Good afternoon,

Unsmudging Fudged Budgets: We have this wonderful old sage analyst at RBC who will (hopefully) never retire. Earlier this year he spoke at an investment conference which just happened to fall on his 967th birthday. After cake, he said: “We have an inclination to vote for people who promise us things we can’t afford.”

It’s like Popeye’s friend Wimpy, remember him? He used to say: “I’d gladly pay you Tuesday for a hamburger today.”

Budget 2024: The Canadian Liberal Government’s federal budget just came out this week.

It was Tuesday.

Coincidence?

Analysis: The Liberals found some money in the crack of the couch and then spent it right away before telling their moms.

Here’s some actual budget analysis: Time-gauged by how you might like your steak:

- Rare: 5-8 minutes Canadian Budget Commentary. Mostly bullet points here:

- Medium Rare: 10-15 minutes from RBC Economics – “Lack of spending restraint offset by revenue surprise and tax hikes.” – here:

- Well-done (not the budget) -- 15-20 minutes from our Family Office tax team – the budget’s tax impacts here:

- Shoe leather -- 20-25 minutes – a pre-budget piece on Canada’s credit rating here:

- Eat your vegetables: BC’s credit rating downgraded thrice in three years – to absolutely nobody’s surprise here:

Samplers follow:

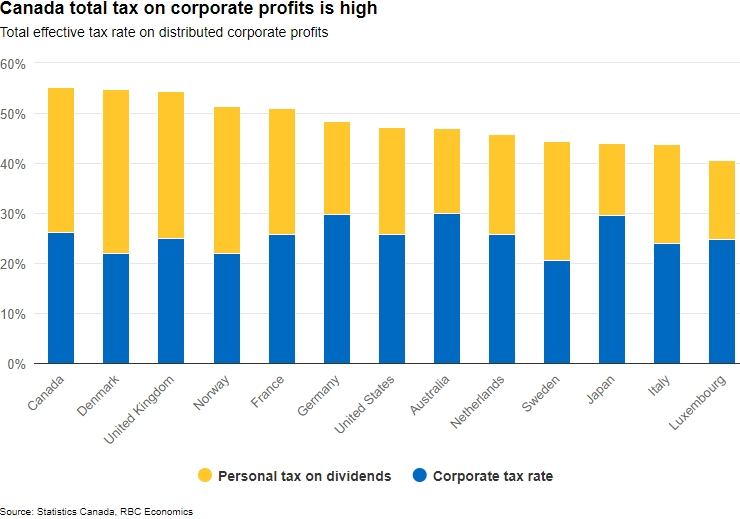

Canada’s total tax on corporate profits seems uncompetitive (see chart below from RBC Economics): “We continue to see the narrow targeting of revenue measures weighing on business investment—which is key to bringing Canada’s productivity growth up to more sustainable levels. Canada already levies the highest tax on corporate profits among triple A-rated countries and G7 economies. We also think the likelihood of higher business costs being passed down to consumers further exacerbates Canada’s affordability challenge and high inflation.”

But Canada is still among the least stinky dirty socks:

| Higher gross debt levels mean that public debt servicing costs are substantially higher in Canada than other AAA rated economies – but AAA is still very good no matter how you burn your steak. The ratio of government interest payments to revenue is the highest in Canada (~7% in 2022) among all AAA countries, but lower than the 12% median across AA rated countries. |

|

Another chart, vaguely relevant:

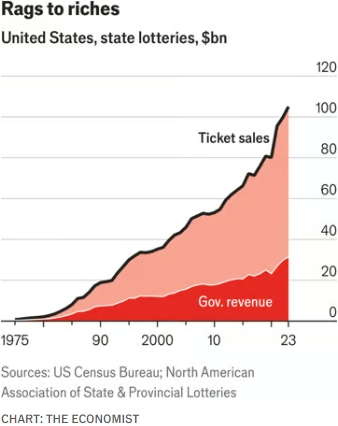

The economics of American lotteries (see chart to the left from The Economist): “The odds of winning the jackpot are unimaginably low—just one in 292m for Powerball. Yet sales are at a record high. In 2023 Americans shelled out more than $100bn on state-run lotteries. Were they a single company, America’s lotteries would be the ninth-most profitable in the country.”

(I call it, pleasant dreams for people who dropped math. Note the spooky relevance to Orwell’s fiction below.)

From Orwell’s 1984: “The Lottery, with its weekly pay-out of enormous prizes, was the one public event to which the proles paid serious attention… It was their delight, their folly, their anodyne, their intellectual stimulant… Winston had nothing to do with the Lottery, which was managed by the Ministry of Plenty…”

Rumoured: New federal department, subordinate to the Ministry of Plenty is designed to improve the environment and finances simultaneously by collecting pop bottles. It’s called The Ministry of Plenty’s Ministry of Empties.

Hey Buddy, can I borrow a dime?

Scenario: You have a crisp $100 bill and two friends vying to borrow it from you, Bob and Carl. Bob has a really good job and always pays on time. But Carl, is unemployed, drunk, and keeps calling you Doll-face.

Question: Could there be conditions under which you would prefer to loan the $100 to the drunken Carl instead of Bob? No, you say?

What if:

- Carl promises to pay you 100% interest, paying back $200?

- Carl gives you the keys to his Corvette as collateral?

- Carl sweetens it further, giving you centre-ice tickets to game 7 of the Stanley Cup final?

Okay, I get it, so what? Assessing government lending risks. When a government needs to borrow, there’s a robust global market for these sorts of loans (not only to governments, but for now…). And it won’t surprise you that just like Bob and Carl, different countries are a better credit risk than others. These varied risks are accounted for with varied interest rates, collateral, terms and so on, sufficient to compensate lenders for the risks. This worldwide lending auction is called the bond market. It could just as easily have been called the “really big loans” market.

Hey buddy can I borrow a trillion? Given our current period of politically-explosive rhetoric, what makes for a good lending practises to sovereign nations? If the wrong guy gets elected this year in Scambalonia, is it all over? Is the USA akin to the Roman empire on the precipice? Pro tip – we don’t learn much about the functionality of the bond market on the 6:00 news, nor Facebook nor Google. The financial incentives there are very different, driven by ad revenue.

The bond market is massive, and there’s a very well-developed methodology for evaluating its various risks. Think about it, why wouldn’t there be with the gazillions of dollars involved? Follow the money. The incentives call for sober analysis. It’s imperfect, but deadly serious. And possibly dull.

Things too Dull for TV (In the style of George Carlin, but stupefyingly boring): Anyhow, here’s a link to some of our very own Bank of Canada’s methods in this regard: Updated Methodology for Assigning Credit Ratings to Sovereigns (bankofcanada.ca)

And I have lots more for anyone who remotely cares., but I deleted it because it’s something shy of gripping.

True story: Years ago, just as I was graduating university, I called my uncle, who was a senior EVP at RBC to quiz him about banking. The business card he had given me earlier said he was in charge of credit and country risk for RBC – all of it. The earth. It’s true. Anyhow, he raspily mentioned in passing: “Well Mark, it’s no secret – and I think Venezuela’s a basket case.” And I was all: “Oh geez, yeah -- I know what you mean.” And then… thinking… thinking…Venezuela… say something smart – I had absolutely no idea what he was talking about, but there was no need to tell him that. I hung up the phone and dug out my atlas…

Congratulations, this email is over.

Enjoy your weekend!

Mark