“Whenever you find yourself on the side of the majority, it is time to pause and reflect.” – Mark Twain

Note that the contents of this memo are all my thoughts, and not the views of RBC Dominion Securities. As well, no part of this content was AI-assisted or created.

Friends & Partners,

I hope that you got time to relax, reflect and spend some quality time with friends and family this Holiday Season, and wish you the best for a safe and prosperous 2024.

2023 has been an interesting year, as most prove to be, which makes the role of portfolio management fascinating and a constant learning curve. We started the year with many being outright ‘bearish’ and cautious, encountered a banking crisis in the US, multiple geopolitical events, falling inflation and a recession that never seemed to hit hard (at least so far). I have been noting that we are in a new era of investing, at least one that we haven’t seen for decades.

Consider the profile of this economic cycle – over the past few years it has not taken the form of a traditional, defined business cycle. Economic shutdowns and re-openings were fully coordinated by government and not market forces, and various nations re-opened at different times and ways, with the global economy remaining de-synchronized. So, determining where we are in the cyclical roadmap has been challenging – some strategists say we’re ‘early cycle’ some say ‘late cycle’.

This is new territory for many, though we have seen parts of this movie before. In some ways, global economic conditions are now similar to those experienced after World War II: lingering distortions with deep labour shortages, chronic government spending and a fragmenting world.

The world is undergoing deep structural changes, some of which can lead to higher returns for global investors. Low interest rates of the last decade are finally behind us, and even though that transition caused some pain for many, it is a positive overall development. Investors no longer need to suffer low rates or even take big risks to generate yield. It is now a great time to be a lender rather than a borrower, something which we continue to capitalize on prudently.

We may still be in the early days of the post-COVID era of investing. As was the case in the immediate aftermath of the Tech bubble in 2003, as well as post-Financial Crisis of 2008, confidence has been fragile. Investors and economics were very cautious through most of 2023 until recently, where currently numerous investor sentiment surveys show investors have very bullish expectations for 2024 and the widely followed CNN Fear/Greed Index just hit the highest level of “greed” in two and a half years! In some ways it’s easy to see why investors are so bullish:

- The S&P 500 has rallied more than 15% since the October lows and it’s sitting at near two year highs.

- The financial media has all but declared a soft economic landing inevitable, diminishing any risk of an economic slowdown (despite still high interest rates and an inverted yield curve). US real GDP is pushing 5%.

- The Fed and other Central Banks just completed a historic reversal, abandoning “higher for longer” rate policy and embracing looming rate cuts.

- Volatility readings are very low currently.

These are not unprecedented dynamics, and frankly they’re reminiscent of the time period spanning 2006 and 2007, where the list above looked exactly the same. To be clear, I am not calling for a market collapse or a second round of the Great Financial Crisis, but highlighting that even though history doesn’t repeat, it often rhymes. However, note that opinions among strategists are varying widely, which leaves the consensus in the middle, hoping for a soft landing at the moment but with low conviction. We have to watch the ‘it’s different this time’ narrative. Is this complacency?

Declining inflation (disinflation) and a soft landing (slowing growth but not a contraction) is good for Central Bank policy, but may be a significant challenge for corporate America and negatively impact their earnings. Now that inflation has peaked and is receding, we are also starting to see flashes of the past: discounts. As firms need to become more competitive on price that will impact margins. Meanwhile, salaries and other labor costs are showing no signs of declining, and the bottom line is if margins result in disappointing earnings, that could be a surprise headwind in 2024.

Of course, the Fed and other Central Banks want a soft landing but let’s be clear: a soft landing means slower economic growth compared to today, and slower growth typically impacts companies via reduced revenues as consumers “tighten their belts”. Bottom line is that the Fed has cleared a path for the market to continue to rally but don’t confuse this market with one that doesn’t have risks because at this point, if economic growth rolls over in 2024, Central Banks may be largely powerless to help. Pivots only work once. And the Fed just used it.

Uncertainty remains high, which is why we assess markets from a distance and the outlook for quality companies in the markets. It is easy to mistake noise for signal in volatile markets, especially in the age of social media and short attention spans where we can easily be directed to trivial subjects that are often reduced to short viral moments that seem easier to understand.

