Quarterly Commentary – Fall 2024

Our Q2 commentary touched on the market’s complacency over the preceding 12 months, and while the streak of days without a 2% drop in the S&P500 was broken at 356 days, shortly after our Q2 commentary was published, equity markets have continued their upward trajectory. Several factors are responsible for this, namely an increasingly growing belief that the Fed will be able to execute a soft landing following the most aggressive tightening cycle in history, renewed optimism of a productivity boost thanks to the adoption of artificial intelligence, and the resilience of the US consumer which makes up close to 70% of US GDP.

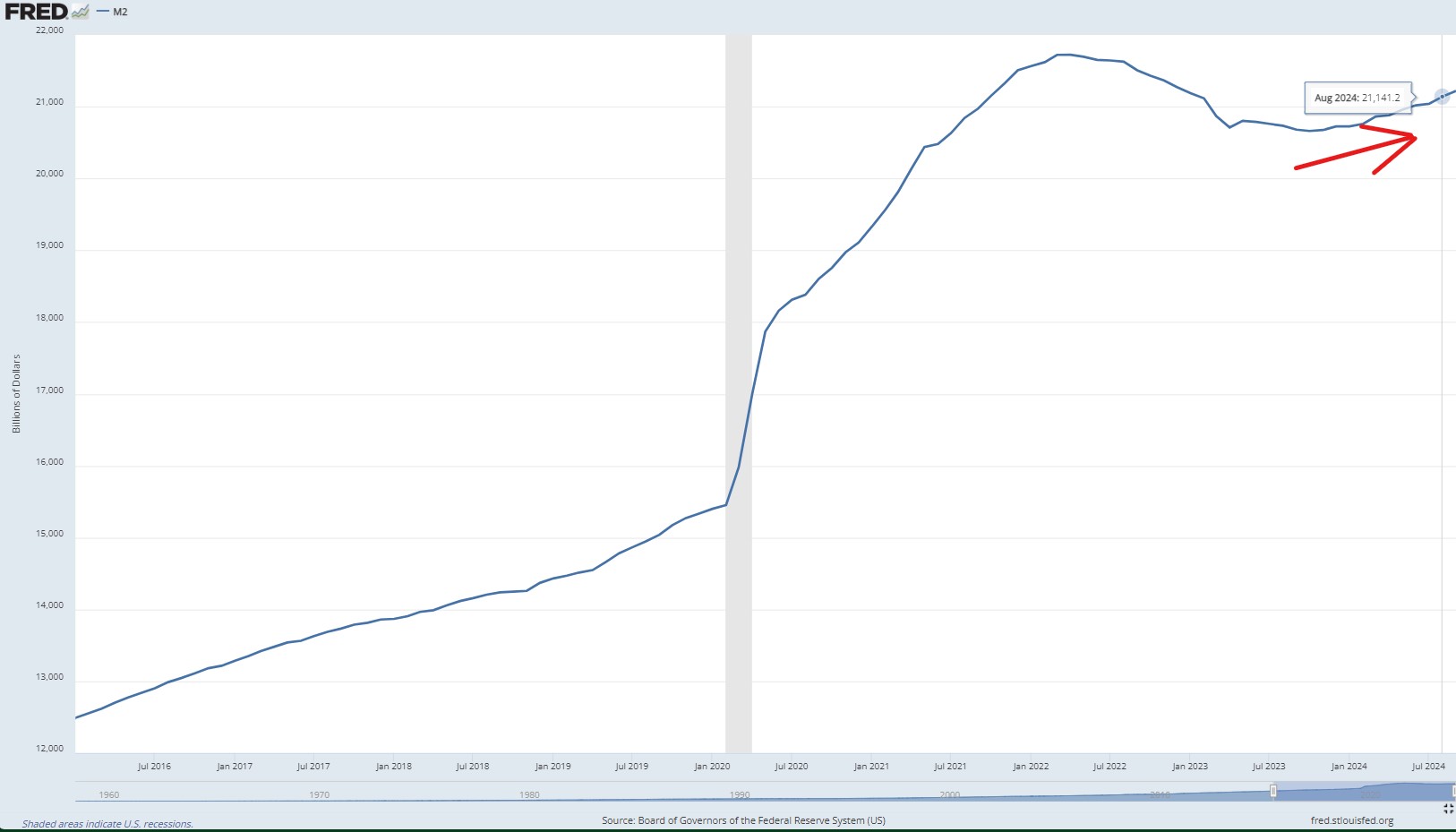

Is the US government propping up the US economy by printing more dollars? – Of the many reasons why markets have been doing so well lately, the following may be one of the most surprising to investors. The following chart shows that money supply in the US reached $21.14 trillion in August. This number had been steadily rising again for several months, after having retreated from its all-time high in early 2022 following the post-COVID recovery period. An increase in the money supply bodes well for equities because there are more dollars in circulation but risks the return of inflation. While other variables are also at play, like the decrease in oil prices and the percentage of companies with intentions of raising prices in the coming months, the already high level of money supply is a risk to be monitored – particularly after the US elections in early November.

United States - M2 Money Supply

Source: Federal Reserve Bank of St-Louis

Performance at September 30th 2024

The results in CAD of the various indices for the quarter ended September 30 2024: +10.5% for the Canadian S&P/TSX index, +4.7% for the US S&P 500 index and +5.5% for the Europe-Asia-Far East index. Interest rates again decreased significantly over the third quarter of the year, leading to a performance of 4.7% for the TMX Canadian Bond Index. The depreciation of the US dollar against the Canadian dollar had a negative impact of -1.1% on US strategies over the same period.

Balanced portfolio returns in Canadian dollar are around +5.5% for the last three months and between +18.0% and +20.0% over the last twelve months.

Considerations

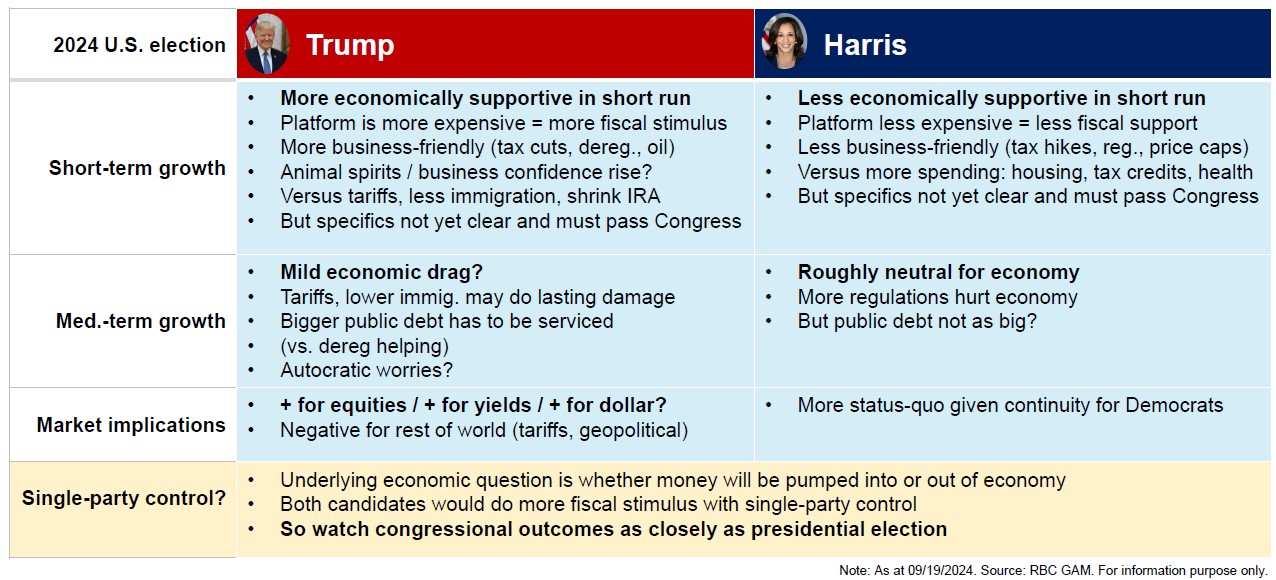

US Elections – On November 5th 2024, millions of Americans will head to the polls to choose the next President of the United States. Poll numbers seem to suggest the race remains close and will likely ultimately be decided by several thousand votes in just a handful of swing states. What impact will a Trump or Harris presidency have on the economy and markets? We believe it depends on whether the election results in a divided or split Congress. A united Congress may mean that fiscal stimulus will be magnified by both sides, while a divided Congress limits the fiscal boost. Our colleagues over at RBC Global Asset Management have put together the following table that summarizes short- and medium-term growth prospects under both presidencies, as well as market implications.

The Bank of Canada could lower the key rate to as low as 2% – We have long spoken of central bank divergences between Canada and the United States, and given the resilience of the US consumer (as well as the Canadian consumer’s larger sensitivity to changes in interest rates), these divergences have only gotten larger, with the Federal Reserve’s terminal policy rate expected to reach 2.75-3%, while Canada’s terminal rate has now moved from 3% to 2%, which has resulted in a weaker Canadian dollar since the beginning of October. RBC Capital Markets’ currency strategist, George Davis forecasts that the Canadian dollar will reach $0.70-$0.71 relative to the USD ($1.41-1.43 USD/CAD) by the end of 2025.

| Key rate forecasts as of October 2024 | Canada | United States |

| Rate at the peak | 5.00% | 5.50% |

| Current rate | 3.75% | 5.00% |

| Rate at end of 2024 (exp.) | 3.25 - 3.50% | 4.50% |

| Terminal Rate | 2.00% | 2.75 - 3.00% |

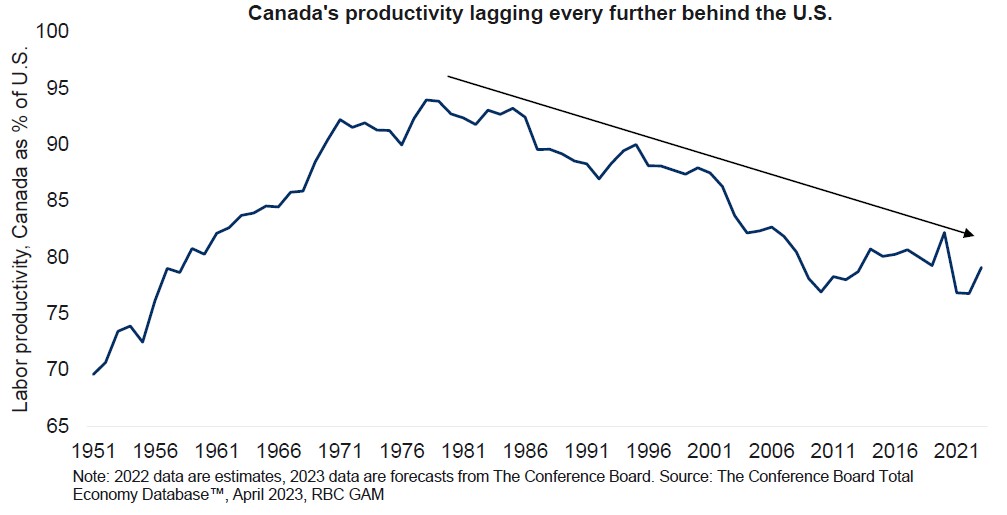

What effect will a weaker dollar have on Canadian productivity? – Canada’s productivity growth lag has long been a matter of concern for economists; a discussion about the economy is not complete without discussing productivity. Canada’s productivity relative to that of the US has been on the decline since the late 1980’s, and took a particularly hard hit following the tech bubble of the early 2000’s. Part of the explanation lies in the sectoral differences between the two economies; Canada’s economy is more reliant on natural resources, which often have lower productivity growth rates than knowledge-intensive and more scalable sectors like technology, of which the US has more of.

A weak dollar may be positive for exports as it reduces the cost of Canadian goods to foreign buyers but can have the negative effect of discouraging purchases of new machinery often produced in economies with a stronger currency, such as the United States & Germany. It also limits research & development spending, which directly negatively impacts Canadian companies’ competitive advantage.

Proceed with caution, but proceed – that would likely be our message moving into the end of the year. While one may think it tempting to predict a correction given rich valuations in equity markets paired with investor optimism reflected in various indicators (valuations, volatility indices & investor optimism surveys, to name a few), we acknowledge that there is no line in the sand that distinguishes between a fairly valued market and an overvalued one, but rather that it is a matter of probabilities.

Given the strong performance in financial markets in 2023 and so far in 2024, we encourage you to inform us of any projects or foreseeable expenses which would require a significant withdrawal from your investment accounts.

Wishing you a wonderful Autumn season, we thank you for the trust you place in our team.

“As long as autumn lasts, I shall not have hands, canvas, and colors enough to paint the beautiful things I see.”

-Vincent Van Gogh

Mathieu & Anthony

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. â / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2024. All rights reserved. This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. will ensure that your own circumstances have been considered properly and that any action is taken based upon the latest available information. The strategies and advice in this report are provided for general guidance. Readers should consult their own Investment Advisor when planning to implement a strategy. Interest rates, market conditions, special offers, tax rulings, and other investment factors are subject to change. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein.