Good afternoon,

Aleksandr Solzhenitsyn is most famous for his masterpiece, The Gulag Archipelago, but he also wrote a few other stinging critiques of his Soviet homeland including his fictional work, In the First Circle. As the name implies, the story is oniony.

Near the central layer of the vast Soviet empire a group of scientists struggle in an inner city gulag, trying to build the technology to trace a phone call. But sandwiched in among the plot’s main characters, two brief chapters take us inside comrade Stalin’s office, and then even inside his head. In effect, after thousands of purges, and waves of paranoia, at the very core of the prison state, Stalin himself is trapped and alone in his own protected lair. Alone in his head, he’s convinced that he holds the world on his shoulders, physically and intellectually.

“Stalin felt so lonely because he had no one to try out his thoughts on. No one to measure himself against. Still, half the universe was there in his breast, all order and clarity.“

That kind of unearned certainty would ultimately bring down the regime, as a succession of leaders evolved into so many Marie Antonettes, but without the pretty hair. Later Gorbachev and co. would be utterly surprised at how much venom the populace had built up against the Party’s systemic oppression (oh how the term tables...).

Eerily Real: Another extreme example of central planning’s ill effect is seen in the current heap of Chinese real estate, moldering empty, as the Middle Kingdom crawls out of Mao’s insomniac ideals and into Xi’s ordered dream.

As noted below, the scale of this particular ghost project is stunning enough. But when we consider that this is just one of many such failed ventures it all morphs into a seeming dystopian graphic novel.

A peak at the week:

In a week where AI stole the headlines again, and continued to drive expectations, we touch base on its likely impact on banking.

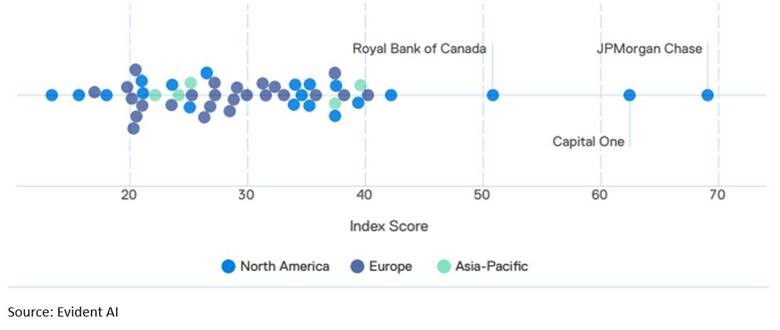

Banking on the Machines: The Evident AI Index[ii] assesses the approaches business are taking towards AI readiness. Global banks are assessed on 100+ individual indicators drawn from millions of publicly available data points specific to four pillars: Talent, Innovation, Leadership, and Transparency.

| RBC ranks highly on a global scale -- behind two US giants, Capital One and JP Morgan, but well out in front of the pack. Other Canadian Banks score also score well, and above global averages. See chart below. |

Hi there!

Hi there!

It’s probably inevitably headed our way. Let’s make sure it serves us, and not the other way around!

Enough said about that.

Comparative Outcomes: I promise this is not directly-related to the WSJ story above, but here’s an interesting piece for Canadian investors on the historical returns for real estate verses stock portfolios: Stocks vs. real estate: Considerations for Canadian investors (rbc.com).

And how much of our real estate surge over the past 20 years is a spillover from China’s? It’s hard to say, but likely that it’s not nothing.

And finally… Global insights for February 23, 2024. In this week’s issue:

Shaking up corporate Japan

The Nikkei 225 just passed its record high reached 34 years ago, despite the Japanese economy being in recession. We explore the factors behind investors’ enthusiasm and explain why the underwhelming macroeconomic backdrop is not viewed as a deterrent.

Regional developments: Canada’s inflation decelerated more than anticipated in January; U.S. equities climb as the artificial intelligence theme powers ahead; UK and Europe look to be on the path to recovery; Taiwan’s stock market index reaches all-time high on AI optimism.

More here: Global Insight Weekly.

Feel free to contact me with any questions and/or to discuss investment ideas.

Enjoy your weekend!

Mark