The danger today lies in investor complacency, and refusal to change portfolio strategy to align with the shifting markets and macro fundamentals. During the past decade, markets were focused on a low interest rate backdrop and buying the dip. This meant that technology, growth stocks and all things America steadily outperformed. The reverse may occur moving forward – higher interest rates coupled with a bifurcated growth outlook have changed the calculus. A new bull market may be unfolding — just not the one that most expect.

If the 25 years in the markets have taught me anything, it’s that outcomes are usually not binary, so we don’t normally get a universally positive resolution, nor does everything break bad very often, either. The truth is usually in the middle, and that’s where I am on the outlook for next year at this point. And, as always, there are a number of puts and takes to balance, and many reasons for optimism as well as caution. So we continue to take advantage of some very interesting situations and strategies, and position accordingly.

Some Other Interesting Things to Highlight + Events

On Thursday, Jan 18, 2024 at 11:30 AM - 1:00 PM EST, we are hosting a virtual event entitled “Embracing Personal Purpose for Wellness-Driven Leadership”. We have 3 speakers who are juggernauts in their respective disciplines and thought leaders. Gain insights from renowned speakers dedicated to positive impact, and reflect on your personal purpose for professional and personal growth. Let's collectively shape a healthier, purpose-driven world - your purpose matters, and together we can make a difference in 2024 and beyond. Discover the transformative power of purpose-driven leadership with "Women Worth & Wellness"™. See more detail and register HERE.

We will be hosting Olympic Bronze Medalist Marion Thenault to speak at Beaver Valley Ski Club on March 2nd (Silver Creek Room, 4:30 pm) which should be very interesting and exciting! Marion is exceptional and has gone through a number of pivots and transformations over her career, an experience that landed her on an Olympic podium in a sport she didn’t originally know existed.

Be Careful What You Wish For? Lower Rates Could Signal Slowing Growth And Hit Earnings*

In mid-December, numerous ‘blue chip’ US firms across different industries (including FedEx, Winnebago, General Mills, Nike, etc.) each warned about either 1) margins or 2) revenue. And each of these stocks declined after posting disappointing earnings, and while it’s only anecdotal, these results bring up important points.

Declining inflation (disinflation) and a soft landing (slowing growth but not a contraction) is good for Central Bank policy but may be a challenge for corporate America and negatively impact earnings. Interestingly, the surging inflation of the past several years didn’t result in a large decrease in consumer demand like it usually does. Instead, consumers kept buying and paying higher and higher prices. The result has been a margin explosion for many companies who realized the consumer will pay substantially more than before and not dramatically reduce demand.

However, now that inflation has peaked and is receding, we are starting to see flashes of the past: discounts, and as firms need to become more competitive on price that will impact margins. Meanwhile, salaries and other labor costs are not declining (yet) and if margins result in disappointing earnings, that could be a surprise headwind in 2024.

If we get any sort of an economic slowdown, this slower growth will impact companies as consumers “tighten their belts” and we saw some evidence of that in Winnebago earnings and NKE earnings for example.

The bottom line is that falling inflation and slower growth are positive from a macroeconomic standpoint because it means lower future interest rates. But from a corporate earnings standpoint, it’s a potential threat and the earnings results from December confirm we need to watch this closely because if earnings results are too optimistic for 2024 (currently around $245/share for the S&P 500) that could pressure markets as earnings estimates are revised lower.

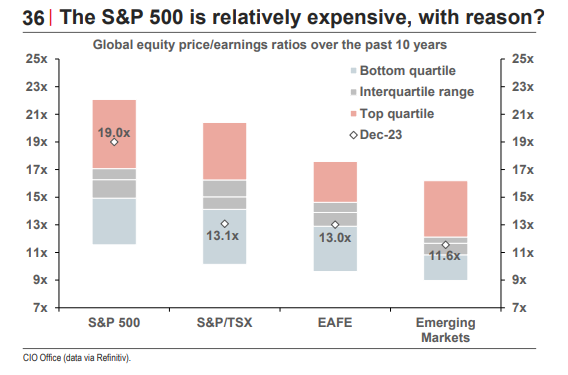

The cautious argument is that much of the good news out there is already priced into stocks and that leaves the market vulnerable to any disappointment. Consider that the S&P 500 is trading at 19.4X 2024 S&P 500 earnings, which is arguably a fairly rich valuation given Fed funds is over 5% and the economy is slowing (it’s just a question of by how much). Meanwhile, the relentless rally since late October has sucked in a lot of the “chasers” on the way up, meaning there are a of “late longs” (people who missed most of the move and are in at high prices) who are skittish in the face of bad news, while there’s also less “dry powder” on the sidelines to support stocks if there’s bad news.

