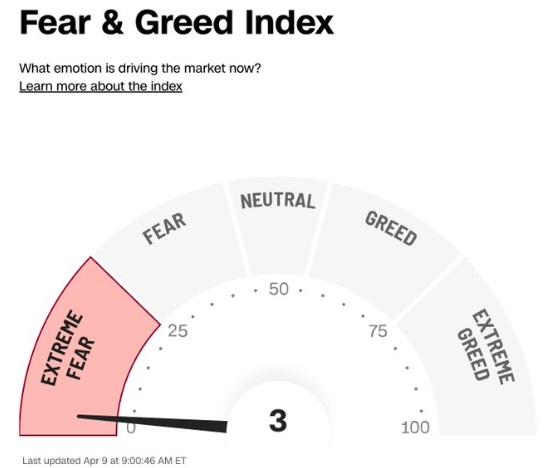

The wild swings of the market have been nauseating for even the most seasoned investors. How are you feeling? With such a pervasive negative tone, the mood of the market certainly seems washed out. The Volatility Index (VIX) is an indicator that represents the amount of fear in the stock market. A level of 25 would signal distress among investors and anything above 35 would be considered a panic. At the height of April’s uncertainty, the VIX achieved a level of 60, which puts this event on par with the Great Financial Crisis and the Pandemic. Another popular measure of investor sentiment called the 'CNN Fear and Greed Index' measures investor sentiment on a scale of 1 to 100. We hit a low of 3. Yes, 3. There wasn’t really much room to get increasingly fearful according to that indicator.

