After years of underperformance relative to large-cap stocks, small caps finally appear ready to stage a resurgence. Investors should take note of this shift in the 2025 equity outlook, as the conditions seem favorable for a renewed run in small-cap equities.

The Past Five Years: A Period of Divergence

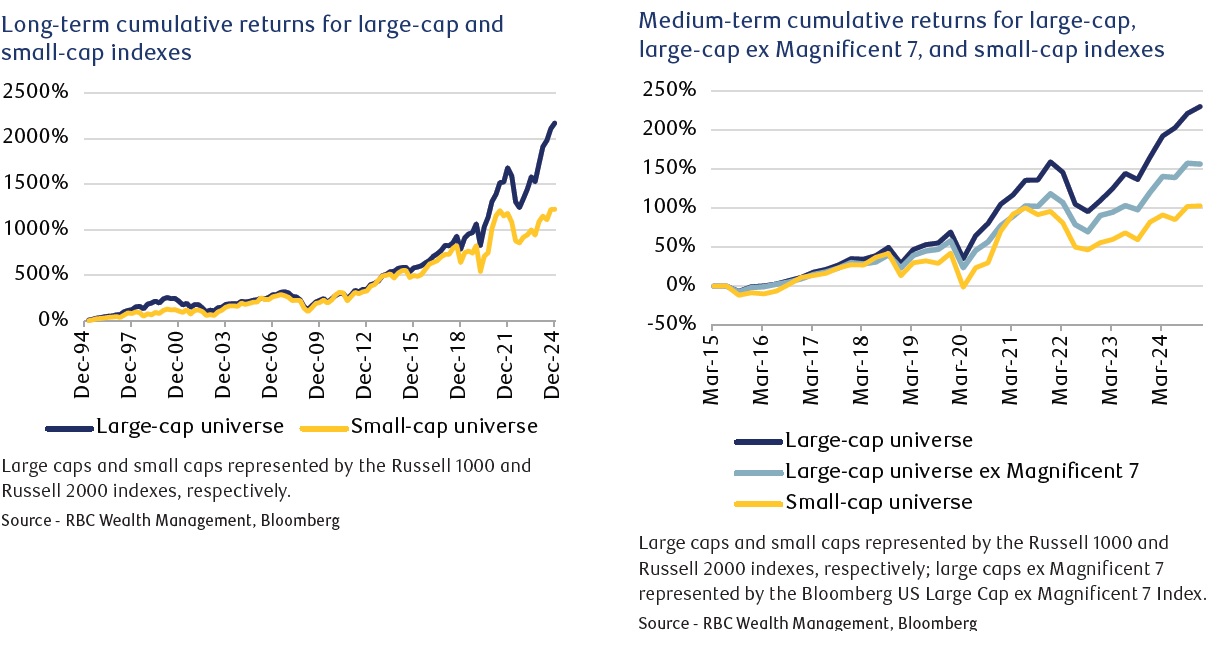

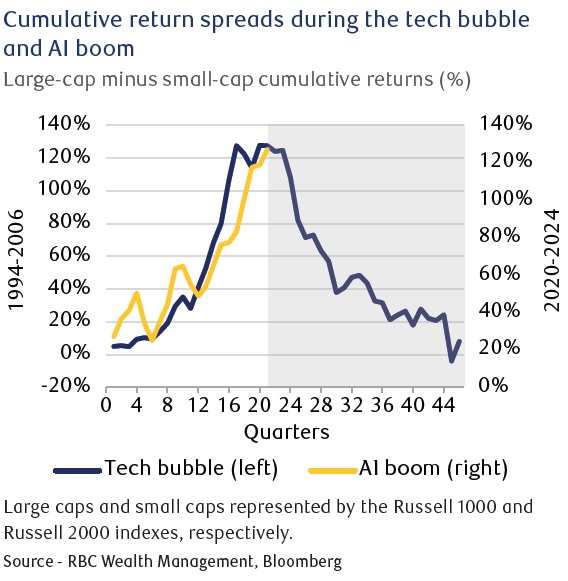

The last five years have been marked by extraordinary economic and geopolitical events: global lockdowns, economic restarts, historic government stimulus, green initiatives, record inflation, rising interest rates, and the rapid ascent of artificial intelligence (AI). These factors have driven a pronounced decoupling of large- and small-cap returns, similar to the tech boom of the early 2000s. As a result, large caps have delivered above-average returns in four of the last five years, creating a significant performance gap between the two asset classes.

The AI-driven rally, spearheaded by the so-called "Magnificent 7"—Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta Platforms, and Tesla—has fueled large-cap outperformance. Even when these high-growth stocks are excluded, large caps have maintained a meaningful lead over small caps. However, history suggests that such gaps eventually correct, and we may be on the cusp of such a shift.

Learning from the Past: A Potential Reset

The current divergence between large- and small-cap performance is reminiscent of the tech bubble era. However, unlike the early 2000s—when large-cap stocks collapsed due to weak earnings—today’s large caps continue to generate robust profits, particularly in AI-driven sectors. While investor enthusiasm for AI remains strong, the return spread between large and small caps could still reset, though for different reasons this time. Key catalysts beyond earnings—such as mergers and acquisitions (M&A) and initial public offerings (IPOs)—have historically played a critical role in small-cap performance. Large-cap companies are currently sitting on record cash reserves of nearly $2.5 trillion, with the Financials sector alone accounting for almost half. Despite these strong balance sheets, small-cap M&A activity in 2024 hit a record low, with just 52 deals totaling $113.7 billion—worse than the 2008 financial crisis. The slowdown has been largely attributed to rising interest rates, which have dampened corporate risk-taking.

Similarly, small-cap IPO activity has struggled. Although 2024 saw a modest recovery, with 31 IPOs per quarter and $7 billion in total value, this is still far below pre-pandemic levels, which typically ranged from 60–100 IPOs and $15–$20 billion per year. However, early signs of recovery in late 2024 suggest that the tide may be turning.

Catalysts for a Small-Cap Rebound

Several factors could help small caps regain momentum in 2025. The Federal Reserve’s shift toward monetary easing marks a critical turning point. After a period of aggressive rate hikes aimed at curbing inflation, a looser monetary policy environment is likely to encourage corporate risk-taking, including increased M&A and IPO activity.

Additionally, changes in regulatory oversight could play a crucial role. With new appointments expected under the Trump administration at the Federal Trade Commission and the Department of Justice, M&A activity is likely to receive a boost. A more deal-friendly regulatory environment should pave the way for increased acquisitions of small-cap companies by cash-rich large-cap firms, providing a significant tailwind for small-cap valuations. Another key factor is elevated earnings expectations for large-cap stocks, particularly in AI-related sectors. The market's high expectations could lead to volatility if results fail to meet the lofty projections, potentially prompting investors to rotate into small caps. Furthermore, election-related uncertainties that weighed on investor sentiment in 2024 should fade, adding further support for small-cap equities.

2025 and Beyond: A Favorable Outlook for Small Caps

Looking ahead, small caps appear well-positioned to narrow the performance gap with large caps. A combination of lower interest rates, renewed corporate risk-taking, improved M&A and IPO activity, and a more favorable regulatory environment should drive small-cap outperformance. Moreover, with large caps facing stretched valuations and heightened expectations, investors may seek diversification in undervalued small-cap stocks. After years of trailing their large-cap counterparts, small caps are poised for a turnaround. As the investment landscape shifts, investors should not overlook this segment of the market, which could play a crucial role in shaping equity performance in the coming years.