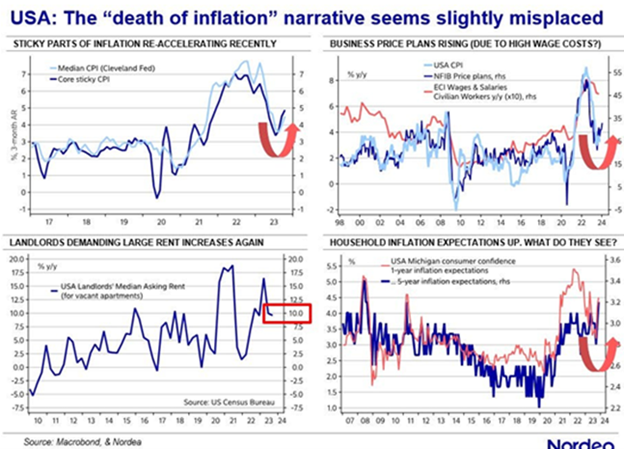

This could be an example of some investor complacency. Markets are essentially acting as if there’s not going to be any recession at all, but are also expecting the Fed to cut rates 6 times over the next 12 months! This could be a recipe for a rebound in inflation that’s not fully subdued quite yet. And note that Fed Chairman Powell has noted multiple times that he would rather overtighten and risk a recession than under-tighten and risk higher inflation. Food for thought…

Reasons for Optimism – Some Of The Positives*

There is always a wall of worry that the market tends to climb.

In 2024, continued positive overall economic momentum from easing financial conditions could well drive the potential for P/E expansion. Currently, the S&P 500 P/E (on 2025 EPS) is 15.3x, ex-FAANG – this is excluding the big tech names that pull the index around. This is arguably attractive considering the 10-yr yield is at ~3.9% and yields potentially fall further in 2024.

The key drivers for P/E expansion could be the following (from FundStrat):

- INFLATION: Inflation tracks sub-3% on housing and used cars continuing to drop in price. The 6-month annualized core inflation rate has now fallen to 2.5% versus 4.5% six months ago, certainly a positive trend.

- INTEREST RATES/FINANCIAL CONDITIONS: Ease as Fed ends “inflation war” and drops rates into 2024. As well, since 1958 there are ZERO examples of the market being lower one year after an extreme interest rate impact has peaked.

- PRODUCTIVITY: Lifts as immigrants and labor supply improve

- GLOBAL GROWTH: Lift as Europe or China emerge from stagnation

- PENT-UP DEMAND: US companies expand due to pent-up demand

- PROFITS: S&P 500 profits set to gain >10%

- INVESTOR FLOWS: Investors allocate out of cash into equities

There is a lot of cash sitting in money market funds currently. The last time money market flows really reverted back (2009) was a very good time to own equities and there was a "dash-out-of-cash" for 3 years:

Source: Bloomberg

The impact of interest rates on equity market return dispersion peaked at over 60% at the beginning of October. This means that everything moved together, and the stock prices of both good and bad companies all moved together. That is finally improving, helping good stock-picker mandates perform.

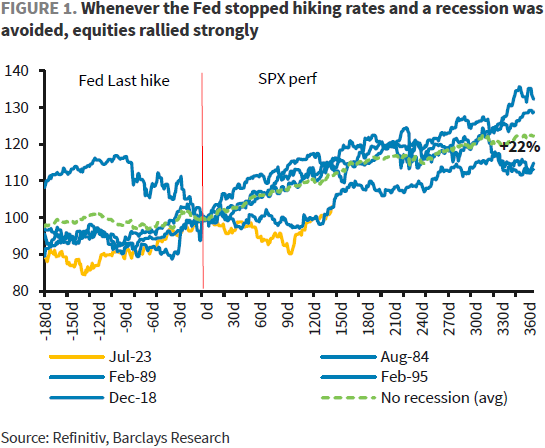

Equity markets can continue to rise if economic expansion stays intact. The decisive dovish pivot from the Fed this week could fuel more melt up in risk assets into the new year. History suggests that when Fed hikes stopped, policy pivoted and a recession was avoided, equities rallied strongly. Global Central Banks are all expected to cut earlier in 2024 now, which could help fuel markets.

