvigorate the economy amid an economic downturn have been proceeded by very different market outcomes than cuts made amid a soft landing. Ultimately, the path of monetary policy is just one of many elements that could influence the direction of markets in 2024.

So, Central Bank cuts tend to juice up equity returns, at least over the longer term. But they don’t juice the economy interestingly – Jeffries notes that “we catalogued the start of the last 11 rate cut cycles going back through the 1970s, and showed the resulting changes in US GDP. Notably, while most of these instances occurred during or just before recessions, the largest average slowdowns in GDP occurred 4-6 Qs out, before seeing reacceleration. Also worth flagging, GDP was lower 2 quarters out in nearly all cases, with one exception being a cut cycle that began at -8% GDP growth. The point is, cuts don’t seem to necessarily juice the economy up, especially if it is in the process of slowing down."

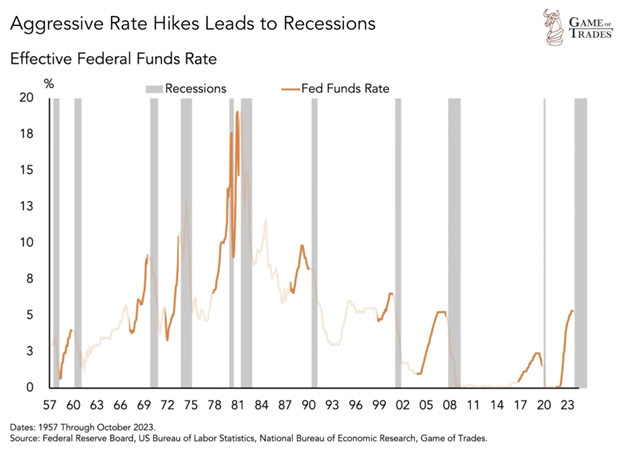

Our Monthly Recession Check! Let’s Not Assume We Have Avoided One*

An imminent recession was forecasted by many starting a year ago, and even though we may have seen a technical recession a few quarters ago, it basically hasn’t happened yet, and many are calling for it not to happen (i.e. the economy will pull off a ‘soft landing’). Let me quickly take you through this story in a few quick charts.

This is the chart that is making many assume that a recession is bound to hit at some point:

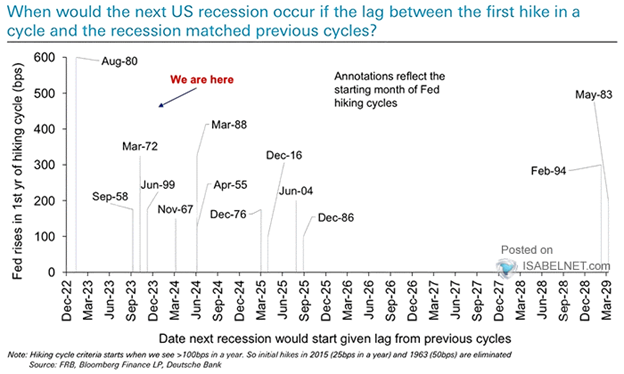

Keep in mind that based on the start of the hiking cycle, it is not uncommon to not be in recession yet:

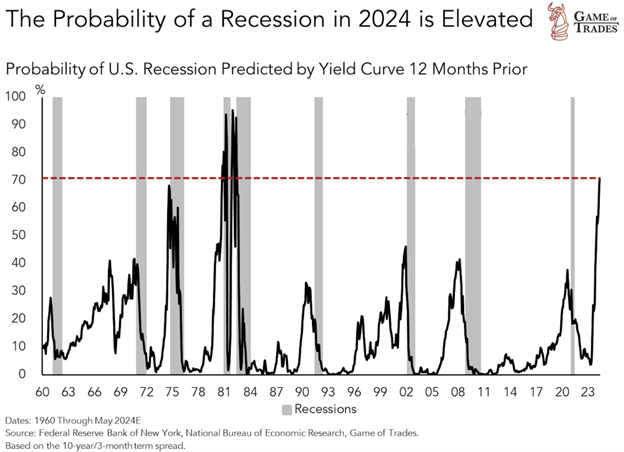

The biggest indicator of recession, the yield curve, is certainly making its case:

