CIBC was the bank of the Toronto Blue Jays after they joined a group led by Labatt Breweries to purchase part of the team.

- In 1977, they purchased a 10% stake of the Toronto Blue Jays for ~$700,000.

- In 2000, they sold their stake to Rogers media for ~$16.5 million.

This was a particularly effective investment, realizing an annualized return just shy of 15%. (Over the same 23-year time, the S&P 500 stock index “only” returned ~12% per year). They clearly identified an attractive long-term business to purchase and patiently waited. However, investors can also learn from what CIBC did not do in making this private investment. They did not:

- Forecast what the economy would do in 1977.

- Forecast what interest rates would do in the next few years.

- Sell their ownership when interest rates did indeed rise meaningfully a few years into their holding period.

- Sell their ownership when the political party in power changed.

- Sell their ownership when it looked like the economy would tip into recession.

- Sell their ownership when the Toronto Blue Jays missed the playoffs.

- Call up potential buyers every day and get a price quote on their ownership stake of the Toronto Blue Jays.

Source: Sportsnet

Source: Sportsnet

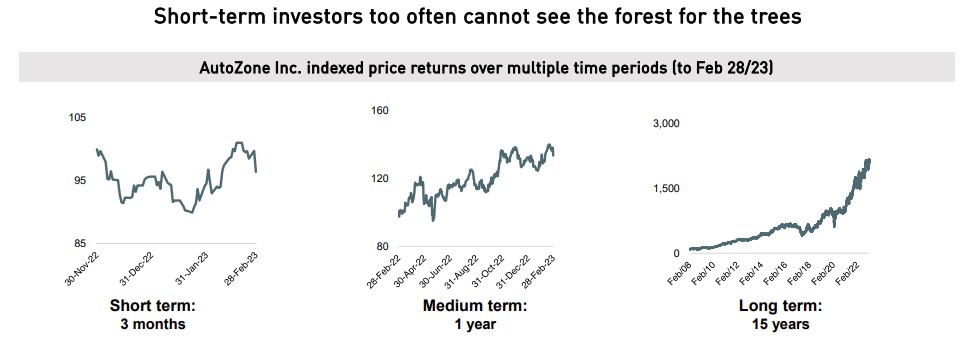

We strive to adopt a similar mindset when investing in stocks; we are buying portions of great businesses after all, and we patiently hold these businesses and wait for them to pay dividends and grow their free cash flow. Really, the key difference between a private business investment (like the Toronto Blue Jays) and a stock investment is that stocks provide daily liquidity and are priced daily. This results in meaningful short-term price fluctuations, depending on the short-term mood of the market. However, a short term drop in the stock price of a high quality business is not a reason to panic. Eventually, as the great businesses continue to make money, the market will recognize this and the stock price will bounce back to reflect the intrinsic value of the business – similar to holding a beach ball underwater. As they often do, Warren Buffett and Charlie Munger said it best:

“The big money is not in the buying and the selling, but in the waiting.”

– Charlie Munger

“If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.” – Warren Buffett

Source: Canoe Financial

Quick Hits

- March Madness in global banking. It all started with the failure of Silicon Valley Bank (SVB) after a bank run. Simply put, a bank “borrows” deposits and “lends” them out, making money on the rate difference. SVB mismanaged interest rate risk with fixed loans (investments in long-term treasuries) and variable deposits (deposits from tech-related clients).

-

- As a result, higher interest rates squeezed SVB from both sides: their clients needed cash given the difficult environment for tech/Venture capital, while their bond portfolio dropped in value. SVB then had to sell their investments at a loss and ran out of money to give back to their depositors. SVB’s failure led to the shutdown of a few other US regional banks, and eventually UBS’ takeover of Credit Suisse in Europe (a bank that has been plagued by challenges for years).

- A couple important high-level thoughts:

- Currently, RBC thinks that these failures are indicative of individual bank problems, and not a systemic banking issue.

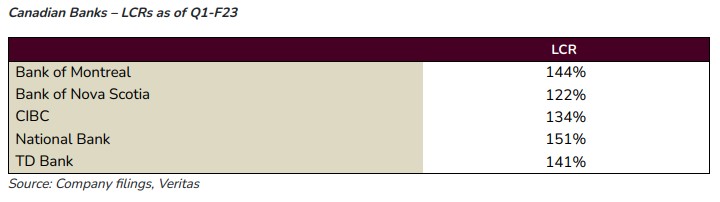

- We remain confident in the stability of the Canadian banking industry. Unlike some of the U.S. regional banks, the Canadian banks have a few advantages: a deposit, asset, and customer base that are all very well diversified, elevated liquidity positions, and high capital levels. While heightened regulatory scrutiny over the past few years may have limited the Canadian banks’ profitability, it has left the group better positioned to deal with periods of stress. (LCR= Liquidity Coverage Ratio, 100% is the minimum requirement).

-

- There was a great retirement planning article in Barron’s magazine a couple weeks ago, “The 10 Years Before retirement Are Critical. How to Be Ready.” Some of the key points:

- Fine-tuning your asset allocation: diversify across quality investments and build out a retirement income plan. (I’d add, it’s critical to have an income delivery strategy that provides income when the markets are down, as our “cash wedge” strategy does).

- Hedging your health: To prepare for an unexpected early retirement, save while you can, make sure your liabilities are looked after and consider disability insurance (apparently 47% of people end up retiring earlier than expected!).

- Prepping for an emergency: Keep 3-6 months’ worth of living expenses in cash reserves, for unexpected expenses.

- On March 28, 2023, Deputy Prime Minister and Minister of Finance Chrystia Freeland released the federal budget. Fortunately, there were no changes to personal or corporate income tax rates, capital gain inclusion rates or the principal residence exemption. For a breakdown of the Federal Budget, please check out the summary from our Family Office Services team here.

- The First Time Home Buyer’s Account is now live. For people over 18 that don’t yet own a home, this account neatly combines the benefits of an RRSP (tax deduction) with the benefits of a TFSA (tax free growth). $8000 in contribution room per year, up to a maximum of $40,000…please reach out to me if you’d like to see how this could apply to your situation.

If you have any questions, please feel free to reach out.

I can best be reached by e-mail, or by phone at 519-747-1653.

Have a great month.

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The strategies and advice in this report are provided for general guidance. Readers should consult their own Investment Advisor when planning to implement a strategy. Interest rates, market conditions, special offers, tax rulings, and other investment factors are subject to change. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license. © 2020 RBC Dominion Securities Inc. All rights reserved