We Still Need To Discuss The Possibility of Recession And Implications*

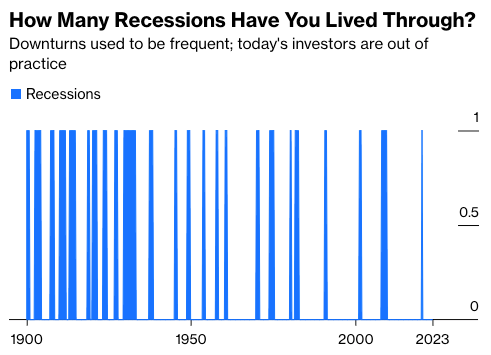

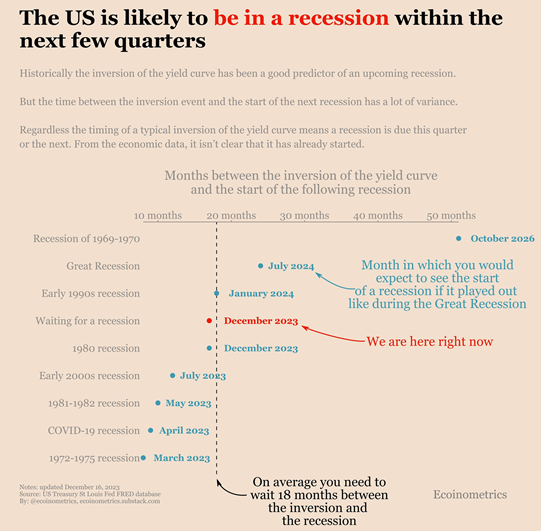

Are things really different this time? That is noted before almost every recession hits. And here’s a curious fact – excluding 2020 (which doesn’t really count), there hasn’t been a proper official traditional recession for more than a decade. Have the economic policy technocrats simply solved the business cycle?

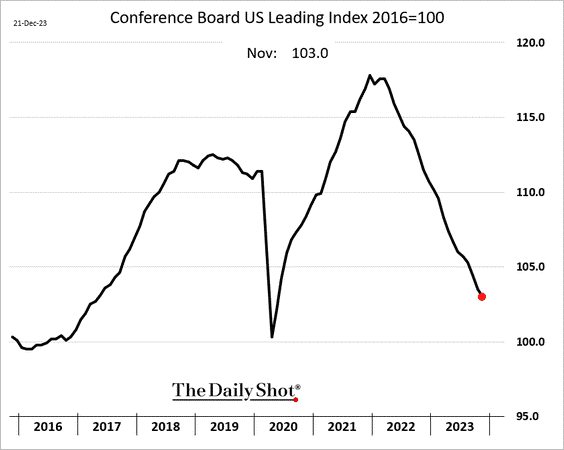

Source: Daily Shot

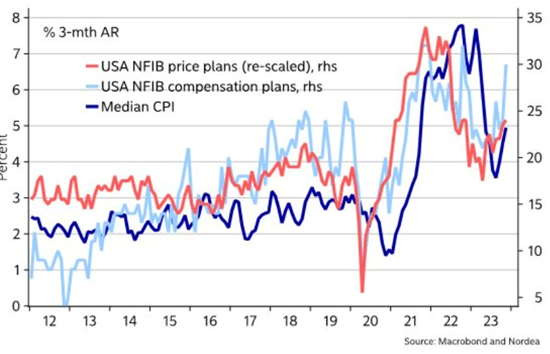

This is a good chart showing we aren’t out of the woods quite yet:

Even if a recession is averted, the possibility of a growth scare in 2024 is still very possible (I wrote about this extensively last month Here). Our economists believe that the economy will likely slow through the first half of 2024 before recovering later in the year. Savings that were built up during the pandemic are finally being depleted, government spending is set to slow and geopolitical frictions are intense. The main headwind to the global economy, though, is that interest rates surged to their highest level in 16 years by mid-2023 and, if they remain elevated, higher borrowing costs could discourage business and consumer spending while making debt-servicing more difficult.

There are also signs that economic data is now feeling the pressure of higher interest rates. Global trade is contracting, business expectations are soft, housing activity has plummeted and the labour market is starting to lose momentum gradually. The Conference Board’s index of leading indicators has declined for 20 months in a row:

Although pathways to an economic soft landing are evident and the odds of such an outcome are improving as inflation moderates, they continue to look for mild contraction in the U.S., Canada, the UK and eurozone during the first half of 2024.

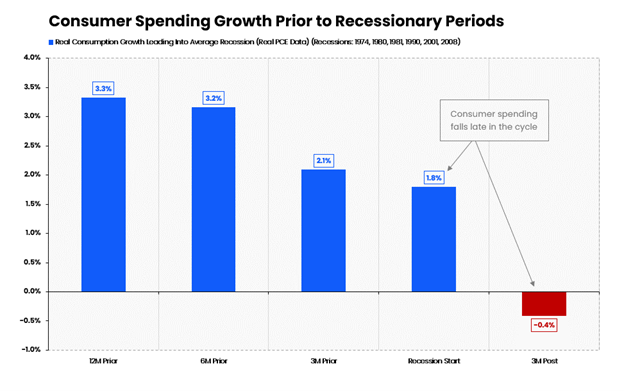

If we are headed for a recession, we likely won’t know it until we are there. The consumer doesn’t stop until the recession has begun. (We did see Fedex off 10% in Dec on the back of poor earnings).

Source: Nordea

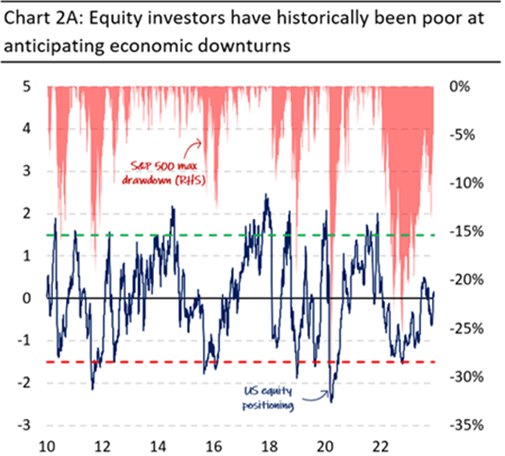

On the investment implications front, fascinating chart below. History suggests that equity investors are not timely when it comes to pricing severe downturns; this time should be no different. While it’s worth bearing in mind that asset prices typically bottom before the real economy, by the time investor flows reach max bearish thresholds, that’s typically also when asset prices trough. Most tend to sell low and buy high, because it’s ultimately driven by sentiment and emotion…

Source: NBF

Are There Opportunities?*

I won’t go into detail on portfolio construction in this note, but I will highlight a few things worth considering.

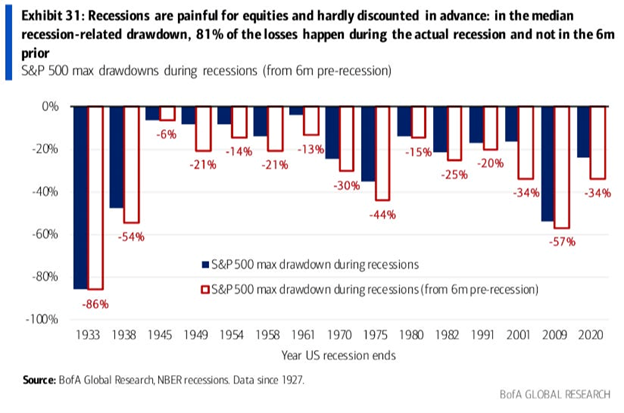

The chart below shows the drawdown in equities during recession (the dark blue bars) vs. the drawdown including the time period 6-months prior to recession. For the most part the bars are fairly close together…or in other words, most of the pain comes “during” recession. One takeaway from this is that recession risk is basically ignored by markets until its unignorable.