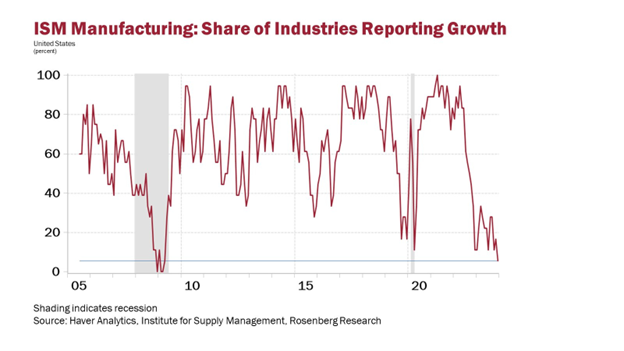

And this chart is showing that ZERO industries are reporting any growth!

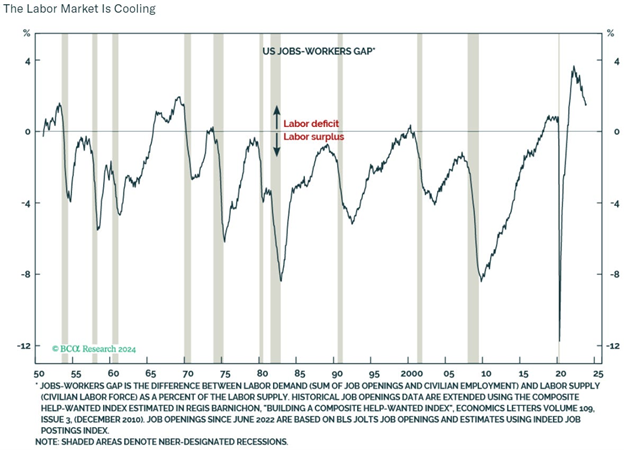

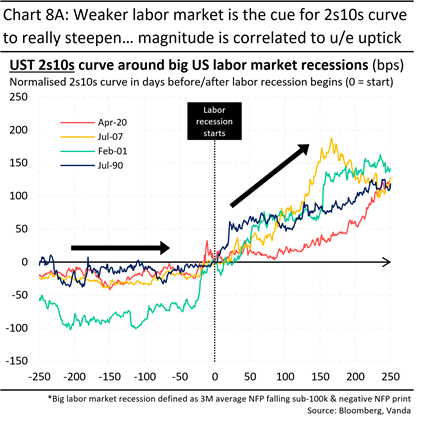

If you’re watching this soap opera, you’ll know that all eyes are on the labour market, which has remained resilient so far. This will be the last shoe to drop, if it does. There are early signs that it is weakening…

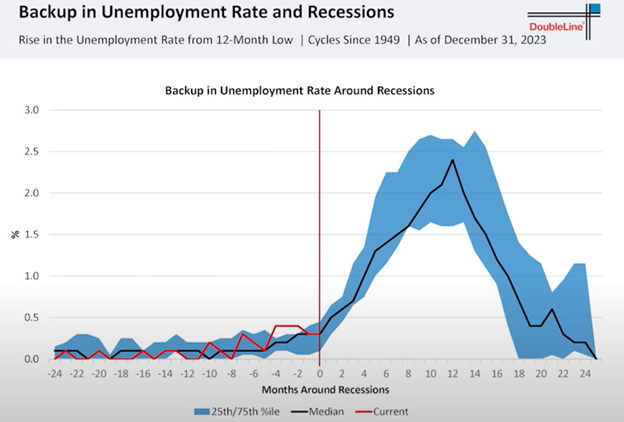

Note that the unemployment rate doesn’t start rising until the recession starts:

Source: DoubleLine

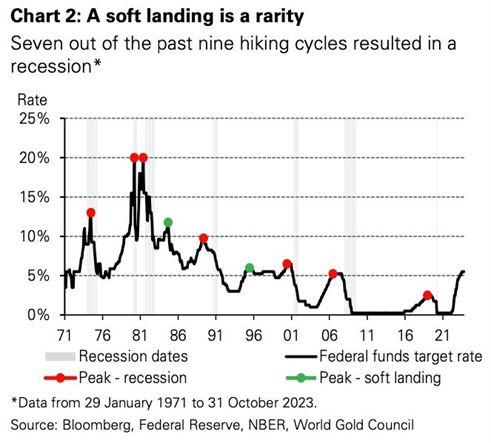

To conclude on this, current consensus is we get interest rate cuts, a decent economy and higher earnings. Certainly a soft landing is possible, but historically it is the exception not the rule:

The Other Side of the Story – Things Ain’t So Bad*

Markets inevitably climb a ‘wall of worry’ over time, without fail. There are always lots of negative data points to find, but finding the positives that can potentially outweigh the negatives and clear the path for markets to move higher is sometimes the larger challenge.

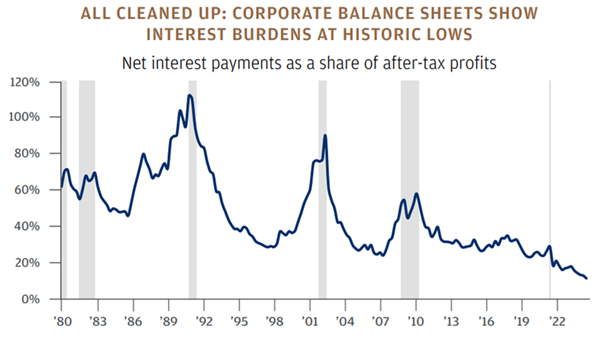

Here’s one you may not have seen: corporate balance sheets are bastions of strength:

Source: Haver

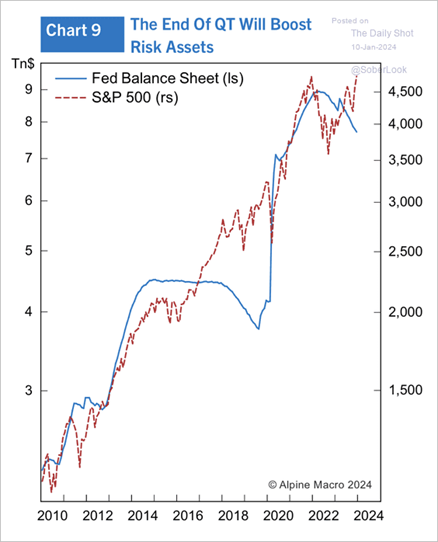

The US Central Bank will end its balance sheet shrinkage soon, and this should be very supportive of markets, especially amid rate cuts:

Source: Alpine Macro

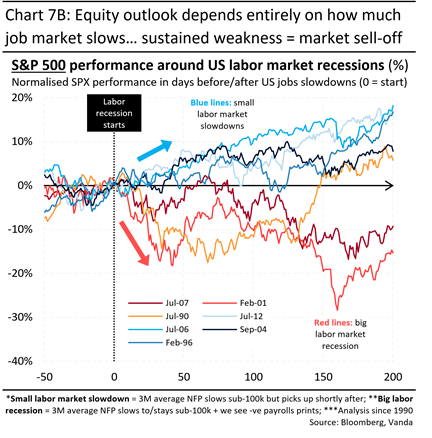

When labour markets weaken, equity markets can pull thru without significant pain if jobs data isn’t too bad. This usually harkens the re-normalization of the yield curve as well:

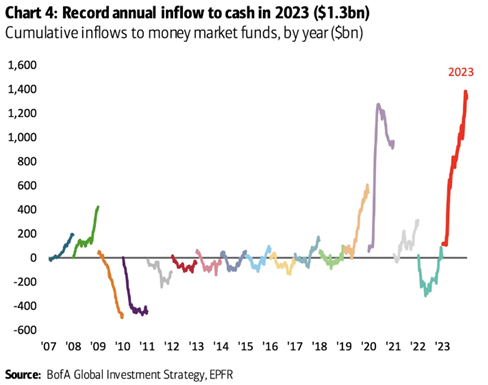

Finally, as I noted up front, there’s a pile of money on the sidelines to support equities (and bonds). Tons of money flowed into money markets last year: