Good afternoon,

A tough week in markets, as the bet on every possible bit of good news slid off the table for a while, and interest rates hugged the tail of stubborn inflation. More below in our weekly Global Insights articles. But first…

As a regional risk manager, I very seldom dealt directly with clients since my focus was more like a security guard than a bank teller. Credit risk decisions can occasionally be very heavy – as peoples dreams crash to the earth, we wrestle with whether to extend further credit, to continue in patience, or just wrap it up and stop sending good money after bad. It’s excruciating.

One Friday (it’s always a Friday) I got a rare phone call from a mayor of one of the cities in our region. An important business in his town was on the brink of receivership, and as a major creditor, we were involved in the go-or-no decision the decision. This mayor, I’ll say it gently – had a high opinion of himself. He had his assistant call me first, who then passed the phone to him – an apparent attempt to impress. In short order he barked a phrase I can never scrub from my memory. Shouting: “Listen Mister. Do you know who I am?”

Hmmm. How does one answer?

“Well actually no.”

“My name is _____ ______, and I run this city. This business you are shutting down is very important to us and I’m not going to sit here and…!” (You get the idea.)

For context, A problem loan can be an enormous drain on time and energy (and cash). Back in the days of paper files, a problem loan file would grow from a thin manila folder into a banker’s box stuffed with correspondence within a few weeks. Dozens of emails every day, letters from lawyers, conference calls with special higher-ups at the bank, site visits, lawyers, other lawyers, a few tears, sleepless nights, lists upon lists of assets and liabilities, and still more lawyers. And sometimes politicians.

The bank is always wrestling with its perception as a big ugly cigar-smoking devil, although in truth, we always looked meticulously for a way to salvage a difficult situation, sometimes (rarely) even quietly walking away. We were several weeks into this painstaking process – and probably still had several weeks to go when this politician managed to squeeze us in to his busy afternoon.

So, what do you say to a steaming hot angry mayor trying to throw his weight in your direction? Like – I don’t know – a crow on a wilted cabbage?

“Mr. ____. I’m glad you believe in this business. So did we. In fact, it was important enough to us that we invested (insert big number here) into it. We’ve allowed our client to postpone payments on the loan several times over the past 5 years and we’ve been scouring the earth for a solution. So, yes – we’re all-in -- up to our uncomfortable parts. Is the city offering to put up some sort of financial contribution – say even 1/10th of ours?”

Crickets. He left the mayor’s office in a bit of a financial scandal a year or so later. Interesting.

I’ve already exceeded the boring story limit here, but in future, I thought it might be interesting to share some of our analytical approaches to sovereign and government credit risks, especially in light of the caustic politics we swim in. Stay tuned. Yes, we lend to governments too, and have a careful procedure for evaluating their default risks.

As promised, here’s this week’s Global Insights:

Rally realities

It’s been a nearly unprecedented winning streak for the U.S. stock market. But in this heady atmosphere there are some nagging vulnerabilities that investors should keep top of mind. We dig into these, and why a Market Weight position in U.S. equities is appropriate to balance the risks and opportunities.

Regional developments: Gold outperforming Canadian equities; U.S. inflation was higher than expected in March; ECB maintains policy rates at 4% and hints at rate cuts in June; Asian Development Bank says Developing Asia poised for better growth.

More here: Global Insight Weekly.

Feel free to contact me with any questions and/or to discuss investment ideas.

And a Few Visuals for the data-oriented:

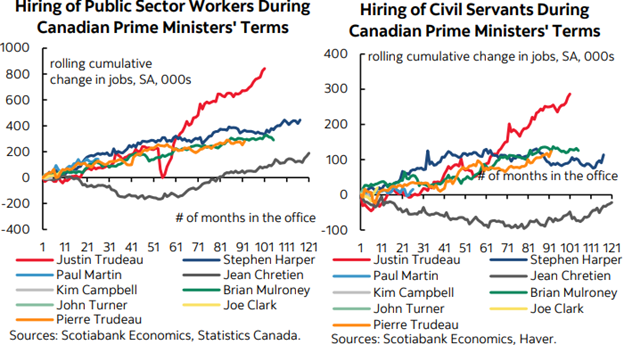

Skyrocketing public sector payrolls in Canada (see charts below from Scotiabank Economics): “The massive upward march in public sector jobs is continuing. 52% of all jobs created in Canada since the start of the pandemic have been in the public sector including 18.4% of all jobs created over this period that have been in public administration (civil servants). This rising weight on sagging productivity is not helping matters.”

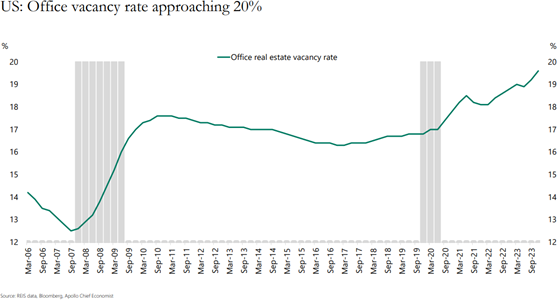

Office vacancy rate still rising (see chart below from Apollo Academy): “The vacancy rate for U.S. office is approaching 20%. And this is in a strong economy with a strong labor market. If the unemployment rate starts rising because of the lagged effects of Fed hikes, the office vacancy rate will increase even more.”

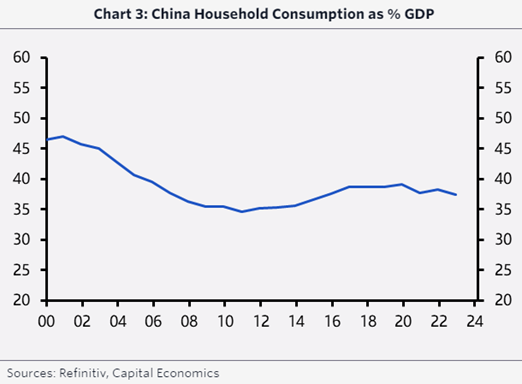

China’s transition to a consumption-based economic model has stalled (see chart below): “China’s consumer demand remains structurally weak. Household consumption accounts for just under 40% of GDP compared with nearly 70% in the U.S., and this share has not materially changed in recent years, despite policy commitments to boost it.”

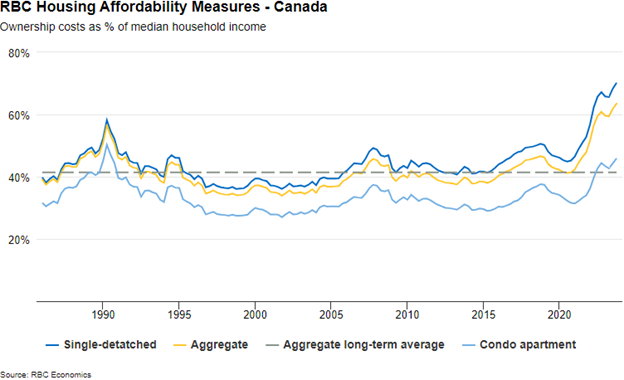

Here’s an Interesting Read: RBC Economics – Canadian renters face higher hurdles to accumulating wealth than homeowners: Canadian renters are getting squeezed more than homeowners, making home ownership an even more distant dream. This threatens renters' path to accumulating wealth—which could exacerbate inequality over the longer term.

Upward mobility: This optimistic little crawler caught my daughter’s eye a few days ago, at her rainy south coast campus.

Upward mobility: This optimistic little crawler caught my daughter’s eye a few days ago, at her rainy south coast campus.

She was duly impressed by the aspiring imp. (You can decide who was impressed with whom). They had a little chat, went to Starbucks and exchanged favourite Tiktoks.

Oh how amphibious ambitions excel in our academy.

And odd how odious alliterations abound among schmucks

Enjoy your weekend!

Mark