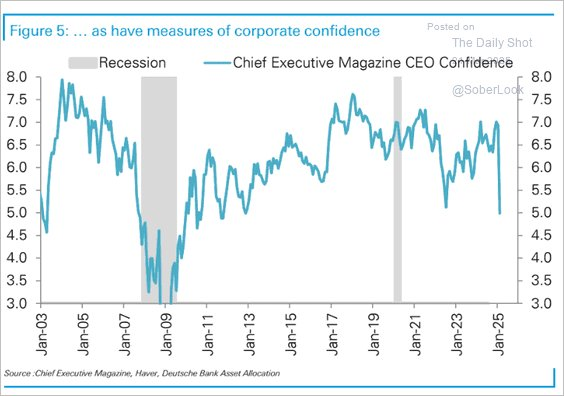

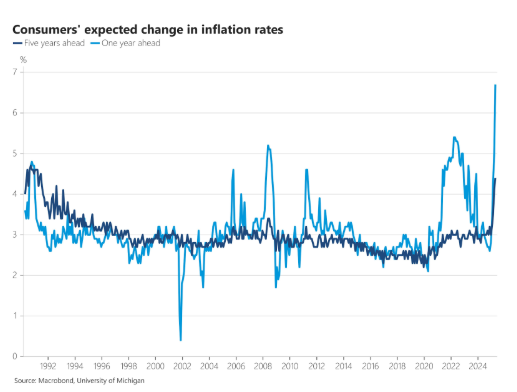

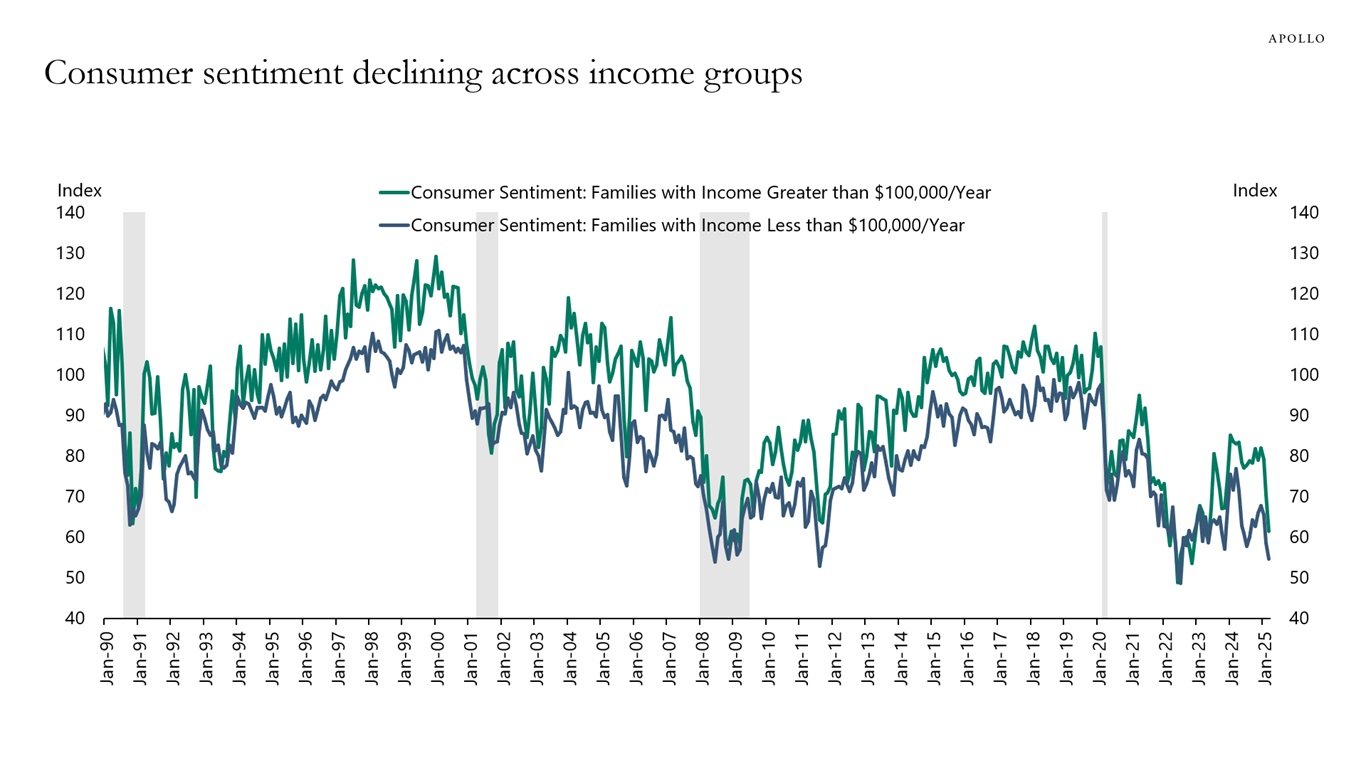

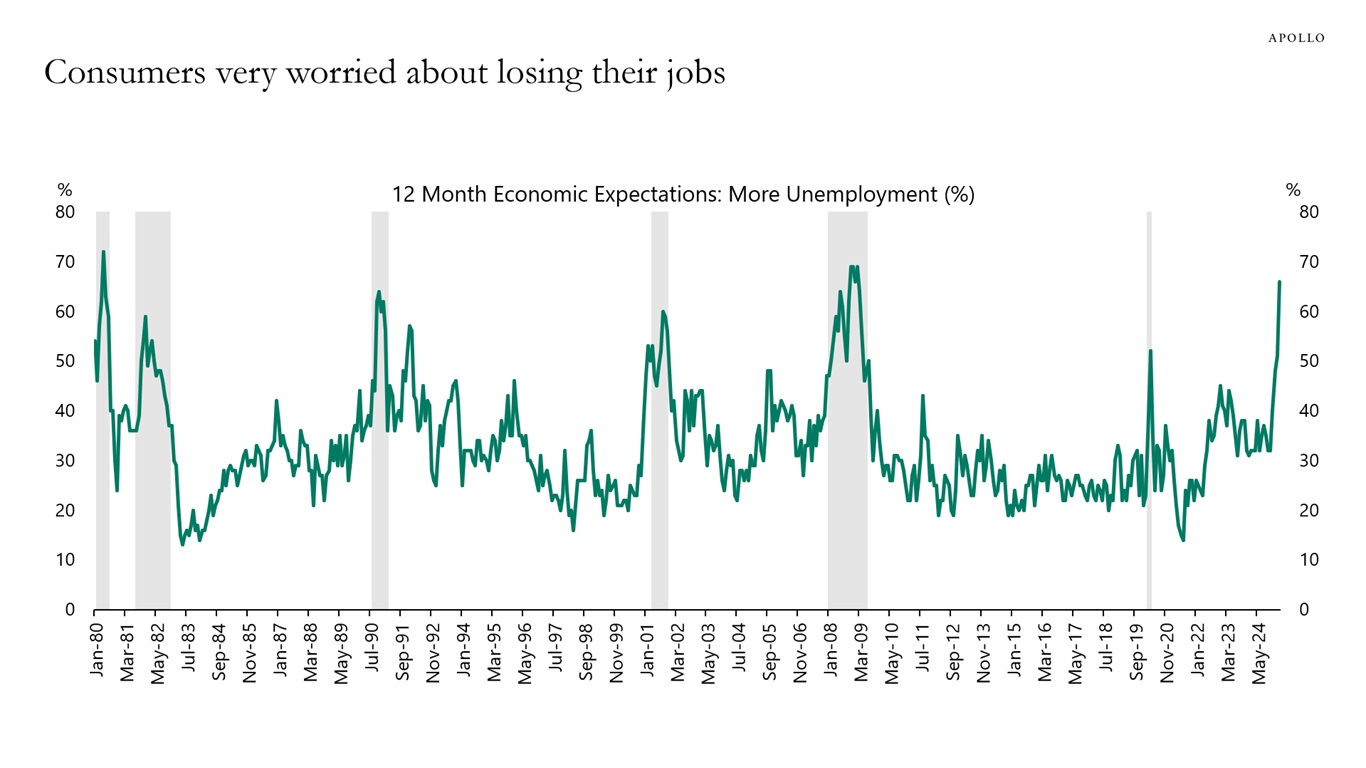

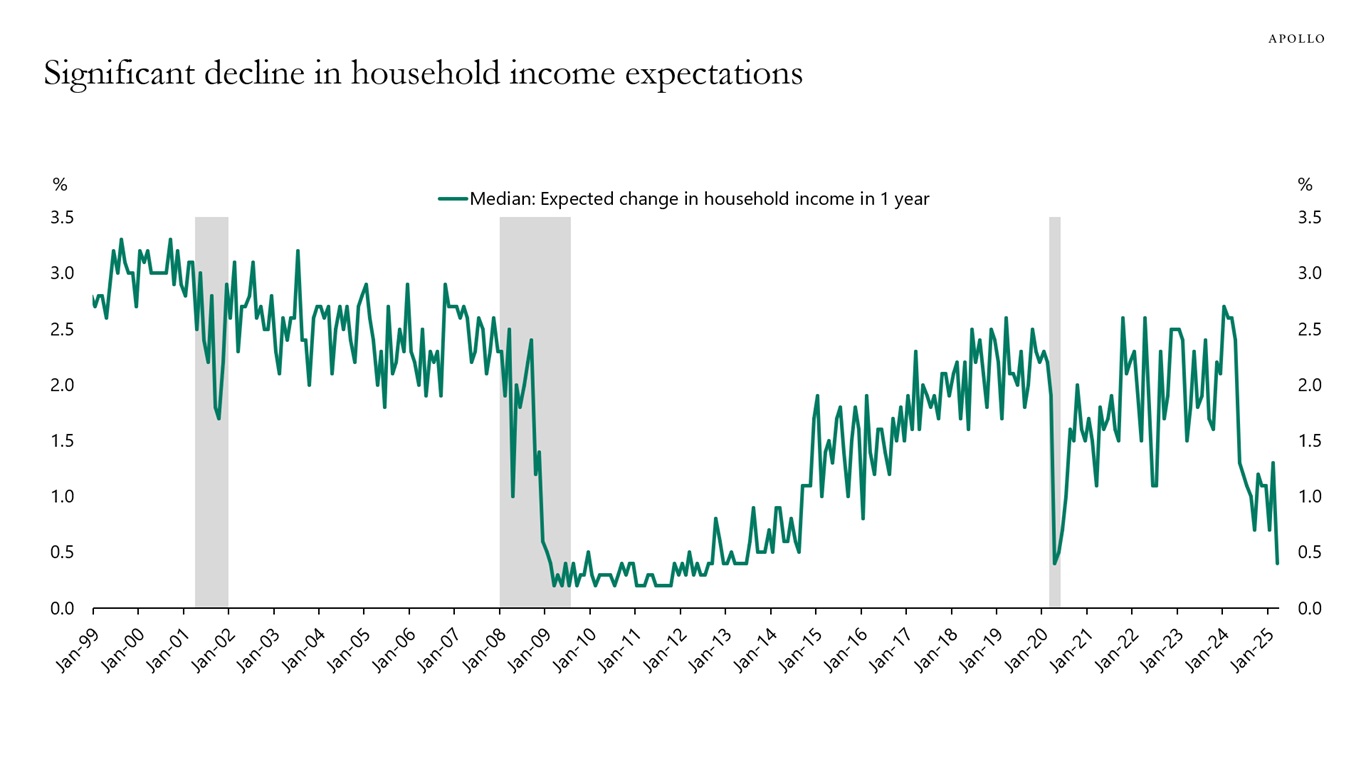

You aren’t alone. Survey after survey reveals how anxious everyone is about the economy, business earnings, inflation, their job security and income prospects. The charts below can help visualize how investors are feeling.

1. CEO confidence levels are below that of the Pandemic and the weakest since the Great Financial Crisis.

2. Consumers’ expected change in inflation have shot up.

3. Consumer sentiment has declined across all income groups.

4. Consumers are concerned about their job security

5. Households expect to earn less income over the next year.

6. The betting markets predicted a 70% chance of recession in 2025.

We know feelings can be deceiving, but how can things possibly go right when it feels so wrong? The data would suggest that surveys and feelings matter less than official economic results. As the chart below shows, after a 10% correction, the average future 12 month return, is markedly better in the scenario in which the economy does not actually enter a recession.

As of now, the economy appears to be quite resilient. Unemployment remains impressively low at 4.2%, the IMF maintains a +1.8% 2025 US GDP growth projection, inflation measures continue to report below expectations, 72% of companies have thus far beaten earnings expectations for Q1-2025, and retail sales remain resiliently above expectations. Could this change with a prolonged trade war? Absolutely, however, at the minimum we should recognize that the economy is not in a recession today and it is starting from a level of strength. Trump’s 90 day tariff delay and his pivot towards more conciliatory rhetoric leaves room for investors to consider whether the final chapter of the tariff saga may actually be better than originally feared. With continued economic resiliency and progress on the geo-political front, we find it hard to start getting all “bear’d” up with the market having already experienced a near 20% drop. Although, it is unlikely that the trade war will de-escalate in a straight line, the recent stock market rally hints that the sun will shine through eventually, and investors need to make sure they are there for it.