Since the sharp tariff induced selloff in April, the equity markets have made a comeback, lifting investor confidence. But the big question remains – can this upward momentum last, or is it just a temporary bounce? By looking at the latest technical data, we can get a better idea of what lies ahead for the market and what risks to watch.

What made this rebound possible? By mid-April, several weekly momentum indicators had reached oversold levels that could support a multi-month equity recovery. These included:

- Momentum indicators that track medium-term market swings

- Volatility Index (VIX) which measures market fear

- Put-call ratios which show trader sentiment

- AAII Sentiment readings which show how individual investors feel about the market

- The percentage of stocks trading above their 200-day moving average

All these signals reached lows in April. They are sometimes interpreted as ‘contrarian’ signals, which means investors may get more bullish when the readings fall to extreme negative levels.

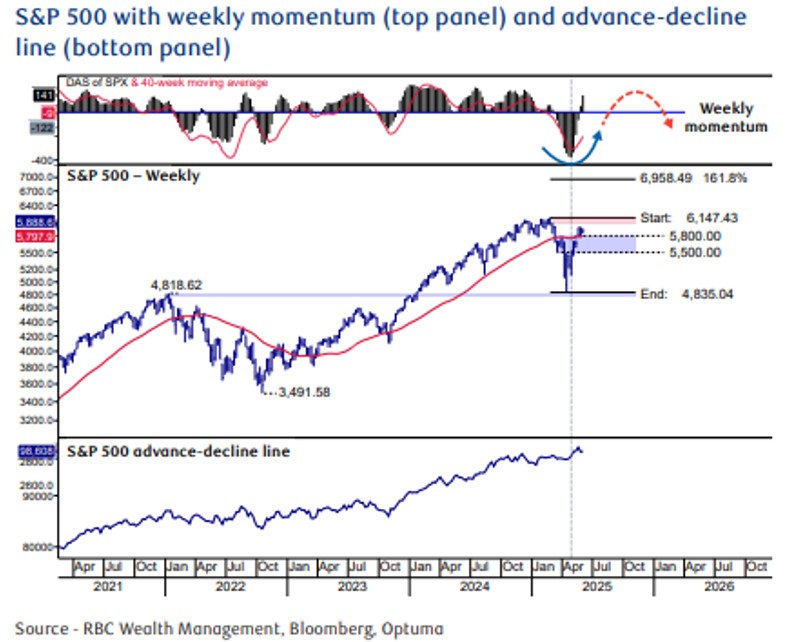

What’s happening now? Since the low point, these technical indicators have been improving steadily. This suggests the market’s rebound could continue into early or mid Q3. The weekly momentum indicators should not move back to overbought levels until Q3 (top panel of chart).

However, there are signs that the rally may face some headwinds as many of the indicators have now moveed back to overbought levels.

Something noteworthy is that the way the S&P 500 has been tracking a pattern that is often seen during the first year of a new U.S. presidential administration. Typically, Q1 tends to start off shaky, followed by a solid rally that peaks around mid-Q3. After that, the market cools off heading into the final months of the year.

So, are we in a bear market bounce? A common worry among investors is that the current rally is a mirage and that the recovery will be short lived. But some of the technical signs suggest otherwise:

- The advance-decline line – which tracks how many stocks are rising versus falling – is showing strong breadth, meaning many stocks are participating in the rally. This is usually a healthy sign, unlike a weak bear-market bounce where only a few stocks rise (bottom panel to chart)

- Major international markets, such as DAX, Canada’s TSX, and the MSCI EAFE Index are hitting cycle highs. This global strength supports the idea that the U.S. market can also push higher.

What else should investors keep an eye on? Two other market factors that are worth watching:

The U.S. dollar has weakened throughout 2025, but it now appears to be at a technical turning point. Indicators show it is nearing a key support level (U.S. DXY index at 98-100 support band) which could mean a potential bounce. A stronger dollar often coincides with a stronger U.S. market. Conversely, if the dollar falls below the support range, it could indicate that capital is leaving the U.S., which would signal more vulnerability to equities.

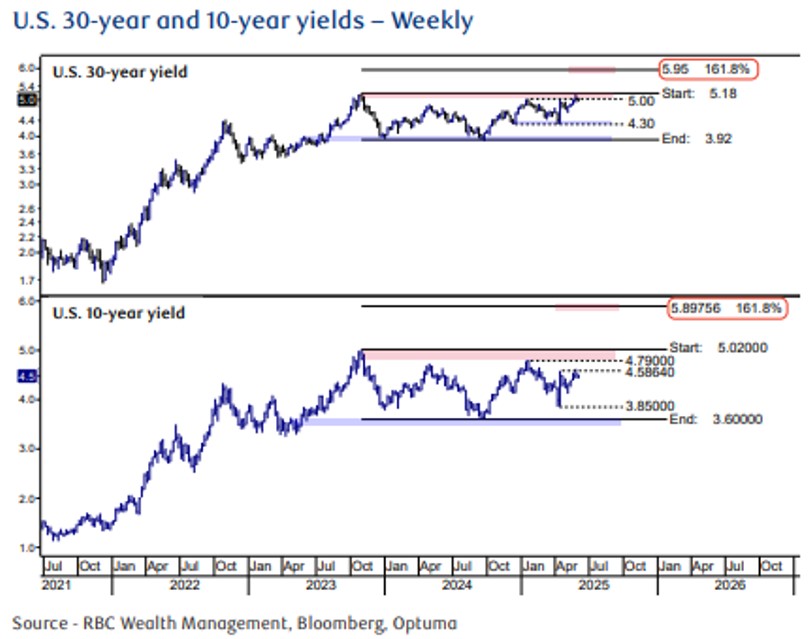

U.S. Treasury Yields can be an important indicators. They are hovering near a crucial resistance level (see graph below). If the 30-year yield breaks above 5.18% or the 10-year yield moves above 4.6%-5%, these higher interest rates would put pressure on stocks. Market may be interpreting this higher move in rates as signalling higher inflation or concern regarding the debt and deficit of the US. However, as of now, these yields are still within an acceptable range.

What does this all mean? Overall, technical analysis suggests that the market’s rebound is likely to continue into early to mid-Q3. Growth stocks may lead the way higher, while defensive sectors offer diversification opportunities. Investors should keep a close eye on the U.S. dollar and treasury yields. Changes in these areas could shift market momentum to an overbought scenario quicker. While markets always carry uncertainty, the current technical landscape supports a cautiously optimistic outlook that allows investors to continue to remain invested or to gradually build on their equity positions.