“It’s tough to make predictions, especially about the future.” - Yogi Berra

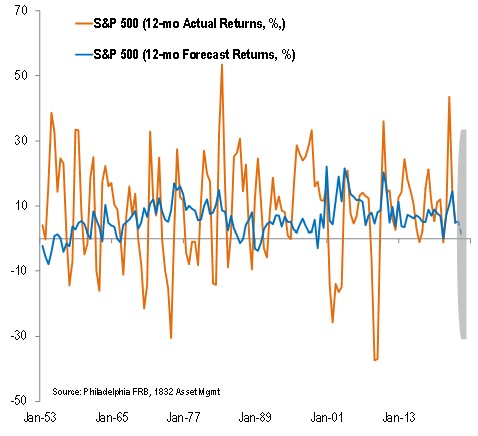

Plenty of time and resources are dedicated to predicting the near-term course of financial markets. In particular, the financial media seems to be obsessed with this topic, and economic and market gurus are quick to satisfy their demand for near-term macro predictions with guesses on what the market and interest rates will do this year, what sectors will perform best, and so on. Unfortunately, as the following chart demonstrates, the “experts’” ability to forecast economic and financial market outcomes is very poor.

Source: Dynamic Funds

(Additionally, note that even people that are “in the know” are often way off target, recall Fed chairman Jerome Powell not too long ago claiming that inflation was transitory).

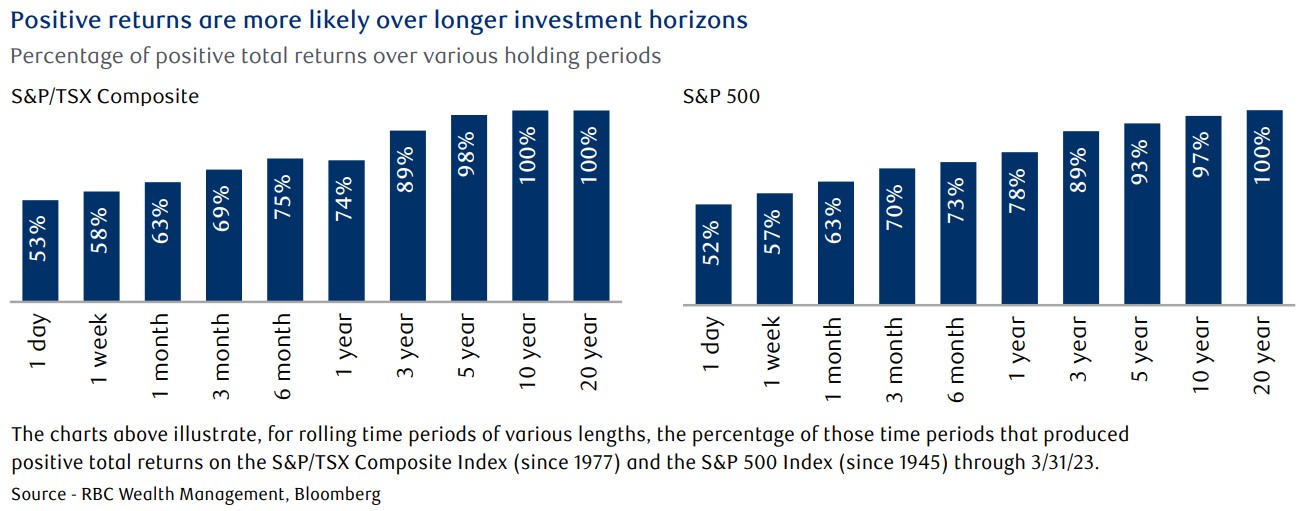

Since we cannot predict short-term market movements, it’s important to appreciate the nature of markets and prepare for a wide range of possible outcomes. A planning-led process ensures that your near-term safety and liquidity needs are met with secure, interest-bearing investments, and affords your high-quality equities the luxury of time to recover after a market drawdown. After all, the market is unpredictable and subject to the mood of the crowd in the near term, but in the long-term the market will confirm business success. I think that investors can develop an advantage by shifting perspectives from the short term to the long term (I would define as at least 5 years). As we can all appreciate, this is a simple concept, but human nature makes it difficult to implement.

As illustrated below, the probability of earning a positive return on any given trading day is essentially the same as flipping a coin. However, as the time horizon is extended, investors can be increasingly confident of attaining a positive outcome. The probability of the TSX Composite and S&P 500 generating positive returns improves substantially over longer periods, rising to about 75%–80% for one-year rolling time periods, nearly 90% for three-year rolling periods, and approaching 100% for rolling periods beyond five years. Clearly, the likelihood of experiencing losses in equity markets diminishes as the investment horizon lengthens.

Because uncertainty is ever present, I think investors should always think in terms of probabilities. Time horizon is a practical tool for managing unavoidable volatility when participating in the stock market, which trends upwards over the long haul. A longer time frame not only increases the likelihood of earning positive returns in stocks, but also allows the benefits of compounding to accumulate for investors.

| “One of my favourite stories is about the little boy in Texas. |

Quick Hits

- India surpassed China as the world’s largest population last month. Not long thereafter, it came to light that Apple was expanding into India. This is another great example of one of our portfolio companies tactfully navigating our tricky world. From RBC’s Thought Leadership group: “Apple is setting its sights on India with a first retail store in the country. The Mumbai store aims to boost the iPhone marker’s 5% market share in the world’s most populous country. While India’s 66-million to 100-million strong middle class is a big draw, its strong manufacturing base could also help Apple cuts its overreliance on China. During his trip, CEO Tim Cook met the bosses of Reliance Industries and Tata Group, two of India's largest conglomerates with interests in telecom and manufacturing, to help boost Apple’s sales and production supply chains in the country.”

- With 1Q23 Earnings Season underway, Lori Calvasina of RBC Capital Markets highlighted: “If there’s one overarching theme that we’re seeing in the data, it’s that the healing process is underway in many sectors.”

- Most equity markets have unevenly gained ground since October 2022, despite a laundry list of concerns. To highlight a few: central banks broadly stayed hawkish, US debt ceiling negotiations are underway, 3 US banks have failed, and geopolitical risks remain (Ukraine/Russia, China/US/Taiwan, etc.) Any number of events could unfold from here, and, over time, the markets march upwards despite ongoing concerns. We continue to stay the course but we are prepared for adverse effects as we continue to focus on owning quality: resilient balance sheets, sustainable dividends, and business models that are not intensely sensitive to the economic cycle

If you have any questions, please feel free to reach out.

I can best be reached by e-mail, or by phone at 519-747-1653.

Have a great month.

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The strategies and advice in this report are provided for general guidance. Readers should consult their own Investment Advisor when planning to implement a strategy. Interest rates, market conditions, special offers, tax rulings, and other investment factors are subject to change. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license. © 2020 RBC Dominion Securities Inc. All rights reserved