Investing in the stock market isn’t always smooth sailing. At times, it feels more like navigating stormy seas, especially during bear markets or sudden bouts of volatility. But for investors with long-term goals, one principle remains clear: stay the course.

While the temptation to react to market drops is strong, history and data repeatedly show that maintaining discipline and remaining invested are among the most reliable ways to build wealth over time.

Bear Markets Are Part of the Journey

Market downturns are unsettling, but they’re far from unusual. Since 1928, the S&P 500 has seen 27 bear markets—defined as declines of 20% or more. On average, that’s about one every four years. Many of these bear markets coincided with economic recessions, geopolitical tensions, or financial crises.

Rather than viewing these periods as reasons to panic, long-term investors should see them as normal and expected phases of the market cycle.

The Cost of Emotional Investing

When markets dip, emotions often run high. Fear leads many investors to sell in an effort to avoid further losses. However, this kind of reactionary behavior can be costly. Selling during downturns locks in losses—and it’s nearly impossible to predict when to get back in.

Trying to time the market successfully requires near-perfect execution:

- You must not sell too early as prices rise

- You must exit precisely at the top

- You must re-enter exactly at the bottom

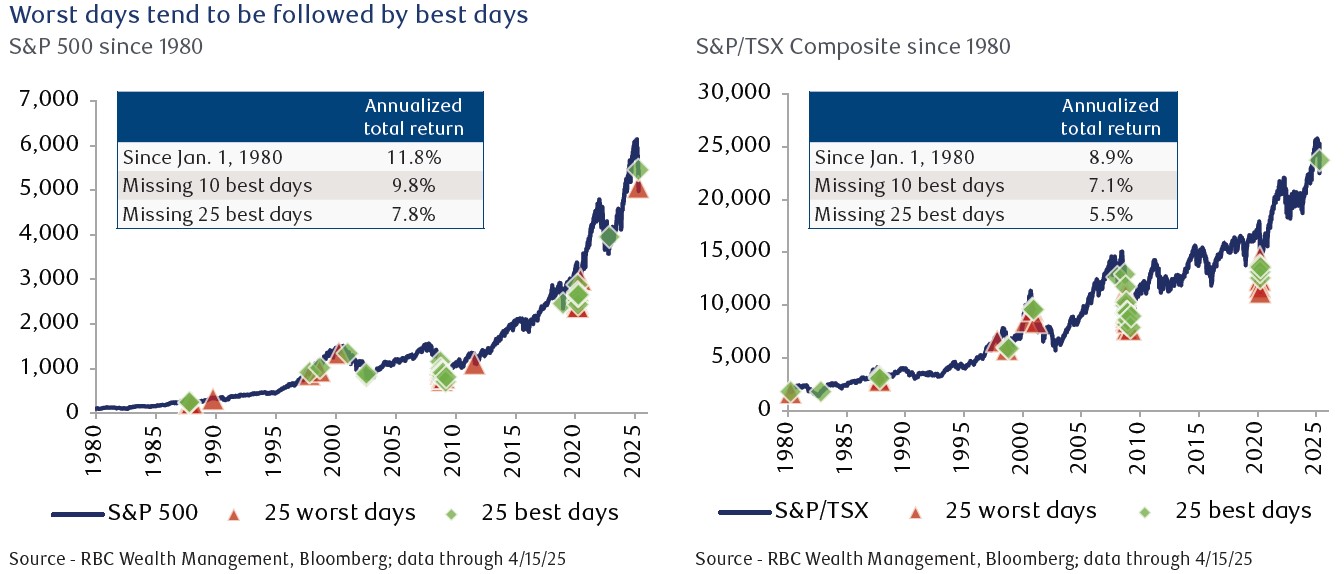

Consistently doing all three is virtually impossible. Even seasoned professionals rarely manage it. And missing just a handful of the market’s best days can significantly reduce long-term returns.

Volatility Is Normal—and Two-Sided

Periods of intense market volatility, whether driven by economic data, global crises, or policy shifts, tend to cluster. These bursts of turbulence often arrive suddenly and in waves. While unnerving, they are also when the seeds of recovery are sown. In fact, some of the largest single-day gains in market history have occurred shortly after the biggest drops. Since 1980, 20 of the S&P 500’s best days happened within a month of its 25 worst days. In Canada, the S&P/TSX Composite showed similar patterns.This illustrates a powerful truth: volatility runs in both directions. Markets often rebound sharply in response to oversold conditions, positive surprises, or policy support. Investors who flee during downturns often miss these rallies.

Why Staying Invested Matters

A well-constructed investment plan is built for the long haul. It's meant to withstand market ups and downs—not just the good times. That’s why the most successful investors are those who remain patient, even when the headlines are grim.Moreover, during periods of extreme volatility, policymakers often step in with stimulus measures or reforms that help stabilize markets. These turning points can be the beginning of the next bull market—but they’re only available to those who are still in the market when the rebound happens.

Final Thought: Time in the Market Beats Timing the Market

Volatility is uncomfortable, but it's also part of the price investors pay for long-term growth. Instead of trying to outsmart the market, focus on staying invested, staying disciplined, and staying focused on your long-term goals. Corrections come and go, but a patient, steady approach can weather the storm—and come out stronger on the other side.