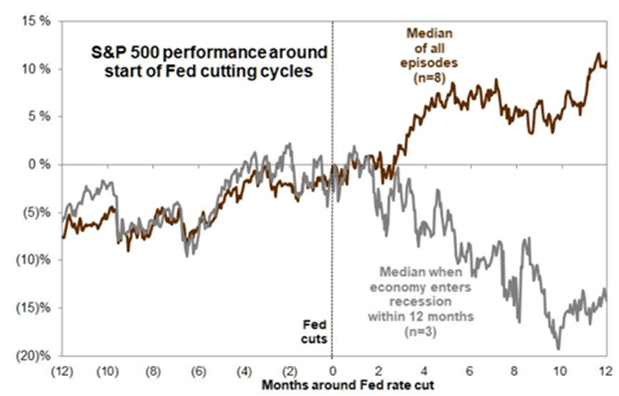

With the market increasingly focused on rate cuts, what that could mean for equity markets will depend on whether the Fed fine lowers rates and tunes policy in the face of fading inflation (brown line) OR whether they are forced into cutting rates in response to recession and/or crisis (gray line):

Source: @mayhem4markets

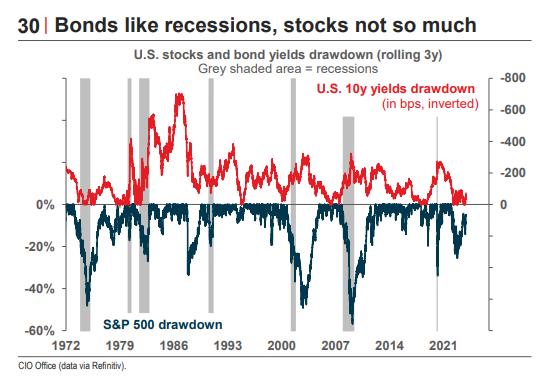

On that note, if you still don’t own any fixed income, you should address this:

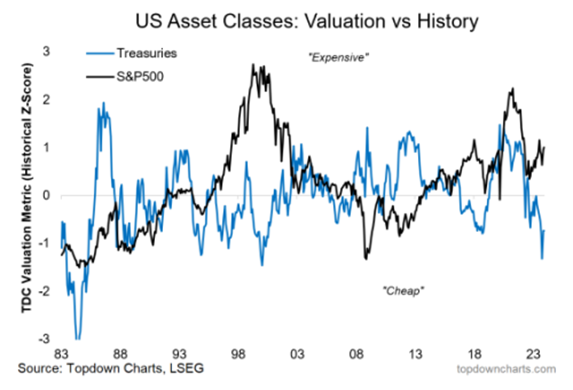

And on a relative basis, it’s time to own fixed income along with your equities no question. Below is a good chart on the relative historical valuation of both stocks and bonds:

Outright long overweight US equities needs to be assessed – there will likely be a shift in leadership in the coming months:

Speaking of relative value, large cap tech/growth is getting out of whack. The best relative value opportunities are small vs large, value vs growth, and global vs US – the chart below explains why. Small-cap valuations are 1999 lows:

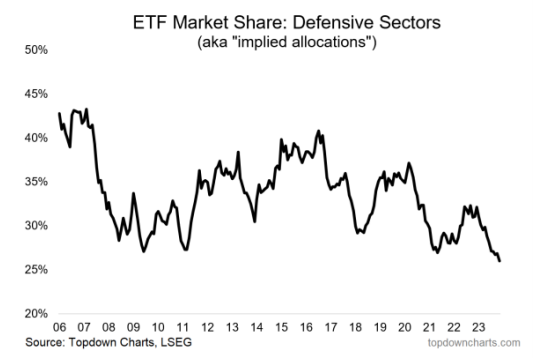

And on this note, the roaring rebound in tech stocks this year left the boring old defensive sectors behind (healthcare, utilities, staples). As such, investor allocations have dropped to record lows. There is a signal here…

Inflation – One ‘Last’ Note Here*

Is the inflation genie officially back in the bottle? Most signs point to ‘yes’, and there are even whispers of deflation being around the corner (which I touched on about a year ago). This is pretty much a good thing, for now – but keep in mind that if the first leg lower of inflation came from the supply side (easing of COVID-induced supply chain bottlenecks), the next leg will likely come from the demand side – which is likely not good for corporate profitability and not good for the “risk-on” narrative.

I just want to highlight a few data points worth watching on this front.

In the past month, a variety of indicators have also rebounded, and the Fed’s posturing can only pour fuel on the fire on this front:

Also note that wage inflation has been sticky, and sticky wage inflation usually opens up the door for persistent inflation – the two tend to be correlated: