Tariffs imposed on imported goods have long been a tool of U.S. trade policy. In 2025, they have once again taken center stage, shaping global trade dynamics and influencing domestic economic conditions.

As U.S. tariff collections climb to record levels, investors and businesses are trying to make sense of the complex effects for supply chains, inflation, and portfolios. Headline rates point to a big shift in trade policy. But the real impact on the economy has been softened by how companies have adjusted and by the use of exemptions, giving a more balanced picture than the top-line numbers suggest.

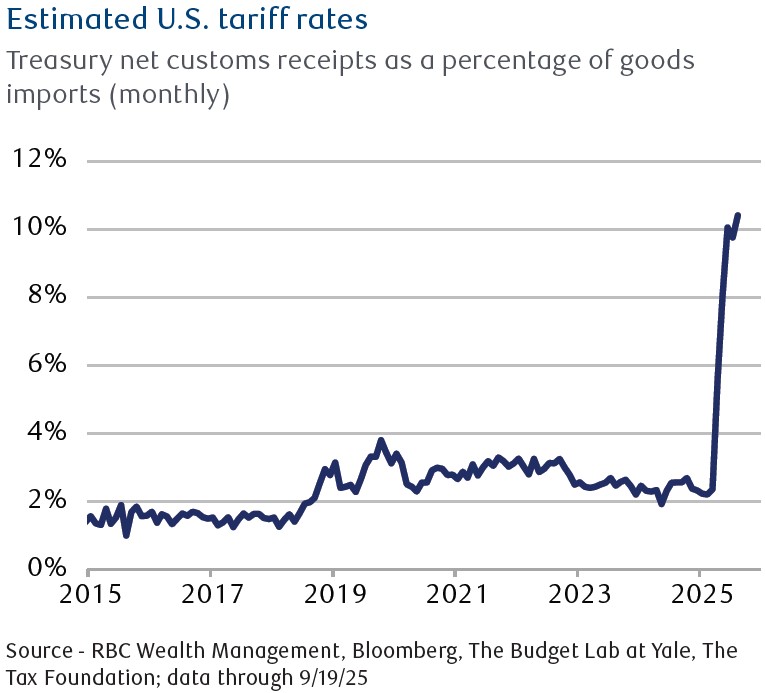

The Budget Lab at Yale and the Tax Foundation estimate that the weighted average applied U.S. tariff rate on imports is now about 17 to 19%, up from 2% earlier this year and the highest since the 1930s. Yet actual collections tell another story. As of August 2025, the effective average tariff rate was closer to 10.5%, well below the headline figures.

There are two key factors driving the gap between headline and actual rates.

1) Trade Diversion and Supply Chain Reconfiguration

High tariffs on certain countries and products have pushed companies to change their sourcing. For example, steep duties on Chinese goods have led firms to buy from alternative markets or route through third countries with lower tariffs. Exports originally destined for the U.S. are now being rerouted to non-U.S. markets such as Canada, Latin America, and Europe.

These shifts keep imports moving while reducing the cost burden.

2) Exemptions Under Free Trade Agreements

Despite the sweeping tariffs, the U.S. has carved out exemptions to protect critical sectors (ie. Pharmaceuticals, energy & raw materials) and specific products, and maintain affordability. Many U.S. imports still come in duty-free under agreements like the United States-Mexico-Canada Agreement (USMCA). RBC Economics estimates nearly 90 per cent of U.S. imports from Canada are exempt. These exemptions cushion the impact from higher headline rates.

Taken together, these dynamics mean that even though dutiable goods face very high rates, the actual economic burden has been more modest than feared.

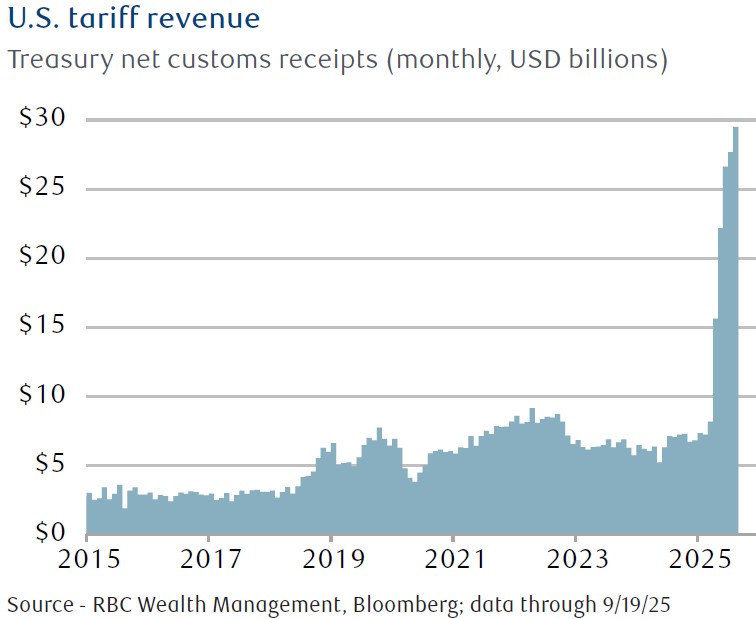

Even with lower effective rates, the overall cost is still large. U.S. tariff revenues are around $30 billion per month, putting collections on pace to reach $354 billion annually, up $275 billion from 2024. The key question is: who is paying?

So far, evidence points to U.S. businesses. The U.S. Import Price Index, which tracks pre-tariff costs, has stayed steady, and inflation has risen less than expected. This suggests companies are absorbing a good share of the duties instead of passing them on to consumers, at least for now. But as inventories bought at earlier prices run down and pressure builds to protect margins, price increases may become more likely. If that happens, more of the cost could shift to consumers over time.

The future path of U.S. trade policy is still uncertain. In November, the Supreme Court is expected to hear a case that challenges the legality of certain tariffs. If the Court rules against them, the Trump administration may need to rework its trade measures, possibly replacing some tariffs with new mechanisms.

While headline tariff rates grab attention, they don’t tell the full story. The effective rates, what businesses actually pay, are shaped by a complex web of exemptions, trade agreements, and strategic sourcing. For financial analysts, supply chain managers, policymakers and investors, understanding this distinction is crucial for navigating the evolving trade environment.

In this setting, it makes sense to balance strong fundamentals against optimistic valuations and policy risks. Keeping equity and risk allocations close to strategic targets remains a prudent approach. Focus on quality businesses with strong balance sheets and pricing power, and diversify across sectors and regions to avoid concentrated exposure to tariff-sensitive areas.