As we look toward the future, four secular trends are set to reshape the global economy and redefine our way of life: unrelenting AI investment, the challenges of an aging population, the rise of renewable energy, and the electrification of infrastructure. These powerful shifts hold vast implications, offering significant opportunities for investors to align their portfolios with transformative growth areas. Here’s a closer look at each trend and its potential impact over the coming decades.

1) The Surge in AI Spending

Artificial intelligence (AI) continues to dominate investment strategies, driven by the dual forces of innovation and competition. Companies across industries are embracing AI to maintain relevance in an increasingly digital landscape. Microsoft’s AI-related expenditures have surged to nearly $60 billion annually, and firms like Accenture are seeing dramatic increases in AI-related bookings, which jumped from $300 million in 2023 to over $2 billion within three quarters of fiscal 2024.

Despite the immense investments, AI adoption remains in its infancy. Currently, only 6.6% of U.S. companies utilize AI for business purposes, leaving ample room for growth. Early adopters, such as AI hardware manufacturers and software providers, are reaping the benefits, with stock valuations skyrocketing.

Infrastructure supporting AI, including electricity generation, transmission, and data centers, also presents long-term investment opportunities. While companies leveraging AI to boost efficiency or sales may see gains, these advantages could diminish as AI adoption becomes widespread.

2) The Aging Population and Economic Strain

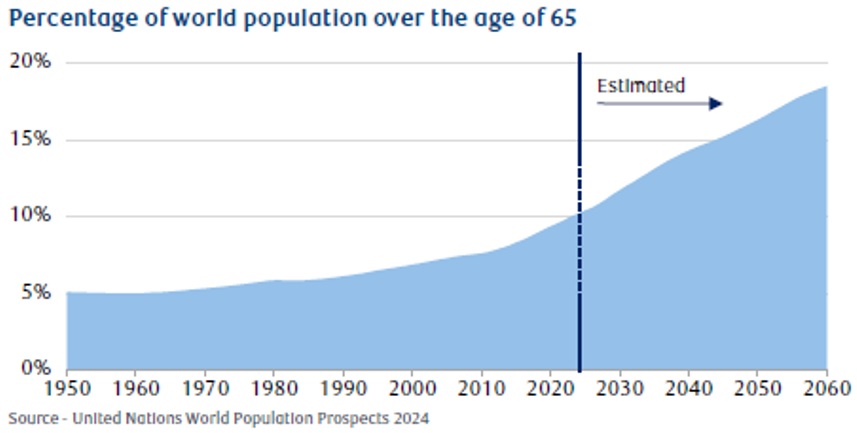

The world is aging rapidly. By 2050, 1.6 billion people are expected to be 65 or older, with those over 80 becoming a significant demographic group. This demographic shift poses challenges for healthcare systems and economies, as the financial burden of caring for non-earning individuals escalates.

For example, the U.S. spent $360 billion on healthcare costs for individuals aged 65 and older with Alzheimer’s in 2024, matching the combined costs of cancer and cardiology care. Moreover, unpaid caregivers provided services valued at $346.6 billion in 2023. To counter these pressures, investments in improving “healthspan”—the number of healthy years an individual experiences—are gaining momentum. Biotech firms developing treatments for chronic diseases and longevity-focused solutions stand out as key beneficiaries. Additionally, financial services such as wealth management and insurance are critical in helping individuals plan for longer lifespans, while real estate markets are responding with innovative multi-generational housing options.

3) Renewables Ascending as the Dominant Energy Source

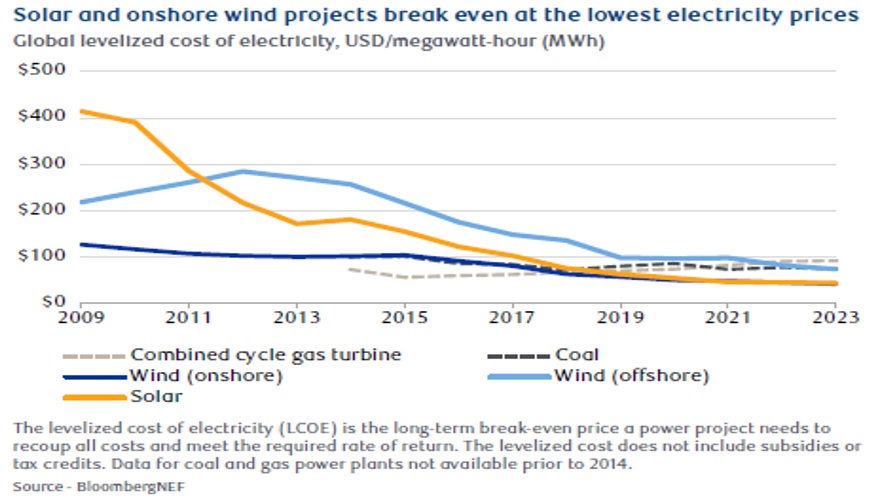

The transition to renewable energy is accelerating, driven by declining costs and increased adoption. Wind and solar installations have surged, and renewables now constitute a significant share of power generation in many regions—25% in the U.S., one-third in China, and nearly half in the UK by 2023.

While government subsidies initially fueled this growth, market dynamics have since taken over. Solar capacity alone doubled globally within two years, with installations regularly surpassing International Energy Agency (IEA) forecasts. Even traditionally fossil fuel-dependent regions, like Texas, have embraced renewables, becoming leaders in wind energy and tripling solar production in three years.

The primary obstacle to further growth is permitting delays, not technical or financial barriers. This ensures a steady pace of renewable installations in the years to come. Key investment opportunities include renewable energy equipment manufacturers, energy storage providers, and developers of smart grid technologies.

4) Electrification of Infrastructure

Electrification is revolutionizing how the world consumes energy, driven by the plummeting costs of renewables and breakthroughs in grid-scale storage. Advanced battery technologies like lithium-ion, sodium-ion, and nickel-hydrogen are transforming renewables into a reliable power source by addressing their intermittent nature.

In 2023 alone, grid-scale storage capacity doubled globally to 90 gigawatts, and the market is projected to grow at an annual rate of 40% through the decade. This growth supports broader electrification trends, from data centers powering AI to energy-intensive industries such as steel and cement production. Additionally, rising global temperatures are fueling demand for electricity-intensive air conditioning systems.

Countries integrating grid-scale storage with nuclear power, such as China and France, are particularly well-positioned to build resilient energy infrastructures. Investors can find opportunities in utility-scale battery manufacturers, developers of cutting-edge energy storage technologies, and companies modernizing grid infrastructure.

Positioning Investment Portfolios for the Future

The “Unstoppables”—AI investment, aging demographics, renewable energy, and electrification—are long-term, transformitive trends that will shape global markets for decades. While they offer immense potential, navigating these opportunities requires careful consideration of risks:

Macroeconomic Conditions: Interest rates, inflation, and policy shifts could impact growth trajectories

Sustainable Business Models: Companies must demonstrate scalability and sustainability to capture long-term value

Valuation Discipline: Overpaying for growth, even in high-potential sectors, can erode returns

By thoughtfully integrating exposure to these trends, investors can position their portfolios to capitalize on transformitive growth while mitigating risks. These secular shifts not only present challenges but also unparalleled opportunities to align investments with the future of the global economy.