Good afternoon,

Regarding the Market’s mood: This year’s market seems to be forecasting a mild recession at worst and wants to get out in front of the recovery before the slowdown even gets here. It’s as though it anticipates any slowdown as a detour around a few potholes that the city is already nearly finished fixing. Corrections come – they always do, but to mix metaphors, the market seems expect a soft landing.

It’s tempting to call the market silly and overspent, but in its own way its collective wisdom could have a point. Despite looking some days like a little dancy-wiggly boy waiting for his turn in the bathroom, if it’s right, it makes sense to be among the first back in (there’s still a lot of cash out there). So, for now, mildly bad news is good news and mildly good news is bad. It’s a bit upsy-downsy wrongy-upsy. It’s like when our kids used to say:

“Dad, are you excited about next Halloween? I can’t wait! What are you going to wear? I’m going to be Edward Scissorhands. How about you? Have you decided yet? It’s gonna be soo awesummm! Have you decided yet? Have you?”

“Honey. It’s November 1st.”

And as if to prove the point:

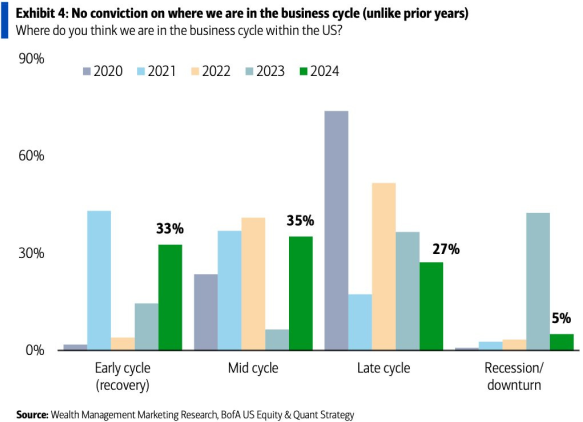

The chart below from Bank of America shows that investors are unsure of where we are in the business cycle. “Uncertainty about the economy and its near-term future has filtered into investors’ thinking, given the wide dispersion in outcomes that people are expecting.”

Here’s this week’s take from our global financial analysts:

Off to the races: The Fed’s highly anticipated March meeting failed to deliver much in the way of anything new, but it at least alleviated some of the market’s recent concerns that rate cuts could be delayed. However, other global central banks took steps to grab the spotlight, with potentially significant ramifications.

Regional developments: Canadian inflation softens in February; U.S. housing market showing signs of recovery; Bank of England leaves policy unchanged and the hawks concede; Bank of Japan exits negative rate policy.

Read the rest here: Global Insight Weekly.

Charts and other news:

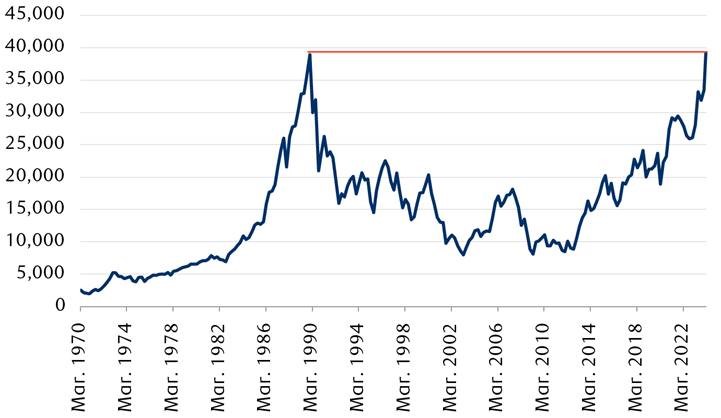

| Peak to Peak: In 1989 my wife and I hosted a Japanese exchange student for several days, a fine young woman who was a recent top-of-class economics graduate. After her brief time with us, she was heading straight back to Tokyo to start a career with the Bank of Japan -- a distinct honour for her and her family.

I’ve often wondered what sort of grief she may have endured there since then. If the 1980’s were Japan’s time to shine, December 1989 represented a financial peak to which the nation, judging by its main stock index at least, would not return to for the next 35 years.

Last month, on February 22, the Nikkei 225 Index finally completed its return to and surpassed that 1989 high. Although the index math is a little more nuanced than the line graph reveals, it’s been a long, slow recovery. See RBC Wealth Management chart below.

During the 35 years between Nikkei peaks:

|

| Garland on Apple’s Tree: This week, the US Attorney General Merrick Garland, initiated a lawsuit against Apple for monopolizing its iPhone product. (Yes, you read that right.) It’s rumoured that next week the AG starts a second but related case against Coca Cola for cornering the market on… Coca Cola. As a preventative measure, they say MacDonald’s has spirited away core samples of its secret proprietary “special sauce.” The Big Mac sauce was reportedly transferred by Donald Trump’s security team into small plastic bottles and hidden randomly amongst his massive warehouse of orange suntan lotion somewhere in the Florida. What could go wrong? |

And, as always, enjoy your weekend!!

Mark