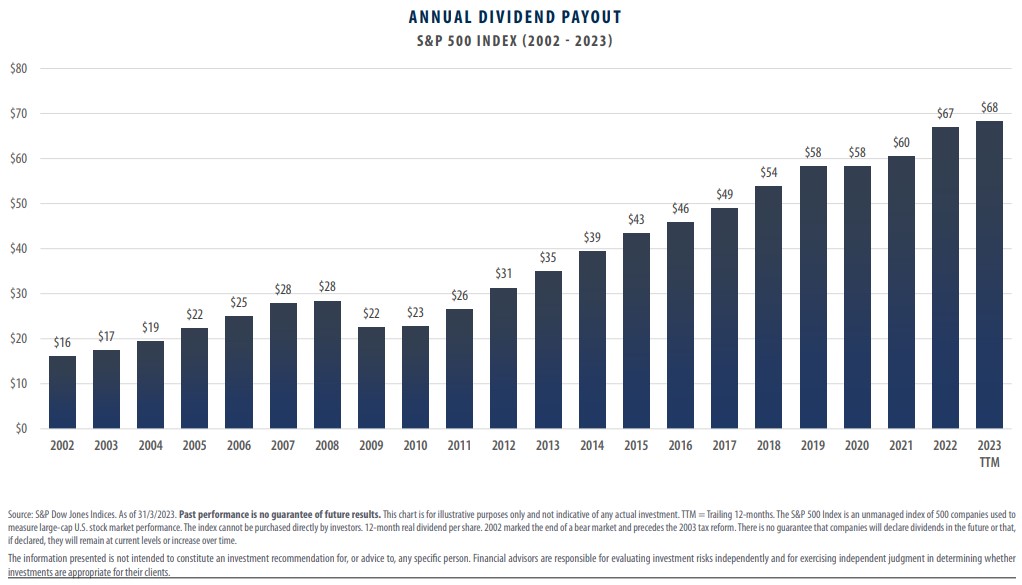

| "Do you know the only thing that gives me pleasure? It's to see my dividends coming in." – John D. Rockefeller The S&P 500, a market-cap weighted index of the 500 largest American companies, grew its cash dividend by ~4.2x over the 20 years from 2002 through 2022. Meanwhile, the market price of this same index increased its price by ~4.4x from December 31st, 2002, through December 31st, 2022. It’s amazing (but unsurprising) that the change in the market price of this index closely tracked the growth rate in its dividend payments over this 20-year period. Dividend payments and their growth are a direct and tangible source of returns for investors, and they tend to reflect the underlying business’ operating performance. However, the market price and change in dividend payments can meaningfully diverge over shorter time periods- while the S&P 500’s dividend payments slipped by ~21% in the 2008 Great Financial Crisis, the index price at one point dropped by ~59%. Howard Marks neatly described this relationship when he said, “In the real world, things fluctuate between pretty good and not so hot. In the markets, they fluctuate between flawless and hopeless.” For the long-term investor, dividends are a helpful signal of the underlying business’ performance. However, short-term market fluctuations are the noise.

Source: First Trust Portfolios Canada Beyond dividends, investors can drill down to focus on a business’s Free Cash Flow. Free Cash Flow adjusts reported earnings for accounting shortcomings and represents the real cash generated by the business in each period. Stated differently, Free Cash Flow can be viewed as the “potential dividends” a company could pay. Alternatively, management teams use their Free Cash Flow to reduce debt, acquire businesses, repurchase shares, or they can hoard the cash. Ultimately, investors should pay attention to their business’ long-term Free Cash Flow generation and growth instead of watching the day-to-day fluctuations of their stock portfolio. Similarly, Warren Buffett emphasized “look-through earnings” in his 1991 letter to shareholders: “Investors can benefit by focusing on their own look-through earnings. To calculate these, they should determine the underlying earnings attributable to the shares they hold in their portfolio and total these. The goal of each investor should be to create a portfolio (in effect, a “company”) that will deliver him or her the highest possible look-through earnings a decade or so from now. An approach of this kind will force the investor to think about long-term business prospects rather than short-term stock market prospects, a perspective likely to improve results. It’s true, of course, that, in the long run, the scoreboard for investment decisions is market price. But prices will be determined by future earnings. In investing, just as in baseball, to put runs on the scoreboard one must watch the playing field, not the scoreboard.” (On a related note, Buffett’s Berkshire Hathaway portfolio is expected to generate $5.7 Billion in dividends this year).

Quick Hits

Source: RBC Wealth Management Please feel free to reach out if you have any questions. Have a great month This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The strategies and advice in this report are provided for general guidance. Readers should consult their own Investment Advisor when planning to implement a strategy. Interest rates, market conditions, special offers, tax rulings, and other investment factors are subject to change. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license. © 2020 RBC Dominion Securities Inc. All rights reserved |